- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

That part of the software is still being worked on....come back to deal with it after the end of the month (Just a guess)

The income will be able to be spread over three years, but the taxes withheld will be credited only to your 2020 tax. So you will have to plan for making sure you have sufficient prepaid taxes to cover the 1/3 of income in each of the remaining years......either thru quarterly estimated tax payments, or extra withholding if you have a W-2 job.

(OR...if you end up with a Federal refund, when you file, you could apply all, or a portion of the refund to the next Federal year's taxes. That would work too. )

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

In TurboTax you'll enter the entire distribution just as it is reported on the Form 1099-R that you'll be receiving from the 401(k) plan. Once Form 8915-E is implemented in TurboTax, TurboTax will prepare this form to allow for splitting the income over three years.

As SteamTrain said, any tax withholding from this distribution will be credited on your 2020 tax return. If if the result is a refund, you have the option to apply that refund to your 2021 taxes equivalent to a Q1 estimated tax payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

Now...what I have not seen is a discussion anywhere on whether any income-taxing states have passed state tax rules to follow/coordinate the same procedures, or have decided to tax the entire distribution for 2020.

That could get messy

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

State tax returns use the federal AGI as a starting point, so states would generally have to pass specific state legislation to disallow spreading the income over three years by requiring an add-back of the deferred income and in subsequent years a subtraction for the income already included. It would also create a nightmare with respect to reporting any repayments. I can't imagine such legislation ever getting passed since it would almost certainly mean the end of the careers of any legislators who supported such legislation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

true....I read thru my NC 2020 instructions, and they have a section where they specifically unlink with a certain number of pre-2020 Federal exceptions/deductions etc (like the QCD itself, of all things....but then later remove it as an itemized deduction), but NC doesn't mention this particular situation, so they probably will continue to just use Federal AGI as the starting point.

I thought the review here of 4 payback examples, on how they may have to be to handled in future years or amendments, was particularly interesting, and shows how messy it might get for some folks:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

Has Turbo Tax updated the software to accept the three year option for COVID distributions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

According to the following link on TurboTax Federal Forms availability, the Form 8915-E is available now.

Federal TurboTax Forms Availability

The Form 8915-E does help you determine if you want to divide the COVID distribution over 3 years for tax purposes. The form should guide you through the steps needed

The withholding on your 1099R will be applied to the current year withholding on your return, but you can apply any refund on your return to next year's estimated tax.

Additional instructions for using the 8915-E form are at the following link:

IRS Instructions for Form 8915-E

[Edited 03/01/2021|2:40 pm pst]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

I can not get this form to active. I am not given a option to spread out my withdraw over 3 years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

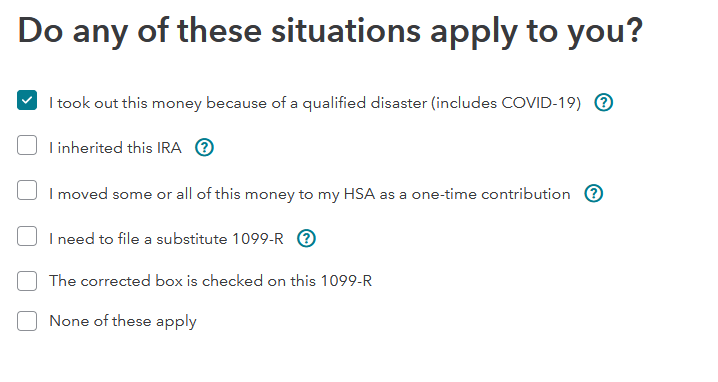

Are you taking a Roth 401K retirement withdrawal? Try changing the coding in box 7 to a 1,2, or 7 by dropping the letter code in front of it. Go through the screens then after you have entered the Covid-19 distribution information, go back to the 1099R input and change it back. You should see this screen and check the 1st box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

Hi, Since all taxes were claimed for covid withdrawal in 2020, do I put zero in the federal /states tax fields when I enter my 1009-R for 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

@sasmin wrote:

Hi, Since all taxes were claimed for covid withdrawal in 2020, do I put zero in the federal /states tax fields when I enter my 1009-R for 2021?

If you did not receive a 2021 Form 1099-R then you should not enter anything in the section for a 1099-R. Delete the 1099-R you started if it is not a 2021 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

That doesn't work as it won't bring up the questions on if I qualify for the disaster if I don't enter it. How else would I enter that info?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

@sasmin If you opted to use the 2020 withdrawal as Coronavirus-related and spread the distribution over three years then you have already entered 1/3 of the withdrawal on the 2020 tax return. You have to enter the 2nd 1/3 of the withdrawal on the 2021 tax return.

All the federal taxes withheld from the withdrawal were entered on your 2020 tax return as a tax payment. The taxes withheld cannot be spread over three years.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty) or enter a 0

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

You should not receive the "Needs Review" in the Federal Review section if -

You Leave blank or enter a 0 in the box for 2020 Form 8915-E, line 4, column b

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I took a COVID 19 withdrawal from my 401k and want to claim the wdrwl over 3 yrs, I will enter 1/3 of wdrwl ea yr do I claim the tax I already paid over the three yrs?

Sorry I click No when it asked if I had a 1099-R from 2021 . Then it brought me to the section to fill out from my 8915-E. However its still saying it news review but when I click on it, it just goes through the same questions..

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Pk841

Level 2

ArchesNationalPark

Level 3

ArchesNationalPark

Level 3

adacerda

New Member

sareyann

New Member