- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: IRA to Roth Conversion - IRA Basis

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Hello, I'm having issues with the IRA Basis...

Here is a timeline of what I did....

from ~ 3/1/2022 - 2/20/23: My IRA had a balance of $0.02

02/21/23 - Made a NON- Deductible contribution to my IRA

02/21/23 - Converted $6,000 of that to my Roth IRA

My 2023 1099-R has:

Box1: $6000

Box2a: $6000

When TurboTax asks for my IRA Basis, it says to look at my previous years Form 8606..

So I look on my 2022 taxes on Form 8606 line 14, and it says $0.0

Then Turbotax says I must pay taxes on that distribution .. So I'm wondering what am I doing wrong??

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

There are two things needed in your 2023 tax return to report a back door Roth IRA conversion.

First, you have to enter the non-deductible Traditional IRA contribution made in 2023. That will establish the basis in your Traditional IRA. Based on your information, prior to 2023 your Traditional IRA basis would be zero.

Second, you enter the Form 1099-R that is reporting the distribution from the Traditional IRA which is then converted to the Roth IRA. With the distribution being equal to the basis, this should be non-taxable.

Here is a TurboTax article that gives you these steps to follow so that it is reported correctly in your return:

How do I enter a backdoor Roth IRA conversion?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

There are two things needed in your 2023 tax return to report a back door Roth IRA conversion.

First, you have to enter the non-deductible Traditional IRA contribution made in 2023. That will establish the basis in your Traditional IRA. Based on your information, prior to 2023 your Traditional IRA basis would be zero.

Second, you enter the Form 1099-R that is reporting the distribution from the Traditional IRA which is then converted to the Roth IRA. With the distribution being equal to the basis, this should be non-taxable.

Here is a TurboTax article that gives you these steps to follow so that it is reported correctly in your return:

How do I enter a backdoor Roth IRA conversion?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Thanks! I followed that guide and found where I messed up

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Oops... I spoke too soon.... now I see where I'm getting confused ... Here is a corrected timeline:

From ~ 3/1/2022 - 2/20/23: My IRA had a balance of $0.02

02/21/23 - Made a NON- Deductible contribution of $6,000 to my IRA FOR THE YEAR 2022

02/21/23 - Converted $6,000 of that to my Roth IRA

01/15/24 - Made a NON- Deductible contribution of $6,500 to my IRA FOR THE YEAR 2023

02/15/24 - Converted $6,500 of that to my Roth IRA

the 1099-R is for the 2022 IRA conversion....

so when I enter $6,500 into the box that says "Tell us how much you contributed between Jan - April 2024... it is making me pay taxes on it.

should Box2a on the 1099-R have $6,000?

Further guidance would be greatly appreciated !

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

It's OK that box 2(a) of Form 1099-R has a taxable amount in it. If you answer the questions properly it won't show as taxable on your return.

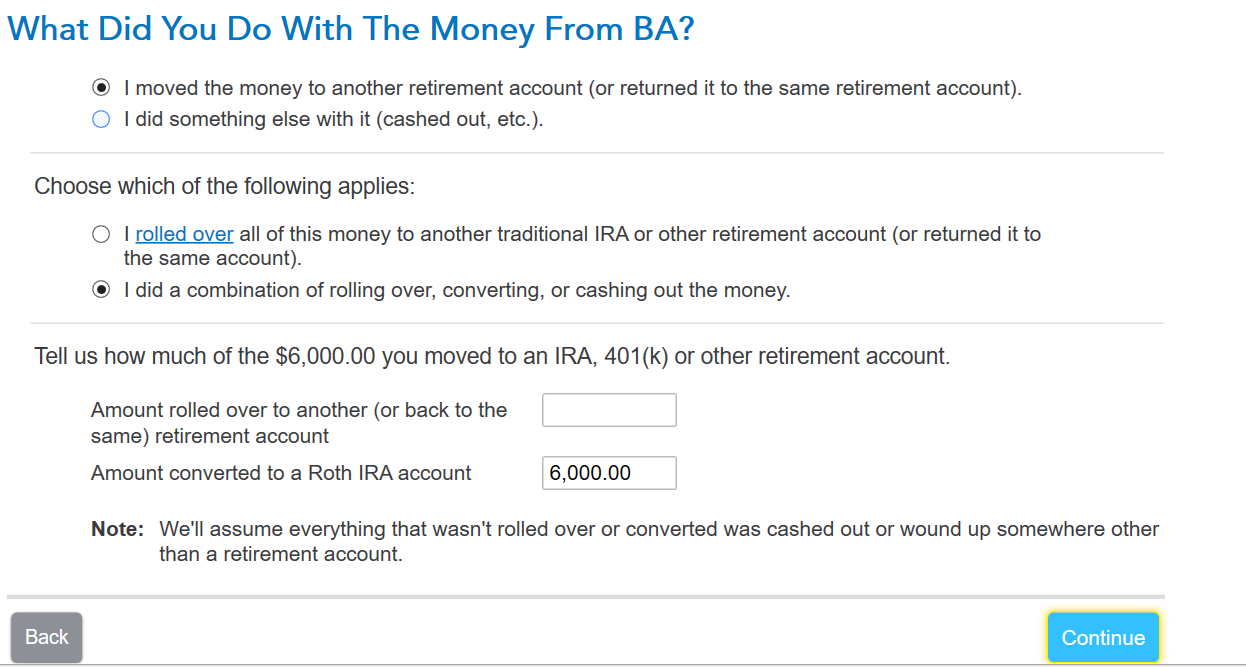

When reporting the Form 1099-R, you need to indicate that the money was rolled over to another retirement account but don't indicate that it was rolled over to a traditional IRA account. Enter the amount converted to the Roth IRA.

Your IRA basis at December 31, 2022 will be $6,000, the amount you contributed that year, since it had not been rolled over to the Roth IRA at end of 2022.

Indicate that the value of your traditional IRA at end of 2023 is $0:

When you enter your IRA contribution for 2023, say you want to make it non-deductible and enter the amount:

After you enter your IRA contribution in 2023, say that you had a $6,000 basis at end of 2022, as you did on the Form 1099-R entry.

That should make everything non-taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Thanks! It says I need to write an explanation about the basis change.... Is this good enough?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

I would state that you are amending your 2022 Form 8606 and you are entering the corrected basis.

It seems that your 2022 Form 8606 shows an incorrect basis since you stated line 14 shows $0

To confirm, did you enter the nondeductible traditional IRA contribution on your 2022 tax return? You don't show an IRA deduction on your 2022 Schedule 1 line 20, correct?

You will have to correct your 2022 Form 8606. If you didn't enter the nondeductible contribution for 2022 or show a deduction on Schedule 1 then you will have to amend your 2022 return. Please see How do I amend my federal tax return for a prior year?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

This sounds like the traditional IRA contribution for 2022 was reported incorrectly on your 2022 tax return.

First, you must amend your 2022 tax return to correct the Form 8606 to include the $6,000 nondeductible contribution made for 2022. This will result in $6,000 on line 14 of the 2022 Form 8606 to be carried forward to line 2 of your 2023 Form 1099-R.

Second, Roth conversions a made in a taxable year, not for a taxable year. Nothing about the Roth conversion of the $6,000 is relevant to your 2022 tax return.

You would normally begin your 2023 tax return by transferring in the tax file for the amended 2022 tax return, causing your $6,000 of basis from 2022 to be carried forward as I mentioned, but it might be too late to consider doing that if you are already well into completing your 2023 tax return. If simply correcting the basis in 2023 TurboTax to show the $6,000 causes TurboTax to prompt for an explanation of your change in basis, the explanation would be that the 2022 Form 8606 was amended and the adjustment is to provide the corrected basis value from line 14 of the amended Form 8606.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Thanks for your help!

For my 2022 Taxes:

Schedule 1 has line 20 as blank.

Form 8606 is as follows:

1)

2) 6000

3) 6000

4)

5) 6000

6) 0

7) 6000

8 )

9) 6000

10) x1.0

11)

12) 6000

13) 6000

All the rest is 0 or blank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Line 7 of the 2022 Form 8606 should not show $6,000. Your timeline shows the $6,000 Roth conversion as occurring in 2023 not 2022.

How did you report a Roth conversion in 2022 if you had no 2022 Form 1099-R for a distribution from a traditional IRA?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

not sure? maybe from the 2021 backdoor roth? anyway, I have officially given up 😄

I'm just going to hire someone to sort out this tax mess I made, and hopefully next year it will be back to where I can do it on my own lol

Thanks for everyone's help though!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

I just realized my Roth IRA has not released a 5498 for 2023 yet.... could this be part of the issue??

I also don't have a 2023 - 5498 for my IRA yet.... just the 1099-R

I have no tax statements for my Roth IRA for 2023 as of right now ....

"We've started publishing 2023 tax information online. Events related to the holdings in your account(s) could delay your tax documents through February 28. For additional resources, visit our Tax Center."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

Forms 5498 are not needed. The amounts and timing of contributions and conversions are already known to you from your own records of these transactions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

I made a traditional IRA to Roth Conversion in 2022 (Back-Door Roth). I contributed $6000 to my traditional IRA in 2022 (non-deductible). Some months later I converted it to a Roth IRA. The market had dropped by then and the conversion amount was only $5300 approximately. After entering all the information including the 1099R showing the $5300 on my 2022 return, my Form 8606 showed me ending up with a basis of $700 even though the account was emptied. This basis carried over to my 2023 return. Is this correct? Or should I have entered the full $6000 as the amount converted on my 2022 form 8606 (even though it was only $5300)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA to Roth Conversion - IRA Basis

E59, your 2022 Form 8606 is correct.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hnk2

Level 1

NMyers

Level 1

gomes_f

New Member

fpho16

New Member

Darenl

Level 3