- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: On my NYS return, the credit for the Govt Pension appears, but so does the credit for other p...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

You don't have a limit on the number of pensions you can claim on your New York State return. If your pension is taxable to New York and you are over the age of 59 ½ or turn 59 ½ during the tax year, you may qualify for a pension and annuity exclusion of up to $20,000.

This exclusion from New York State taxable income applies to all pension and annuity income included in your federal adjusted gross income. You can review that information here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Hi Tom. I have token 709578 from you.

We'll look into this!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

@DaveF1006 I understand, but it doesn't appear to be correct if the Pension is a NYS pension. Because it is a NYS pension, the entire amount is exempt. Applying the additional $20,000 adjustment makes the total negative. That's the part that seems like it is doubling up. My understanding is that the NYS credit that exempts the pension is good and the additional $20,000 would only apply if there were additional pension amounts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Hi GabiU,

Thanks, I just posted a response to Dave's earlier reply.

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

I have the same problem when clicking the radio button for New York State and City Pensions for a NYCERS pension. It excludes both the pension plus the $20,000 exclusion, which I'm sure is wrong. When I click US Government pension or Other Authority pension, it reverts to only deducting the Pension amount and not the $20,000. I am sure this is a bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Re: NYCERS pension is causing NYS tax to take both NYS exclusion and $20000 pension exclusion

It depends. New York State does give an exclusion up to a maximum of $20,000 depending on the income. It is correct to choose NYS and Local retirement system as the correct choice. I was intrigued by this scenario I tested it out in my own program to see if my results were the same as yours. This is what I found.

- Embedded in the New York State tax code reveals that the pension exclusion is 1/2 of the actual annuity amount until $40,000 then the exclusion is capped at $20,000

- I first plugged in $20,000 as the pension amount and my result was a pension exclusion of $10,000.

- I next plugged in $30,000 and the pension exclusion is $15,000.

- Next amount was $40,000 and received a $20,000 exclusion.

- For giggles, I plugged in $54,000 and received the $20,000 maximum.

If you have the opportunity to view your It-201, you will see the actual pension exclusion on line 29 and should reflect what I just mentioned. If different, you may wish to contact Live Turbo Tax Tech Support at 1-800-448-8848. Live support has the ability to look at your screen to pinpoint any issues you have and help you correct reporting mistakes if applicable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Has this been resolved? I discovered the same flaw. Unless the tax law was changed in 2020 (and I doubt that), we are incorrectly reducing our taxable income by $20,000. Several years ago, when I took periodic withdrawals from Deferred Compensation, Turbo Tax correctly gave them the $20,000 exclusion from that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

On my 2020 Turbo Tax Deluxe Windows version, it does not seem to be resolved. It is subtracting the full City pension, and also $20,000 when all there is is the city pension. This leads to us getting back way too much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

I hope we get a fix for this. I tried selecting that I did not get periodic payments (clearly not true since these are monthly) but that didn't work either. On another thread, someone suggested deleting the 1099-R entity and re-entering, which will be my next step. Another suggestion was starting a new return but I'm not doing and hoping TurboTax fixes first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

It depends. If all else fails, try this and let me know if it works.

- Log into Turbo Tax

- Select the State Taxes tab on the left side of your screen.

- As you navigate through the screens, you will see a screen that says changes to federal income.

- Look under the heading Wage and Retirement Adjustments

- The first entry below that will say Received Retirement income.

- You will make entries in this section that will determine the full taxability of your NY pension.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

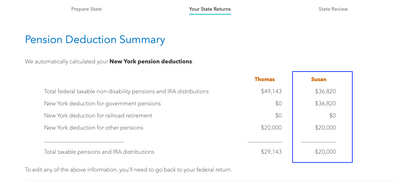

When I do this, I get the payee and the state distribution amount. There is an edit button next to our two state pensions. Selecting Edit returns a question if we are beneficiaries of someone who died. Answer is no. This leads me to a page called Government Pension Exclusion. Numbers are already included, which are the total pension received. These are the correct amounts. Next page is a summary of both pensions. The lines are Total Federal taxable non-disability pensions and IRA; New York deduction of govenment pensions; New York deduction of railroad retirement and New York deduction for other pensions. It is this row where the $20,000 was inserted but I overrode it on the forms. The last line is Total Taxable pensions and IRA distributions. In my case, it is still showing as a negative number - the difference between the total pension (line 2) and the total federal distribution (Line 1). I haven't opened up TurboTax 2019 to see how it was handled in prior years but that is my next step to see what changed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Dave - I went back and re-entered the pension information and made sure I answered the questions properly on my federal return.I then verified that the state adjustments were properly entered and I still end up getting the additional credit, which turns into a -$20,000.

I also verified with the NY State tax department that the extra credit is only available to us if there was additional pension amounts that were unrelated to my wife's state pension.

I also checked and this was not an issue with previous years Turbo tax filings.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

I’ve also gone through all the above suggestions to remedy this problem to no avail. The program persists in incorrectly allowing the $20,000 deduction on my husband’s state pension.

I’m very disappointed since up till now I’ve always been pleased with Turbo tax. I use the Home and Business version.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On my NYS return, the credit for the Govt Pension appears, but so does the credit for other pensions. Should both credits be included or is there an error in TurboTax?

Hi folks!

If you're still having this issue, please include where in the program you are, screenshots and a token number (a copy of your tax return that has all of your personal information removed) so the product team can investigate and submit quickly.

Here's how you send us a token...

If you're using TurboTax Desktop:

1. Click into your return.

2. Click Online and select "Send Tax File to Agent".

3. This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

4. Please provide the Token Number that was generated onto a response.

If you're using TurboTax Online:

1. Sign into your online account.

2. Locate the Tax Tools on the left hand side of the screen.

3. A Drop down will appear. Click on Share my file with agent.

5. This will generate a message that a diagnostic copy will be created. Click on OK, the tax file gets sanitized and transmitted to us.

6. Please provide the Token Number that was generated onto a response.

Thank you! I hope to hear from some of you soon.

GabiU

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MikeNe

New Member

costurbousr

Level 3

quinnamg

Level 1

drhornby

Level 2

user17576991300

Level 1