- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Report recharacterization of Roth IRA?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

I have a similar question with a twist. I didn't recharacterize anything. I made a non-deductible IRA contribution a few years ago. In 2020, I attempted to do a backdoor Roth and converted the non-deductible IRA to a Roth IRA. However, I still have other deductible IRA's. I got a 1099 for the Roth conversion and filled out the questions in the wages section, but when I went into the Deductions section and started filling out the Retirement section for IRA's and Roths, I entered my non-deductible amount, but it never asked me for my deductible contributions for existing IRA's. To make it worse, the software said I owed for an excess contribution. I thought that I made the conversion correctly and only had to figure out the percentage of my IRA's that are taxable and pay that percentage of my conversion amount.

Are there steps to follow in the online Premier version for this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

@nyfutbolfan wrote:

I have a similar question with a twist. I didn't recharacterize anything. I made a non-deductible IRA contribution a few years ago. In 2020, I attempted to do a backdoor Roth and converted the non-deductible IRA to a Roth IRA. However, I still have other deductible IRA's. I got a 1099 for the Roth conversion and filled out the questions in the wages section, but when I went into the Deductions section and started filling out the Retirement section for IRA's and Roths, I entered my non-deductible amount, but it never asked me for my deductible contributions for existing IRA's. To make it worse, the software said I owed for an excess contribution. I thought that I made the conversion correctly and only had to figure out the percentage of my IRA's that are taxable and pay that percentage of my conversion amount.

Are there steps to follow in the online Premier version for this.

Excess contribution? You do not enter anything in the IRA contribution section for a distribution or conversion. That is entered in the 1099-R section.

Unfortunately if you have any other IRA at the end of 2020 a backdoor Roth will not work.

Your non-deductible contribution as shown on a 8606 form line 14 from the year that the non-deductible contribution was contributed will be prorated over the conversation and total year end value of all existing Traditional IRA account.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

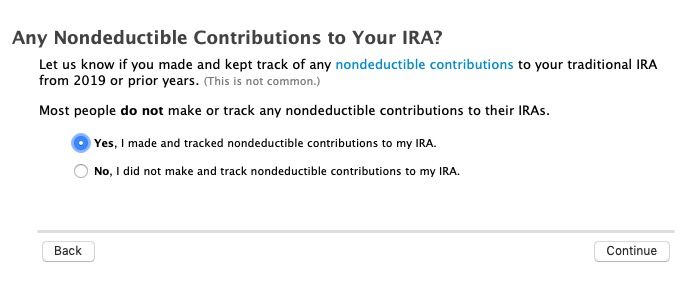

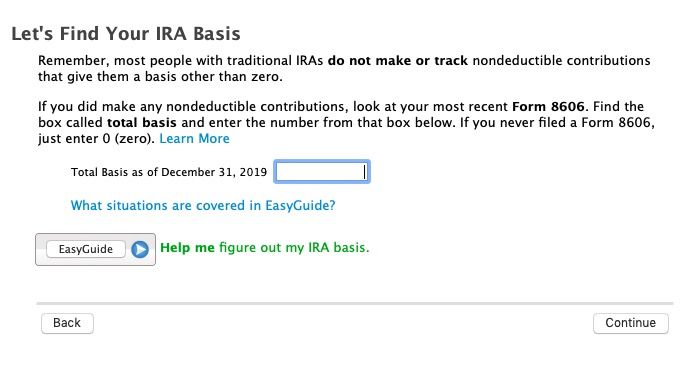

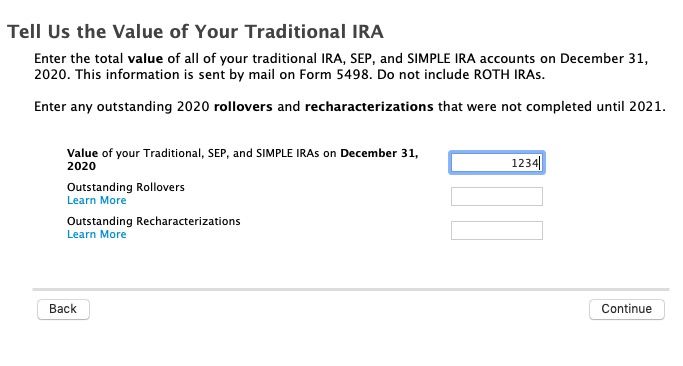

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-14 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

Thank you macuser 22.

Unfortunately, I was able to do the first 2 things, but the 3rd item (total value of IRA's held) did not appear on my screen. "You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020."

I went into tools and found the form 8606. It has nothing on Line 6 because there was nothing on the screen with which to enter it. I used to be able to overide the forms when I used CD's, but I had to switch to the online version. Is there a way I can overide form 8606 on a Premier online version?

If not, I think at this point that I would be wise to just pay the amount of tax that I think I really owe and just send in a paper version of an amended return at a later date (I have spent at least 10 hours reviewing this one item). Would you be able to tell me how I can overide the amount of money that I am paying in tax? I am due a refund, so I'd like to just increase the payment to the government so I don't have to pay penalities due to all of this confusion. Thanks again for all your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

@nyfutbolfan wrote:

Thank you macuser 22.

Unfortunately, I was able to do the first 2 things, but the 3rd item (total value of IRA's held) did not appear on my screen. "You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020."

I went into tools and found the form 8606. It has nothing on Line 6 because there was nothing on the screen with which to enter it. I used to be able to overide the forms when I used CD's, but I had to switch to the online version. Is there a way I can overide form 8606 on a Premier online version?

If not, I think at this point that I would be wise to just pay the amount of tax that I think I really owe and just send in a paper version of an amended return at a later date (I have spent at least 10 hours reviewing this one item). Would you be able to tell me how I can overide the amount of money that I am paying in tax? I am due a refund, so I'd like to just increase the payment to the government so I don't have to pay penalities due to all of this confusion. Thanks again for all your help.

If there is a * next to line 15 then the calculations are done on the "IRA Taxable IRA Distribution Worksheet not the 8606 and the year end total will be on line 4.

That screen is after when you enter your prior years non-deductible contributions.

You should get these screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

The 3rd screen does not come up. I think I will just contact the IRS and ask them for assistance to make sure that I fill out the 8606 correctly. I will probably just use the software to print out empty forms and handwrite in all of the required numbers because I will have to re-work my 1040 form and the form 8606.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

@DanaB27 Thank you for the detailed information. I have a similar case that will affect my 2021 return. In early 2021, I mistakenly contributed $6k to a Roth for year 2021, now I have earnings on that Roth contribution. Since I will exceed the income limit for a Roth contribution, I plan to recharacterize the $6k + earnings to a tIRA and then immediately do a backdoor IRA, all in 2021. Now, is the amount that is moved back to the Roth IRA (in the backdoor process) equal to the $6k plus earnings regardless of the taxes that will be paid on the earnings from the recharacterization or is it the $6k plus earnings minus taxes? And, what would be the steps in TurboTax to enter the information for these transactions?

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

@omar23 wrote:

@DanaB27 Thank you for the detailed information. I have a similar case that will affect my 2021 return. In early 2021, I mistakenly contributed $6k to a Roth for year 2021, now I have earnings on that Roth contribution. Since I will exceed the income limit for a Roth contribution, I plan to recharacterize the $6k + earnings to a tIRA and then immediately do a backdoor IRA, all in 2021. Now, is the amount that is moved back to the Roth IRA (in the backdoor process) equal to the $6k plus earnings regardless of the taxes that will be paid on the earnings from the recharacterization or is it the $6k plus earnings minus taxes? And, what would be the steps in TurboTax to enter the information for these transactions?

Thanks,

The proper way to report the recharacterization and earnings which is to enter the 2019 IRA contribution in the IRA contribution interview section and then say yes to "Did you switch from a Roth to a Traditional IRA - recharacterize".

The amount The amount of the original Roth contribution must be entered - not any earnings or losses.

Then TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharactorized.

There is no tax or penalty on the before-tax earnings since the earning were simply switched into the recharactorized account.

That is the only way to prepare and attach the proper explanation statement for a code R 1099-R.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

Since the after-tax Roth contribution is now a Traditional IRA contribution it can be either a before-tax deduction if your MAGI allows a deduction which might result in an additional 2019 refund, or it will be an after-tax contribution reported on a 8606 form (line 1 & 14) as a "basis" in the Traditional IRA that will reduce the tax of future distributions.

Note that when you do the Roth conversion (assuming that is the only Traditional IRA account you have) the earnings will become taxable at that point.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

This same situation happened for my wife. The Roth got 6000 in 2021 (got married, and income limits needed to recharacterize to tIRA). The only thing is the recharacterization happened in 2022 in February - there were small amt of gains $421. I immediately converted that once it hit the tIRA backdoor to a roth.

My question is regarding forms, i obviously will not get all those tax forms until 2023 (confirmed by fidelity) so how do it go about filing this. Do i need a 8606 still and just explain what happened? Manually add the 421 of capital gains in my income section?

thanks for the help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

No, you do not need to add $421 of capital gains in your income section. The earnings will be taxable when you distribute/convert the funds in 2022.

You will enter the recharacterization when you enter the contribution to the Roth IRA on your 2021 tax return (see steps below). TurboTax will create Form 8606 and you will have a basis on line 14 to carry over to 2022.

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount of $6,000

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the contribution amount of $6,000 (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $6,000 plus $421 earnings were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes" (if you are thinking about doing a backdoor Roth. If you have a retirement plan at work and are over the income limit it will be nondeductible automatically and you only get a warning and then a screen saying $0 is deductible)

You will get two 2022 Form 1099-R in 2023:

One Form 1099-R will be for the recharacterization with code R-Recharacterized IRA contribution made for 2021 and this belongs on the 2021 return. But a 1099-R with code R will do nothing to your return. You can only report it as mentioned above. Therefore, you can ignore the 1099-R with code R when you get it in 2023. The box 1 on the 1099-R will report the total recharacterized amount (contribution plus earnings) but it does not separately report the earnings and box 2a must be zero.

The second Form 1099-R will be for the (backdoor) conversion from traditional IRA to Roth IRA and will be entered on your 2022 tax return.

On your 2022 tax return, you will enter your conversion:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

Hi Dana, thank you for all your replies, they are all very helpful. I think I generally understand, but just wanted to clarify before I go on ahead.

I have a similar situation as many above that I need to somehow resolve. In January of this 2022, I made a contribution of $6000 to the 2021 Roth IRA contribution limit and $6000 more for the 2022 Roth IRA contribution limit. Then I purchased shares using them. I later realized that my MAGI was over the limit, so I had to recharacterize both contributions to a traditional IRA. I think the 2021 contribution was recharacterized on 1/12/22, and 2022 contribution was recharacterized on 1/14/22 (not sure which one is which, since I did not get a 1099R from fidelity yet). Then after that, I backdoored (conversion) the traditional IRA stuff into the Roth IRA together.

First question, since the 2022 contribution was recharacterized into a traditional IRA that technically had some money inside it, does that incur a fee due to the pro-rata rule? All my contributions in my IRAs are from after-tax contributions, so I don't think so, but not sure.

Second question, I know I will get a 1099R form for the recharacterization of 2021 contribution (made in 2022), 1099R form for the recharacterization of 2022 contribution, and a 1099R for conversion (do I get separate forms for 2021 and 2022 contributions, or are they grouped into one? But that is a question for later). If I get the recharacterization forms in 2023, how do I enter the relevant information into the tax filing for 2021 year? I didn't get any forms from Fidelity, so while I did initially contribute 6000, idk how much was recharacterized to trad IRA at that moment (I had to rechar 2 contributions - 2021 and 2022 - and they occurred on different days)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report recharacterization of Roth IRA?

No, generally, if you had only after-tax contributions, reported on Form 8606, in your traditional IRA then the pro-rata rule won't apply. But if you had any earnings then these will be taxable when you make distributions/conversions.

You will need the know the earnings for the explanation statement, please contact your financial institute to find out about the earnings.

You will enter the recharacterization when you enter the 2021 contribution to the Roth IRA:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount of $6,000

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the contribution amount of $6,000 (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes" (since you are thinking about doing a backdoor Roth. If you have a retirement plan at work and are over the income limit it will be nondeductible automatically and you only get a warning and then a screen saying $0 is deductible)

You will get Form 1099-R for the recharacterization with code R-Recharacterized IRA contribution made for 2021 and this belongs on the 2021 return. But a 1099-R with code R will do nothing to your return. You can only report it as mentioned above. Therefore, you can ignore the 1099-R with code R when you get it in 2023. The box 1 on the 1099-R will report the total recharacterized amount (contribution plus earnings) but it does not separately report the earnings and box 2a must be zero.

For the 2022 recharacterization, you will get Form 1099-R with code N. You will have to enter it on your return (it is not taxable and only for information) but you will also have to enter the recharacterization with the steps above.

Next year to enter the conversion on the 2022 tax return:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “Tell us if you moved the money through a rollover or conversion” and choose “I converted some or all of it to a Roth IRA”

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contributions to your IRA?" if you had any nondeductible contributions in prior years.

- Answer the questions about the basis from line 14 of your 2021 Form 8606 and the value of all traditional, SEP, and SIMPLE IRAs

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

meltonyus

Level 1

march142005

New Member

jliangsh

Level 2

igrindgears63

New Member

VAer

Level 4