- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- SSA-1099 MEDICARE B PREMIUM Overpayment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSA-1099 MEDICARE B PREMIUM Overpayment

My SSA-1099 Medicare B premiums ($1088.60) includes an overpayment of $68.00 due to IRMMA overcharge. SSA reimbursed me for this ($59.80 and charged $8.20 for taxes). On the form they show a non-taxable payment of $68.00. When I claim the the medicare B premium do I use the $1088.60 as listed on the SSA-1099 form or do subtract $68.00 and report $1020.60 as the Medicare Part B premiums paid since they reimbursed me? Thanks in advance.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSA-1099 MEDICARE B PREMIUM Overpayment

cdenorch,

The Medicare insurance premium(s) are among the deductible out-of-pocket medical expenses that make up the itemized deduction for medical expenses. Only the sum of those medical expenses that exceeds 7.5% of your adjusted gross income (AGI) count. For most people their current standard deduction exceeds the total of itemized deductions. In any event, it is the out-of-pocket amount that counts so you should subtract the IRRMA reimbursement.

There is one other place where Medicare premiums can come into play. Should you have self-employment income, medical insurance premiums paid during the period you did that work are an adjustment to income and are subtracted from your income, bypassing the itemized deduction restrictions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSA-1099 MEDICARE B PREMIUM Overpayment

I called the TurboTax number and the person from TurboTax said I should use the entire amount otherwise it would be flagged because it was different from the amount posted on the SSA-1099. The total amount of deductions did not exceed 7.5% of my income and the TurboTax software chose the standard deduction.

So I still don't know who has the 'right' answer. I called SSA and the person I spoke to did not know. TurboTax should address it in their software; reading through the posts it appears this is a known issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SSA-1099 MEDICARE B PREMIUM Overpayment

IRS Publication 502 (page 17) states:

Insurance Reimbursement

You must reduce your total medical expenses for the year by all reimbursements for medical expenses that you receive from insurance or other sources during the year. This includes payments from Medicare.

You are allowed to report the full amount of medical insurance premiums at the screen How much did you spend on insurance premiums

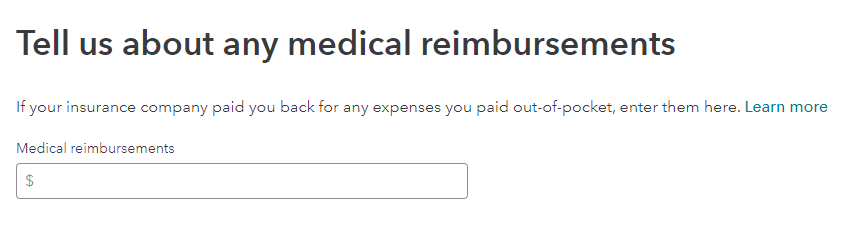

and report the overpayment at the screen Tell us about any medical reimbursements.

The entries may be found under Medical Expenses under Deductions and Credits in TurboTax Online.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kare2k13

Level 4

mdaig

New Member

rockygrod

New Member

Denise83

New Member

wanda-cambridge

New Member