- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Receive pension payments from deceased spouse - equal periodic payments

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

I receive a monthly payment from my deceased husbands pension until I turn 72 or remarry. Should I be listed the amount I receive under the "Other Tax Situations - equal periodic payments" ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

For payments made to you as beneficiary of your deceased spouse's pension, I would expect the Form 1099-R to have code 4 which would already mean that the distribution is not subject to any early-distribution penalty. There is no need to claim an exception if you have no such penalty to begin with.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

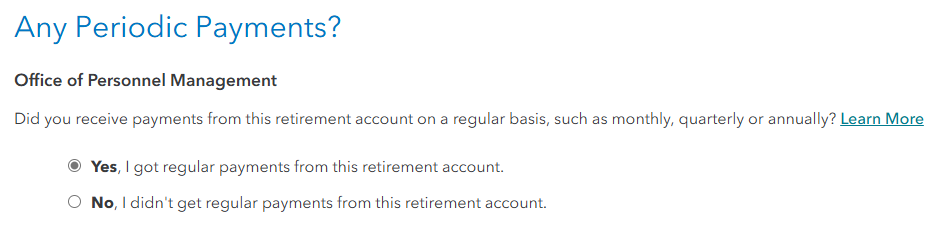

Are you referring to the screen Any Periodic Payments?

If so, you likely should report Yes, I got regular payments from this retirement account.

If you are at this screen, the software is determining how much of the pension distribution should be taxable income.

Perhaps, you received an IRS form 1099-R which reports and amount in box 1 but blank in box 2a? Is this correct?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

Yes I get a 1099-R. They report the whole amount disbursed to me in Box 1 & 2a

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

I was looking at the "other tax situations" section in Turbo Tax for extra tax on early retirement withdrawls

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Receive pension payments from deceased spouse - equal periodic payments

For payments made to you as beneficiary of your deceased spouse's pension, I would expect the Form 1099-R to have code 4 which would already mean that the distribution is not subject to any early-distribution penalty. There is no need to claim an exception if you have no such penalty to begin with.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nadilaadikae3

New Member

Zaatar

New Member

kritter-k

Level 3

menarisw

New Member

Vermillionnnnn

Returning Member