- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

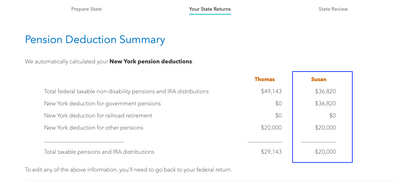

@DaveF1006 I understand, but it doesn't appear to be correct if the Pension is a NYS pension. Because it is a NYS pension, the entire amount is exempt. Applying the additional $20,000 adjustment makes the total negative. That's the part that seems like it is doubling up. My understanding is that the NYS credit that exempts the pension is good and the additional $20,000 would only apply if there were additional pension amounts.

January 18, 2021

3:03 PM