- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- rmd withdrawal issues

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

Having the same RMD issues as everone else. Have tried all the above work arounds and only one I found worked. Here's the link:

Good luck!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

You need to go back through the 1099R entries and revisit all the answers. There was an update on Feb 20, 2025 that fixed the RMD problems. So if you have the Desktop program be sure to update it. The questions have changed so your prior answers won’t be right especially if you answered them with a work around to make them come out right. I would delete the 1099Rs and enter them again manually. That usually fixes it and resets the questions. Deleting has been fixing it for others.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

I tried deleting all 1099R's, updating software, and reentering all, several times, but still didn't work. The link I sent in my first post was the only fix that worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

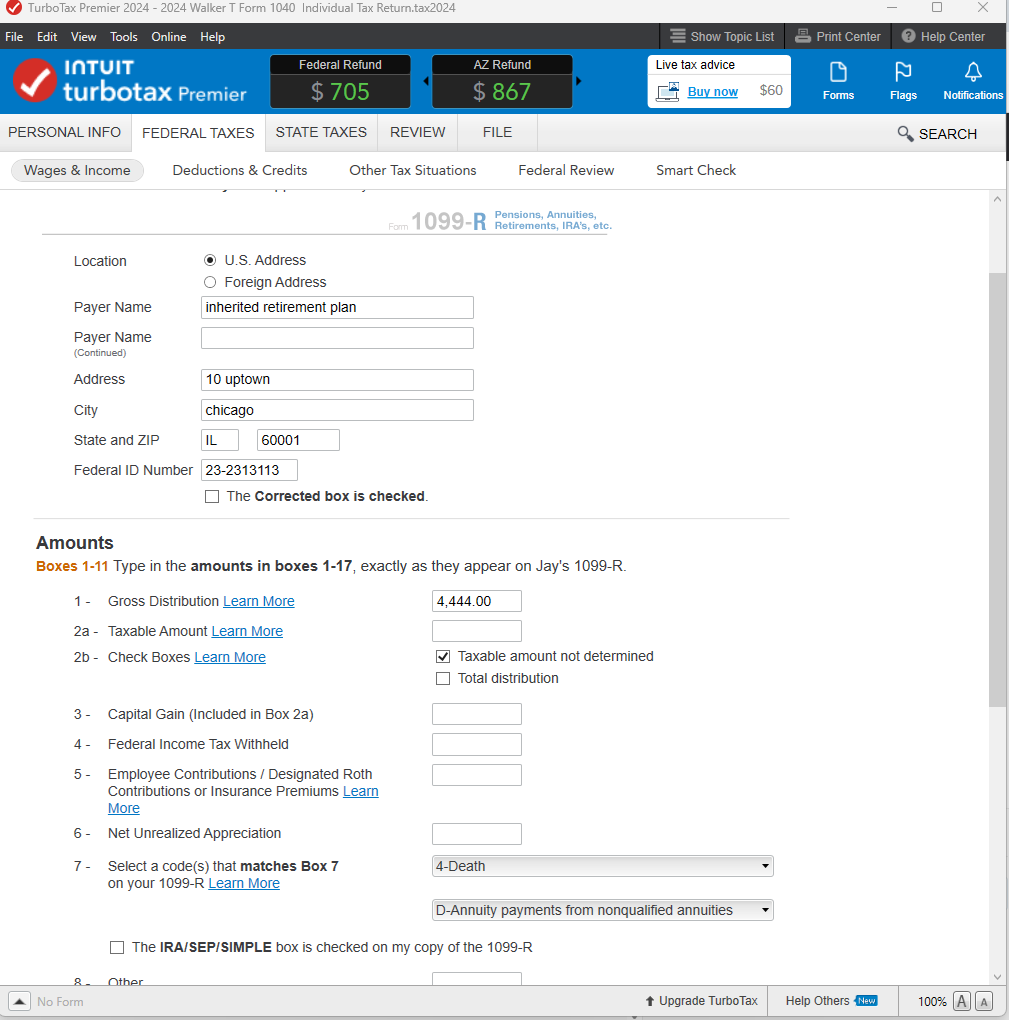

The update that was sent on the 20th may have fixed one RMD problem, but it created a doozy of another one. There are too many of us with an issue related to the distribution code of 4D. Our distributions are from an inherited non qualified plan, but when you go through the screens, you get to one that asks if your plan is a 403b or another qualified plan. We cannot answer that question because our plans are non qualified. We have reported this, but all we get is someone telling us to delete the 1099 and re-enter it. IT DOESN’T WORK!!!!!! The 4D distribution code triggers the wrong thing in the TT software. This needs to be fixed. None of us can complete our forms because of the issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

For the box 7 code 4D - this worked for me today - I chose the 403b and it did ask about my inherited non-qualified annuity.. An inherited nonqualified annuity does not have RMD

Follow these steps:

Your 1099R should have box 7 with a code D for nonqualified annuity and code 4 for inherited. Let's go through the steps:

- Open your return to the federal income

- Select the 1099-R and edit

- taxable amount -if box 2a has no amount or needs to be determined, the program will ask about cost basis. If 2a has a number and you select to use it, the program will not ask about the basis.

- continue to Enter the form

- No Public Safety Officer

- Age of person - before of after Jan 1, 1952.

- select no or yes

- select 403b plan

- RMD, enter zero

- continue

- @TerriLa

The program adds a penalty when you haven't taken the full RMD. The question is, did you take the full RMD?

- If yes, return to the screen where you entered the form.

- RMD = distribution - You can mark the RMD is the same amount and all of it went to RMD, there is no penalty.

- If the RMD is less than what you took, enter the smaller RMD, enter that NOT all of it went to RMD but $XX = RMD did.

- For example: $1000 distribution with a $600 RMD. Enter not all of it but $600 toward RMD. Program is happy. You can't say all of it and have a lower RMD. Review your answers.

- If no, you did not take the full RMD, you would have a penalty. @bruce80

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

@AmyC So glad it worked for you, but for the rest of us, IT IS NOT!!!!! I had everything entered, no problems, no red flags, but I had not filed it yet because I wanted to double check everything. There was no problem with my return until that update arrived on the 20th. At that point, everything screwed up with the 1099.

1. First off, my annuity is not a 403b nor is it a qualified annuity. So you are telling me to lie on my tax return? I would not expect a tax expert to do this.

2. I KNOW 4D means it is an inherited non qualified annuity (which is why it is not a 403b or other qualified annuity for answering the question concerning above #1). I have had it for 4 years now. This is not my first rodeo with this.

3. My mom was already taking an RMD from the annuity when she died, so I had to continue taking an RMD when I inherited it, with no penalty attached.

4. And YES, the amount of my gross distribution is the ENTIRE RMD. My plan advisor and company know what they are doing.

5. If I enter 0 for the RMD, then I am lying because my gross distribution was an RMD.

6. If I enter the full amount of the RMD (my gross distribution), the 403b option charges me a 25% penalty, then TT flags the whole thing as an error. It says (a) Yes RMD should not be selected for this distribution, (b) RMD amount should not be entered for this distribution, and (c) Type of account should not be selected for this distribution

8. If I enter the full amount of the RMD (my gross distribution), and I enter it as another qualified plan, TT then tells me "It looks like the difference between your required minimum distribution and what you took out is...and gives the amount of my gross distribution. So what TT is saying is that my RMD is double what my gross distribution was, which is incorrect. It then charges me the 25% penalty before asking if the remaining amount was taken out in the withdrawal window. If I say no, the 25% penalty remains. If I say yes, then I get charged a 10% penalty. Neither penalty is correct. I took the full RMD as my gross distribution. The program should not be charging me a penalty, BUT IT DOES!!!!!!!! Then once again, it flags it all as an error, saying the same things as it did when I put it in as a 403b.

There are so many of us having this issue with this update. None of what any of you tax experts say to do works. Do you know how many times I have deleted this 1099 and reentered it? How many times I have gone through and answered the questions like you said? We are not the problem, so please stop telling us the same thing over and over that does not address the issue - which is that TT has a major problem in its software. As I said, I have been dealing with this inherited annuity for four years now and this is the first year this has cropped up. And there was no problem until TT sent out the update on the 20th. I feel like TT doesn't care about accuracy and truth any more, nor does it listen to its customers when they all say there is something wrong.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

I apologize for not being more clear and please let me explain. The program questions and answers don't go to the IRS, just your tax forms, not even the worksheets.

1. A nonqualified annuity is not a qualified plan. The program only has two options and all of these questions are to move the numbers around to get them on your form correctly. I want your tax forms to be correct.

2. You have been doing this without issue for several years and now the IRS is getting better computers and updating things and the process has changed without the clarity you need.

3. The goal is to get the program to get your numbers to the right place on the form without the penalty.

4. Since the full amount is the RMD, try entering the RMD as the full amount and answering that all of it went to RMD. That should work, pick qualified plan and the program should figure out it isn't taxable. Again, the only thing going to the IRS is the number on the tax form, the taxable dollar amount and any penalty.

5. Again, any RMD that zeroes out the penalty is fine,

- You can mark the RMD is the same amount as the taxable distribution and all of it went to RMD, there is no penalty.

- If the RMD is less than what you took, enter the smaller RMD, enter that NOT all of it went to RMD but $XX = RMD did.

- For example: $1000 distribution with a $600 RMD. Enter not all of it but $600 toward RMD. Program is happy.

- You can't say all of it and have a lower RMD.

- Review your answers.

6,7, & 8 Sounds like you have been through every scenario possible. Are you looking at your worksheets to see where the numbers are coming from - like doubling? If you look at the worksheets, you can at least see which answer is triggering what. Only your actual tax form counts, the worksheets do not go to the IRS. The worksheets are the program trying to understand.

You should clear cache and cookies since you have gone around so many times.

There are a couple of code 7 issues that are known - which should not affect you maybe it is and you need to wait for a program update.

You want to look at all worksheets as well. Choose to see everything, not just forms. To print or view your forms:

- In desktop, switch to Forms Mode.

- For online:

- On the left side, select Tax Tools

- Select Print center

- Select Print, save or preview this year's return

- If you have not paid, select pay now.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

@AmyC I am getting so frustrated. I did enter the full gross distribution as my RMD, which it is. If I choose other qualified plan and enter my RMD (gross distribution), it charges me a 25% penalty on the full RMD (gross distribution). For example, if my gross distribution was $5000 and I enter $5000 as my RMD, the program says I still have $5000 remaining to meet my RMD. As I stated, it then asks me if I withdrew the remaining RMD within the withdrawal window. If I say yes, it charges me a 10% penalty. If I say no, then it is 25%. Either way, TT flags everything as an error. The only way for it to work is if I put 0 as my RMD, which is incorrect. On the worksheet, if I delete everything that it says is an error, then there is nothing showing that I had an RMD. The first error it encounters is the question asking if I had an RMD. The program tells me that I cannot answer yes.

It has been almost three weeks since the update that messed everything up came out. I need to get my tax return filed. Several of us have tried calling TT, but nothing they say for us to do works and it doesn’t appear that any thing is moving forward to get the problem solved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

Delete all the 1099s or just the non-qualified ones?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

I tried deleting and re-entering both my non qualified annuities. Didn’t make a difference. Program was still charging me a penalty and flagging it all as an error on the 1099 that was coded 4D. Since I knew my RMD was met, the only way I could get around TT’s software glitch was to enter $0 for my RMD amount. It let me proceed with my return. Then at the end when the program checks for errors, it told me I could not enter anything as the RMD, so it took me to the error, I deleted the $0, and finished running the program for any other errors. Then I went ahead and e-filed my return. I know my final calculations were correct because I tried a different tax software program and came up with the same numbers. It’s a shame that TT has put us in this position and does nothing to correct its program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

Has anyone figured out a work around for the non qualified annuity issue? It’s driving me nuts! I’m about ready to just remove the D in line 7 and let TT figure it out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

Could you be more specific with the error you are receiving? I entered a Non-Qualified Annuity from a 1099-R into TurboTax and did not get any errors or other messages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

I have the very same problem!! Please advise!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

NO.... only delete the 1099-R's... then reenter them and try this link. It worked for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

rmd withdrawal issues

Same issue as last year. You would think that after MORE THAN A YEAR THEY WOULD FIX THE PROBLEM.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17716281410

Returning Member

dshafer69

Level 1

jennbomm

New Member

jmtamol2

Level 1

rsaulsbe

New Member