- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Received a 1099-R due to cancelling Group Life Insurance Policy, not retirement related

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-R due to cancelling Group Life Insurance Policy, not retirement related

I received a 1099-R because my employer changed our GUL provider in 2019 and we had the option of cancelling our old policy or maintaining it separately. I cancelled mine and received a disbursement of a few hundred dollars I assume because it was some kind of whole life policy. I'm surprised that falls under a 1099-R because it has nothing to do with retirement. The options in TurboTax that I see don't describe this. Would this fall under an annuity distribution? The distribution code is 7. It just feels odd to answer questions about retirement income so I'm trying to understand the connection. Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-R due to cancelling Group Life Insurance Policy, not retirement related

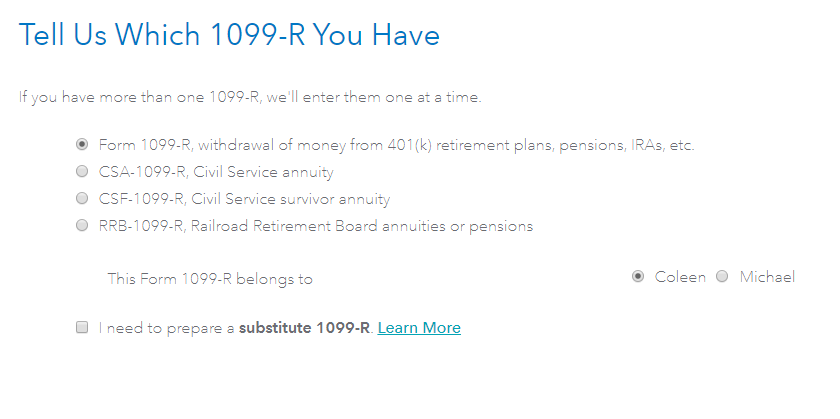

Yes, it is reported on Form 1099-R. On the screen that asks what type it is, mark the first choice as shown.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received a 1099-R due to cancelling Group Life Insurance Policy, not retirement related

Yes, it is reported on Form 1099-R. On the screen that asks what type it is, mark the first choice as shown.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

lenahanpatrick

New Member

zwillhidejames

New Member

bgjeff

New Member

sheli-p-rdh

New Member

rothll

New Member