- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Tax on Social Security

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

All of the income information was entered correctly you guys have an issue with the system PERIOD and someone needs to take this seriously and look into this matter this is frustrating that we are getting this jerk around response for something we did not create. If we have been using this system for several years and all at once this is happening, there has to be something going on in the system that is glitching.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

That is NOT what happened PLEASE put the report and look into this matter

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

TTX has OUR report they don't need to get one from us!! it is in their system

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

I'd like to get a diagnostic copy of your return so that we can see exactly what happened and possibly open an investigation into why your social security income was not properly reported on your return. The diagnostic copy will be scrubbed and won't include any of your personal details.

If you're using TurboTax Online:

Once you're logged in to your account,

- on the left hand panel, click on Tax Tools and then choose Tools

- on the pop up window, select Share my file with Agent

- you'll see a message saying you'll give us a copy of your tax return. Your personal information will be changed so we can't see any private information.

- click okay and you'll get another message with a token

If you're using TurboTax Desktop:

- Click on Online in the top menu of TurboTax Desktop for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number and state then place in this issue.

- We can then review your exact scenario for a solution

Please reply to this message with your token so that we can further assist you. Let us know all other states, if any, that are included on the return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

No...they desperately need that Diagnostic code.

Yes, your file may be on their computer system.....but, they have no access to your actual files without that special Diagnostic copy.

______________________

That's a data safety issue.....If their people had access to everyone's data at all times, think of the massive identity theft issues that would be presented with millions of names, birthdates, SSNs at risk.

A diagnostic copy just cleans out that "personal" information before sending your files data to the agent investigating the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

I do not see ANY of the menus or drop downs you mention. I looked at the desktop, android app, and website app from my phone. None of those choices are shown. I also did a help search - no results.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

On your computer (not on a phone)....log into your account.

Then look below the display of Fed and State acceptaces.....there should be a blue line of text to click on that says "Add a State" (you won't actually be adding one)....once you get into your actual tax file...NOW the Tax Tools selection shows up.

___________________

When posting the Diag file number...check it after posting...sometime the computer AI thinks it is a telephone number, and you might have to repost it...either by inserting a few spaces in the number, or by uploading a scrrenshot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

Token is 12888 183 no spaces

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

Thank you for sending over your token.

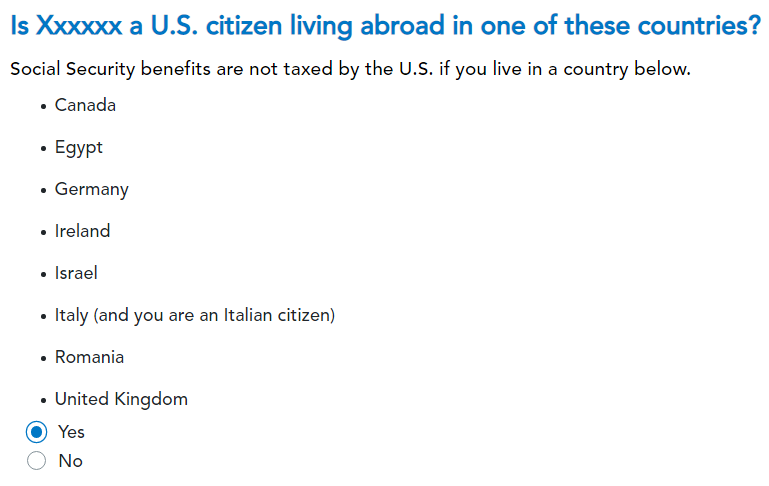

I see that your Social Security benefits were excluded on the Social Security worksheet because of treaty benefits. There's a question asking if you lived in Canada, Egypt, Germany, Ireland, Israel, Italy, Romania, or the UK. It's answered yes in the program (see screenshot). The US doesn't tax SS benefits for citizens living in these countries, in an attempt to eliminate double taxation.

Were you living in one of these countries in 2024?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

Good catch Kesha! No, I have never lived abroad (US only). I'm surprised there wasn't a follow up question asking which country for those of us who made a mistake to confirm...anyway, should I file an amendment? What do you suggest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

Glad that we were able to get that resolved for you!

You can set up an amendment to see if the additional tax that you owe matches the amount that the IRS sent in their letter. If so, you can just pay the additional amount and you wouldn't need to file the amendment. If not, you should file the amendment to reduce the amount owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

Will do, thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

I may have done the same thing. How can I go back into TT and see if I answered that question wrong. My SS money didn’t carry over to 6B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

To go back to that section:

- Open your return

- Go to Federal

- Go to Wages and Income

- Scroll down to Retirement Plans and Social Security

- Select Revisit/Update next to Social Security (SSA-1099, RRB-1099).

- Select Yes and continue to the screen Are you a U.S. citizen living abroad in one of these countries?

To access your tax return if you've e-filed it or printed it for mailing:

- Sign in TurboTax.

- Select Tax Home from the menu.

- Scroll down to Your tax returns & documents.

- Select 2024, and then select Add a State (you're not actually adding a state, this just gets you back in).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax on Social Security

This is exactly what happened to me, I inadvertently clicked yes in the box “are you a us citizen living overseas?” Cause the ssa to be non taxable!

thanks so much for the help

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

marcellas

Level 2

harlandkahn

Level 1

jerryandevescrab

Level 1

tami-disney

New Member

Eddiehg

New Member