- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Software is stating line 11 (distributions from sect. 457 does not match State amount). The n...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Please tell us:

1. The state in question.

2. The amount in box 11.

3. The amounts in boxes 16 and 18.

Also, you had just the one W-2, right?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

The state is Minnesota.

Amount in box 11 is 24,387

Amount in box 16 is 146,839 (matches box 1)

Amount in box 18 is 0

Yes only 1 W2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

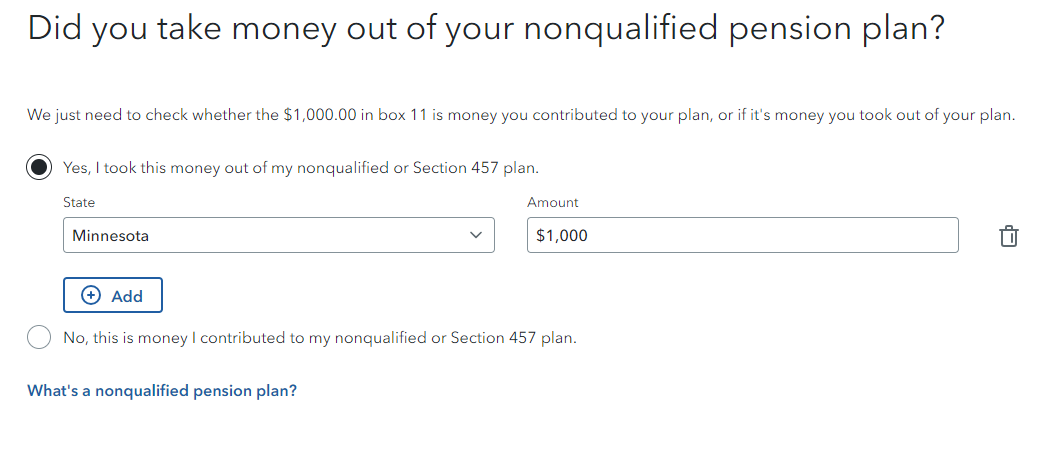

Is this the screen that you are seeing?

If so, is Minnesota the only state tax return included with your Federal 1040 tax return? Or are other state tax returns being prepared?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

That is not the screen I'm seeing.

The screen I'm seeing is represented below. It came up as an item to be reviewed at the end of filling out my Federal information. I imported my W2 so I didn't enter any original values. There is no State amount on the W2 so TurboTax must have filled that in.

=====================================

| Form W-2 (xabc): Nonqualified Distribution (State Amount) - The total amount of Sect. 457 state distributions does not match with the amount of Sect. 457 distributions reported on the federal return. Adjust the state entries as needed. |

| Nonqualified Dis (St Amt) |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

I am getting the same error also. Have a W-2 for only one non qualified plan. Box 11 and box 16 are identical numbers, no number in box 18, state is Connecticut. But error check says "...total amount of Sect. 457 state distributions does not match with the amount of Sect 457 distributions reported on the federal return" However, they DO match.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

The only explanation I can come up with is that there is a bug in the TurboTax software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

I would agree with you, it appears to be a software bug. What I don't know - is this forum monitored by the Intuit developers and is there a plan for a fix coming? If not this forum, is there another way the developers can be made aware?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Exact same problem for Michigan. It must be a bug. I double checked everything and re-entered and deleted things a few times. Exact same amount and info as 2022. New software must be the problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Same here regarding my 2022 return (identical info and no problem last year). I think we're all agreeing that it is very likely a software bug - does anyone know if these threads are seen by Tax Experts and/or Intuit developers and are being brought to the attention of the right people for incorporating a fix?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

I would like to take a deeper look at this.

However, I need a diagnostic file which is a copy of your tax return that has all of your personal information removed. You can send one to us by following the directions below:”

TurboTax Online:

- Sign into your online account.

- Locate the Tax Tools on the left-hand side of the screen.

- A drop-down will appear. Select Tools

- On the pop-up screen, click on “Share my file with agent.”

- This will generate a message that a diagnostic file gets sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response.

TurboTax Desktop/Download Versions:

- Open your return.

- Click the Online tab in the black bar across the top of TurboTax and select “Send Tax File to Agent”

- This will generate a message that a diagnostic copy will be created. Click on OK and the tax file will be sanitized and transmitted to us.

- Please provide the Token Number that was generated in the response

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Token #1166408. Should be an easy fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

If you need another example, I am having the same issue, state is Texas. Here is the token number: 1165576

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Same issue in Ohio!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Software is stating line 11 (distributions from sect. 457 does not match State amount). The nbrs match but it is suggesting changing the State amount. What should I do?

Line 11 distributions from Sect 457 does not match State amount ; indicates State amount need to be adjusted . How do you do that? This involves only one W-2!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

riram

New Member

sonzoil

Level 4

riram

New Member

riram

New Member

mryxyz2004

New Member