- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@nyfutbolfan wrote:

Thank you macuser 22.

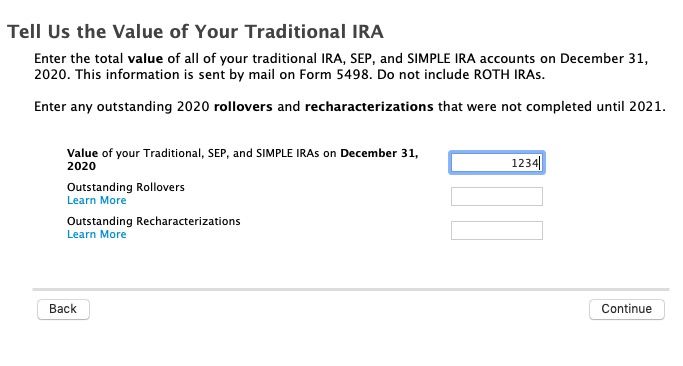

Unfortunately, I was able to do the first 2 things, but the 3rd item (total value of IRA's held) did not appear on my screen. "You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2020."

I went into tools and found the form 8606. It has nothing on Line 6 because there was nothing on the screen with which to enter it. I used to be able to overide the forms when I used CD's, but I had to switch to the online version. Is there a way I can overide form 8606 on a Premier online version?

If not, I think at this point that I would be wise to just pay the amount of tax that I think I really owe and just send in a paper version of an amended return at a later date (I have spent at least 10 hours reviewing this one item). Would you be able to tell me how I can overide the amount of money that I am paying in tax? I am due a refund, so I'd like to just increase the payment to the government so I don't have to pay penalities due to all of this confusion. Thanks again for all your help.

If there is a * next to line 15 then the calculations are done on the "IRA Taxable IRA Distribution Worksheet not the 8606 and the year end total will be on line 4.

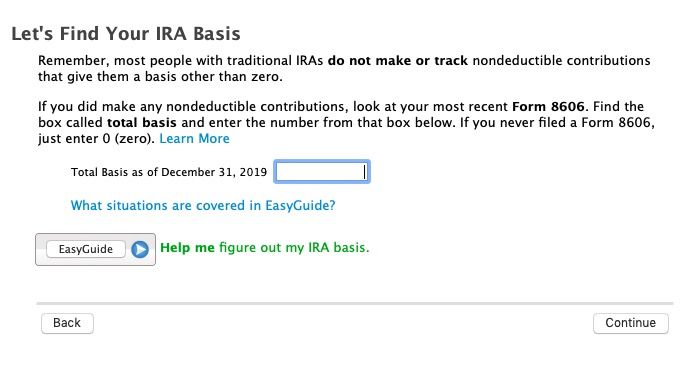

That screen is after when you enter your prior years non-deductible contributions.

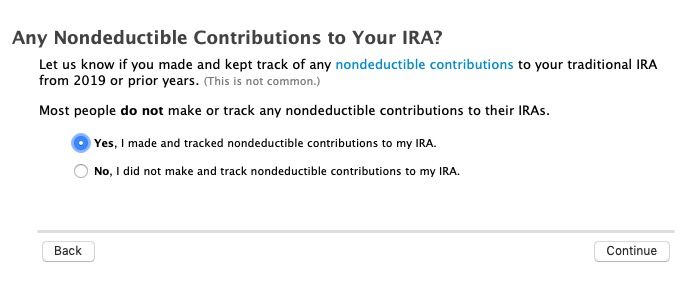

You should get these screens.