- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Thank you I reviewed your token and you haven't answered the 2020 Qualified Disaster Distribution question. But I saw you had two Form 1099-R entered, are both of them from 2022? Please make sure you do not enter your 2020 Form 1099-R on your 2022 tax return. You will need to answer the 2020 Qualified Disaster Distribution questions to enter the 3rd portion (1/3 of the distribution).

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- Enter all your 2022 Form 1099-R (if you don't have any answer "No" to "Did you get a 1099-R in 2022?")

- After entering your last 2022 Form 1099-R click "Continue" on the “Review your 1099-R info” screen

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

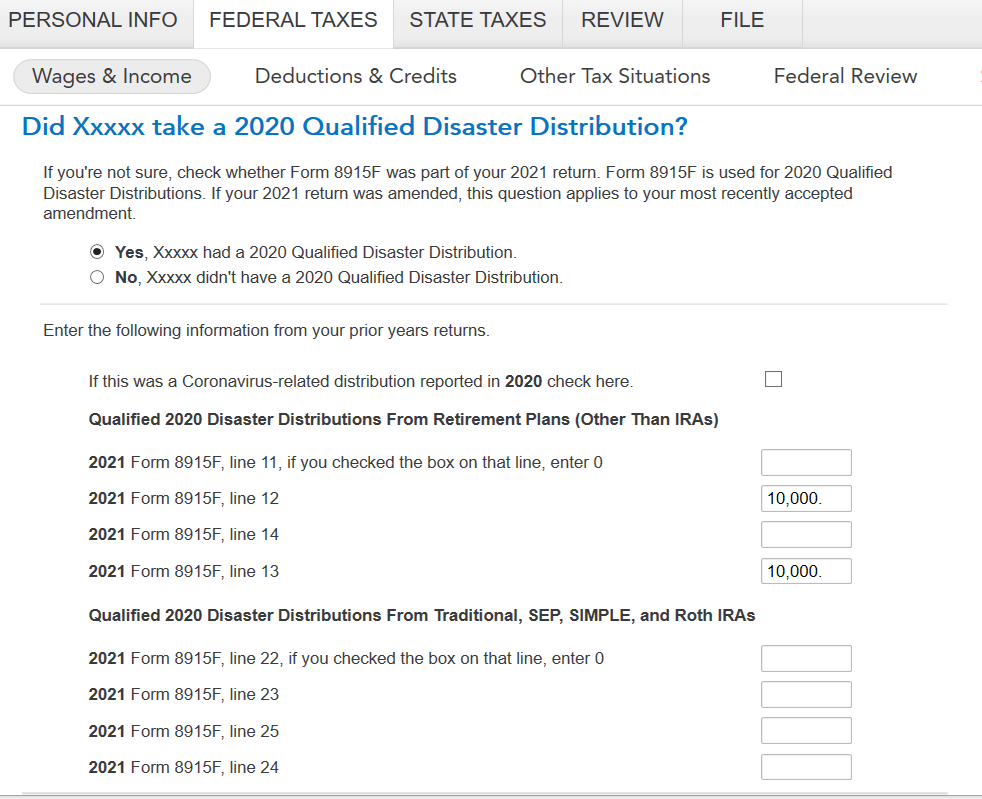

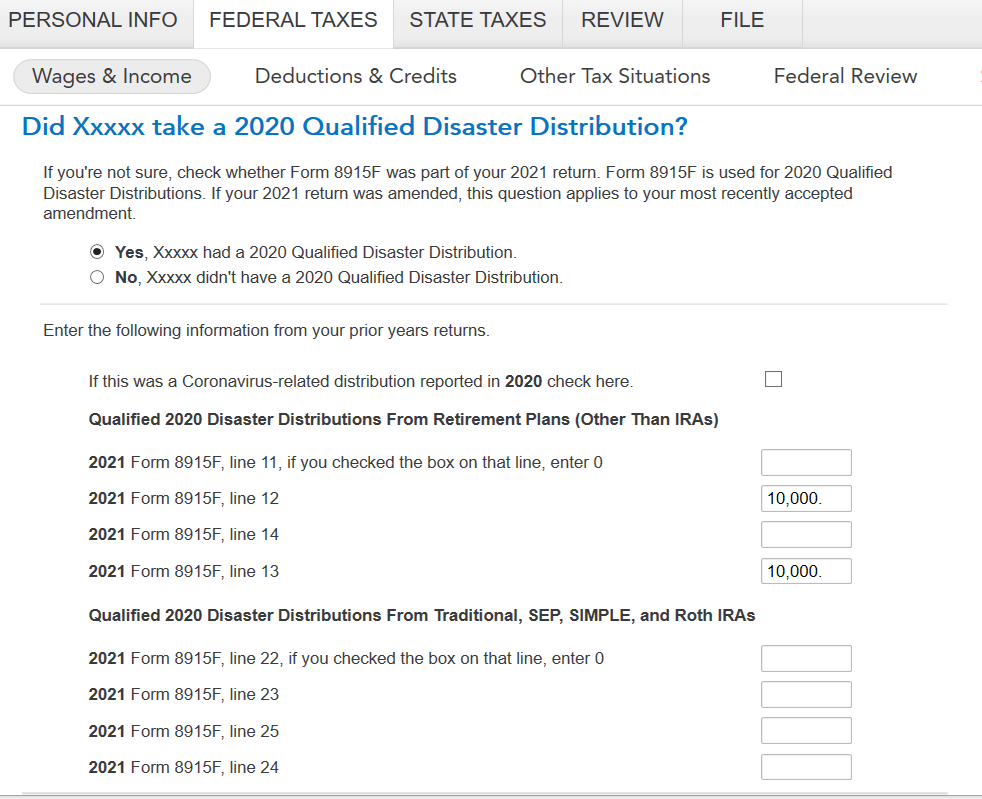

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information from your 2021 Form 9815-F (for example, if you took a $30,000 Covid distribution from a retirement plan (other than IRA) in 2020 and split it over 3 years you will enter $10,000 on line 12 and 13, then $10,000 will be added to line 5b of Form 1040).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Please follow these steps to report the 3rd portion of the COVID distribution or any repayment:

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information from your 2021 Form 9815-F (should be 1/3 of the distribution).

Please be aware that you won't see the 3rd portion on the Income summary in TurboTax but you can verify that it is entered correctly by checking Form 1040 4b (for IRA) or 5b (for none IRA).

To preview Form 1040:

- Click on "Tax Tools" in the left menu

- Click "Tools"

- Click "View Tax Summary" in the Tool Center window

- Click on "Preview my 1040" on the left

Please verify that Form 8915-F doesn't have an entry on line C if you are only reporting the 3rd portion of the 2020 Covid distribution (you may be asked to pay first):

- Select Tax Tools on the left and then Print Center

- Select Print, save or preview this year's return

- Select returns

- In the pop-up window scroll down to Form 8915-F

If you need to delete the line C entry (if you only had the Covid Distribution):

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Uncheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and click continue

- On the "Which disaster affected you in 2020?" screen select the blank entry (click on it) and click "continue"

- Go through all the question

- On the Income & Wage screen click "Edit" next to "IRA, 401(k), Pension Plan Withdrawals (1099-R)"

- Click "Continue" on the “Review your 1099-R info” screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Then recheck the box next to "If this was a Coronavirus-related distribution reported in 2020 check here", enter your information from your 2021 Form 9815-F, and then continue.

Another option is to delete both "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and then go back to the retirement section and reenter the information:

- Open or continue your return in TurboTax.

- In the left menu, select "Tax Tools" and then "Tools".

- In the pop-up window Tool Center, select "Delete a form".

- Select "Delete" next to "Form 8915-F" and "Qualified 2020 Disaster Retirement Distr" and follow the instructions.

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2022 1099-R answer "No" to "Did you get a 1099-R in 2022?" (If you have any other 1099-R then enter all 1099-R and after entering your last 1099-R click "Continue" on the “Review your 1099-R info” screen)

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Thank you. That does not fix my problem and it shows that I have to pay thousands of dollars more than I expected because it is showing my income 100k more than what it should show. When will TurboTax fix this issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Solution posted elsewhere:

You have to delete the 2020 Qualified Distribution Worksheet. Then go back through income and revisit the retirement section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

I cannot recreate your issue and it would be helpful to have a TurboTax ".tax2022" file that is experiencing this issue. You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions for TurboTax Online:

- From the left menu select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

The instructions for TurboTax Download:

- On your menu bar at the very top, click "Online"

- Select "Send Tax File to Agent"

- Click "Send"

- The pop-up will have a token number

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Perfect. Thank you. My token number is 1099756.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Thank you I reviewed your token and you haven't answered the 2020 Qualified Disaster Distribution question. But I saw you had two Form 1099-R entered, are both of them from 2022? Please make sure you do not enter your 2020 Form 1099-R on your 2022 tax return. You will need to answer the 2020 Qualified Disaster Distribution questions to enter the 3rd portion (1/3 of the distribution).

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- Enter all your 2022 Form 1099-R (if you don't have any answer "No" to "Did you get a 1099-R in 2022?")

- After entering your last 2022 Form 1099-R click "Continue" on the “Review your 1099-R info” screen

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information from your 2021 Form 9815-F (for example, if you took a $30,000 Covid distribution from a retirement plan (other than IRA) in 2020 and split it over 3 years you will enter $10,000 on line 12 and 13, then $10,000 will be added to line 5b of Form 1040).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Thank you for all of your help. Another concern, we paid a percentage on our coronavirus distribution in 2020 should that be shown on this year taxes? Year 2020 & Year 2021 it showed up, I believe on line "25b". Can you help me with that please? I sent you a new token: 1100128 Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

No, the withheld taxes on the 2020 Form 1099-R were only applied to your 2020 tax return and are not spread over 3 years. Most likely you received some of these taxes back on your 2020 tax return. Please verify that you entered the full amount when you entered Form 1099-R box 4 on your 2020 tax return. Please verify that you didn't enter 1/3 of the taxes withheld shown on the 2020 Form 1099-R on your 2021 tax return.

I review your token and you entered the 3rd portion correctly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Will the 2022 8915 form tax a third of my distribution like it did in 2020 and 2021? It is adding the whole distribution total to my 2022 income causing a lrg tax bill.

Working with a TT customer they entered lines 12 and 13 for 20 and 21 distributions (through outside CPA). TT accounted for distributed amounts reducing refund amount appropriately following the interview below. (5b enty)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549435158

New Member

tianwaifeixian

Level 4

Smurfect

New Member

LD71

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Liangtwn

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill