- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: If I retire to a state that taxes retirement distributions, is my basis exempt since I alread...

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I retire to a state that taxes retirement distributions, is my basis exempt since I already paid PA state tax on 100% of contributions to my retirement account?

Topics:

posted

April 7, 2023

10:47 AM

last updated

April 07, 2023

10:47 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

4 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I retire to a state that taxes retirement distributions, is my basis exempt since I already paid PA state tax on 100% of contributions to my retirement account?

That would be true in Pennsylvania, but tell us the state so we could see if that state would honor the basis.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 7, 2023

1:20 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I retire to a state that taxes retirement distributions, is my basis exempt since I already paid PA state tax on 100% of contributions to my retirement account?

KY

April 7, 2023

3:07 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I retire to a state that taxes retirement distributions, is my basis exempt since I already paid PA state tax on 100% of contributions to my retirement account?

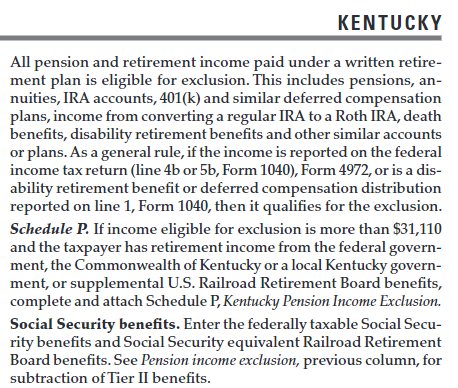

Kentucky excludes the less of 100% of taxable retirement benefits or $31,110. The exclusion is for each taxpayer. Spouses calculate the exclusion separately.

The TaxBook page KY-3 states:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 9, 2023

8:14 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I retire to a state that taxes retirement distributions, is my basis exempt since I already paid PA state tax on 100% of contributions to my retirement account?

Still a large amount of income that is taxed by both states. ☹️

April 11, 2023

5:05 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

BillyWoolfolk

Returning Member

CRAM5

Level 2

fpho16

New Member

janak4x4

New Member

coastercrazy26

New Member