- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Question about Form 1099-R, COVID Distribution and Form 8915F

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

So I got a 1099-R for my COVID-related disaster distribution from the summer of 2020. When I did my 2020 taxes last year I reported the 1099-R and decided to have the amount taxed over the 3 years (2020 - 2022). Now that I am doing my 2021 taxes, I did not get any other 1099-R, and I want to make sure that I do not need to enter the old 1099-R form when I get asked Did you get a 1099-R in 2021? (aka no) and can proceed? Also, how will I know that I will only get taxed one third this year just like last year? Any help would be greatly appreciated.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

You will not receive a 2021 Form 1099-R for your 2020 coronavirus related distribution. The entire distribution was reported on your 2020 1099-R. You do not need to re-enter the 2020 1099-R. You will be able to see on your return that you are only being tax on 1/3 of the total 2020 distribution. If you want to see the return before you file, you can do so by paying and then printing a copy of your return prior to filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

You will not receive a 2021 Form 1099-R for your 2020 coronavirus related distribution. The entire distribution was reported on your 2020 1099-R. You do not need to re-enter the 2020 1099-R. You will be able to see on your return that you are only being tax on 1/3 of the total 2020 distribution. If you want to see the return before you file, you can do so by paying and then printing a copy of your return prior to filing.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

Much appreciated, thank you for the clarification.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

Follow these steps to report any further tax to be paid:

- Login to TurboTax

- Click on the Search box on the top and type “1099-R”

- Click on “Jump to 1099-R”

- If you do not have any 2021 1099-R answer "No" to "Did you get a 1099-R in 2021?"

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen.

You will be guided through the screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

I followed the instructions posted above and it keeps asking me for the Qualified Disaster name. But then right below it, it says CAUTION do not name COVID as the qualifying disaster. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

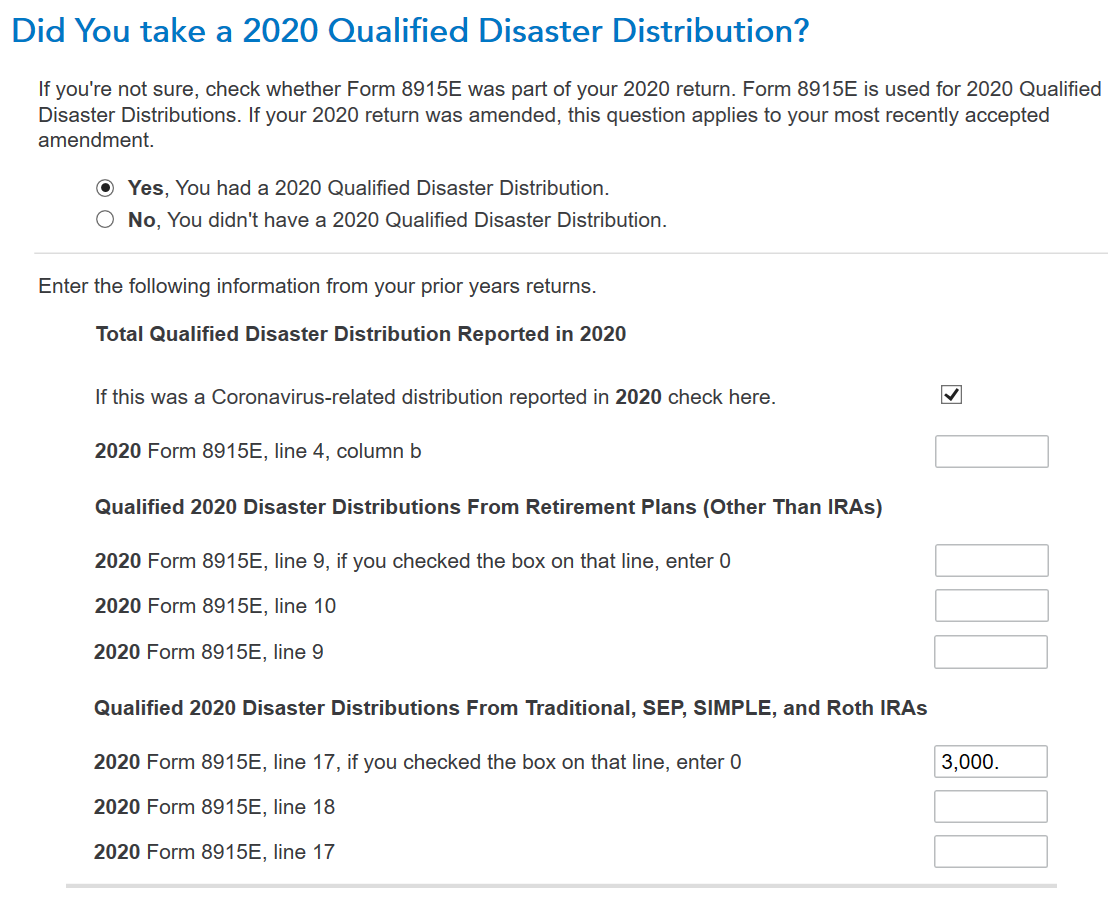

Review the steps and see the images below. The following steps should be used to enter your COVID qualifying distribution. Do Not enter a FEMA code because this doesn't have one. You must have your Form 8915-E from your 2020 tax return.

- Wages & Income > Retirement Plans and Social Security >

- IRA, 401(k), Pension Plan Withdrawals (1099-R) > Start, Revisit or Update > Continue

- Answer Yes 'Have you ever taken a disaster distribution before 2021?

- Answer Yes, You had a 2020 Qualified Disaster Distribution

- Complete the Information using your 2020 Tax return > Continue (use either section but not both (Pension or IRA depending on your situation)

- Enter any amount you may have repaid in 2021, if applicable

- Finish the entry for your spouse if applicable or just click Continue

- Complete any additional retirement questions as you move through this section

- Continue until you have finished and returned back to the Wages & Income Screen.

- Do NOT stop and change sections without completing it.

If the 2020 distribution was from an account that was Not an IRA

- 2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

- 2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

What if I was already taxed 20% at the time of withdrawal? Where do I put that? I feel like I'm getting taxed twice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

Yes, we are wondering the same as well. We took $100,000- $50,000 of that was related to the COVID distribution but $25,000 was witheld for federal taxes at the time. It feels like we are being double taxed as well as there is no where to enter the taxes withheld.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

@Shelly330 wrote:

Yes, we are wondering the same as well. We took $100,000- $50,000 of that was related to the COVID distribution but $25,000 was witheld for federal taxes at the time. It feels like we are being double taxed as well as there is no where to enter the taxes withheld.

All of the federal taxes withheld from the 2020 distribution were entered on your 2020 tax return as a tax payment. Those taxes were included in the 2020 tax refund you received.

Only 1/3 of the 2020 Coronavirus- related distribution was entered on your 2020 tax return as taxable income if you selected to spread the distribution over 3 years.

None of the 2020 federal taxes withheld could be spread over 3 years, only the 2020 distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

Weare in the same situation. Supposed to only pay 10% on the distribution which we did in 2020 and after this late form comes in we are being charged another $12,000 for that same distribution. It went up $12,000 which is 24% on top of what we have all ready paid in taxes... something is not right here

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question about Form 1099-R, COVID Distribution and Form 8915F

Hi,

I entered my amount in line 9 in both fields and it is doubling the taxable amount.

i.e. 1/3 distribution for 2021 should be 10,000...on the 1040 it is using 20,000 as income

I am using the desktop software

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nex

Level 2

jh777

Level 3

Lukas1994

Level 2

tcondon21

Returning Member

veryfast

New Member