- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

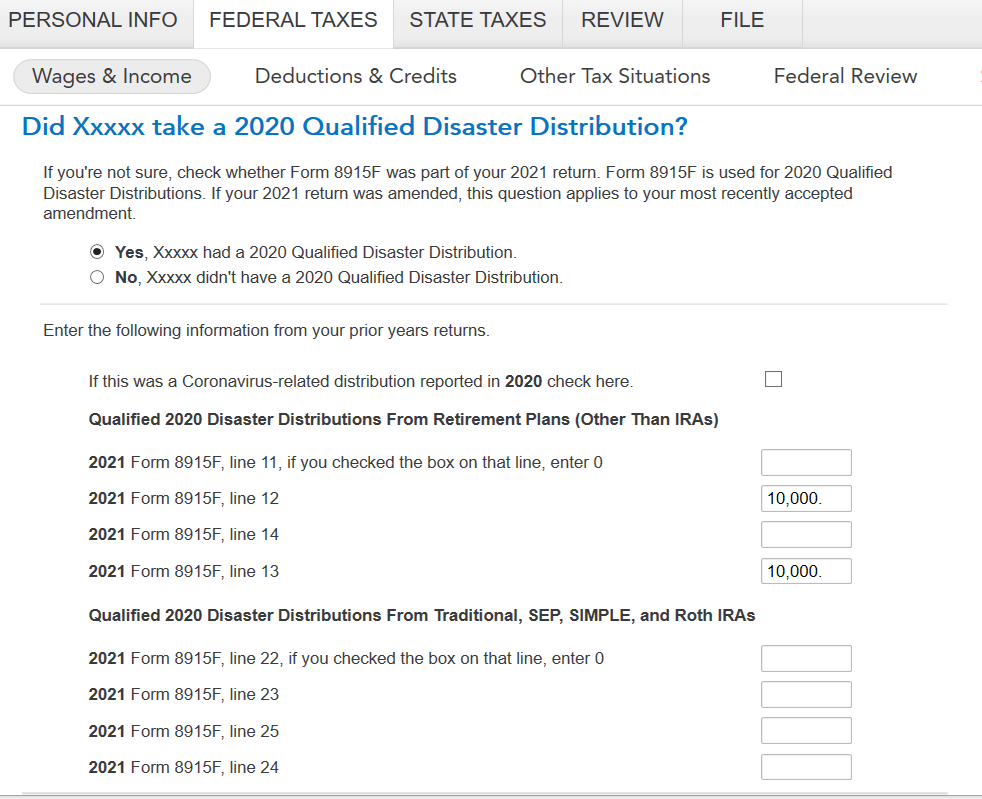

Thank you I reviewed your token and you haven't answered the 2020 Qualified Disaster Distribution question. But I saw you had two Form 1099-R entered, are both of them from 2022? Please make sure you do not enter your 2020 Form 1099-R on your 2022 tax return. You will need to answer the 2020 Qualified Disaster Distribution questions to enter the 3rd portion (1/3 of the distribution).

- Login to your TurboTax Account

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- Enter all your 2022 Form 1099-R (if you don't have any answer "No" to "Did you get a 1099-R in 2022?")

- After entering your last 2022 Form 1099-R click "Continue" on the “Review your 1099-R info” screen

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2022?" screen

- Answer "Yes" to "Did you take a 2020 Qualified Disaster Distribution?"

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here" and enter your information from your 2021 Form 9815-F (for example, if you took a $30,000 Covid distribution from a retirement plan (other than IRA) in 2020 and split it over 3 years you will enter $10,000 on line 12 and 13, then $10,000 will be added to line 5b of Form 1040).

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2023

9:25 AM