Yes. Up to $10,000 is excluded from the penalty, but you do need to indicate that you used the money for a first time home purchase.

Here's how to do this in TurboTax Online:

- Navigate to Federal > Wages & Income > IRA, 401(k), Pension Plan Withdrawals (1099-R) Add/Edit

- Your withdrawal will be shown in a summary on a screen that says "Here's your 1099-R info"

- Choose "Continue"

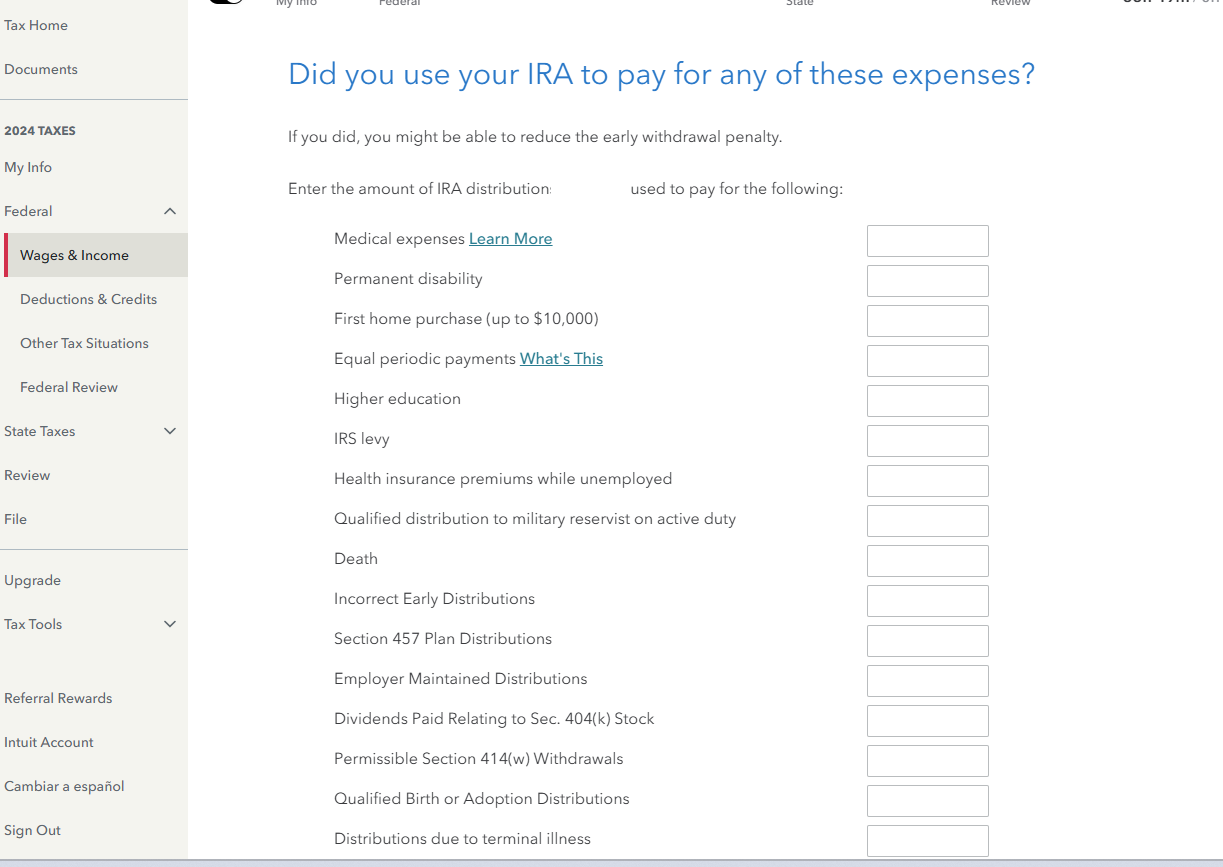

- Continue through the interview until you arrive at a screen that says "Did you use your IRA to pay for any of these expenses?"

- Here, enter the amount of the withdrawal spent on the first-time home purchase (up to $10,000)

Here is some information you may find helpful: An Early Withdrawal From Your 401(k): Understanding the Consequences.