- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

It's OK that box 2(a) of Form 1099-R has a taxable amount in it. If you answer the questions properly it won't show as taxable on your return.

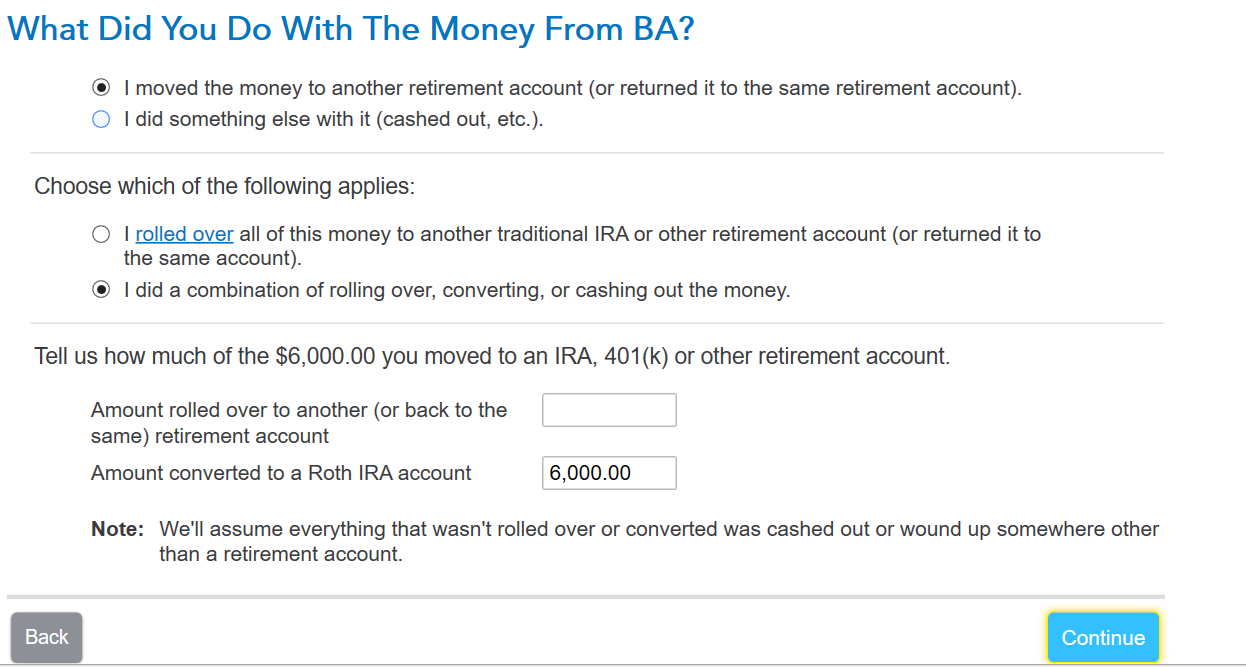

When reporting the Form 1099-R, you need to indicate that the money was rolled over to another retirement account but don't indicate that it was rolled over to a traditional IRA account. Enter the amount converted to the Roth IRA.

Your IRA basis at December 31, 2022 will be $6,000, the amount you contributed that year, since it had not been rolled over to the Roth IRA at end of 2022.

Indicate that the value of your traditional IRA at end of 2023 is $0:

When you enter your IRA contribution for 2023, say you want to make it non-deductible and enter the amount:

After you enter your IRA contribution in 2023, say that you had a $6,000 basis at end of 2022, as you did on the Form 1099-R entry.

That should make everything non-taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"