- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have co...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

It depends. To clarify, do you own a farm or have a farm rental?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

I am glad you asked that question because that was where I was going next. Yes, for 2021 we did have farm income, but what if we didn't? We are not planning to farm this year (we are retired and not running a huge farm operation), but we have applications in for several USDA programs so we may be in the same situation next year, but without any other farm income....what then? There are definitely costs associated with these grants, whether it be tractor fuel and a bush hog, contracted technical assistance, or the purchase of other materials or equipment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

If you had no other Farm Income besides grants, you would still report the grant income on Schedule F.

You can also report any expenses associated with the farm and/or grant there.

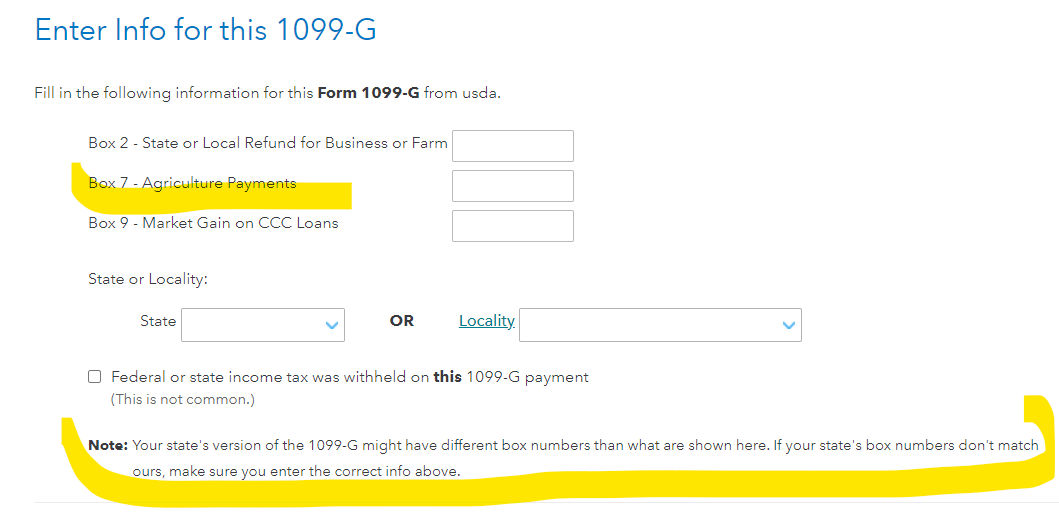

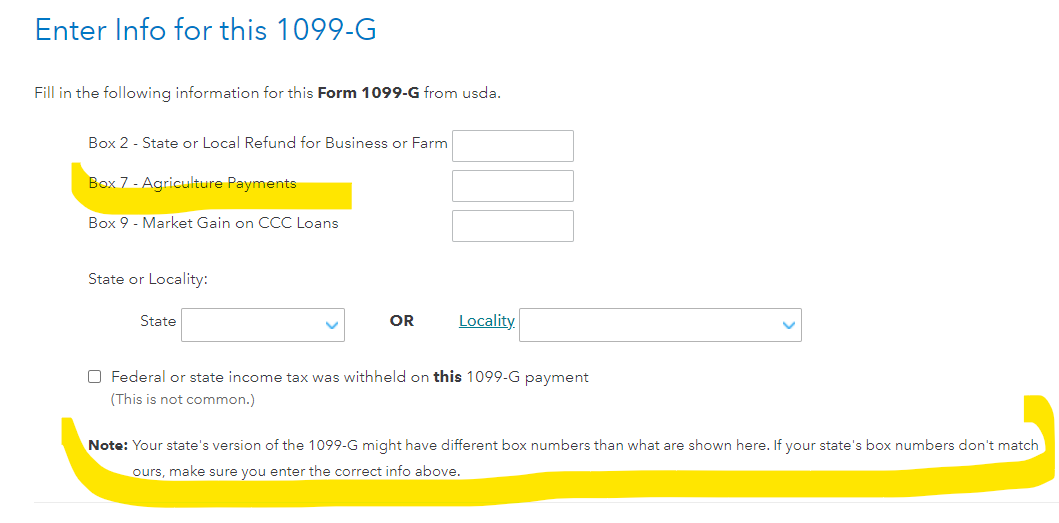

Agriculture Payments are now entered in Box 7 in TurboTax, rather then the Box 6 shown on your 1099-G.

Click this link for more info on Farm Income.

[Edited 2/9/2022 2:55 pm]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

Thanks for that link, but the answer given there doesn't work. After going back to the schedule F, adding another 1099-G form, you end up at a screen where you can only enter income on boxes 2, 7, or 9. There is no box 6, "taxable grant" line to make an entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

If you are using TurboTax Online, you are correct that there is no Box 6 to use to enter your payment. Use box 7 to enter the amount that you received on the 1099-G.

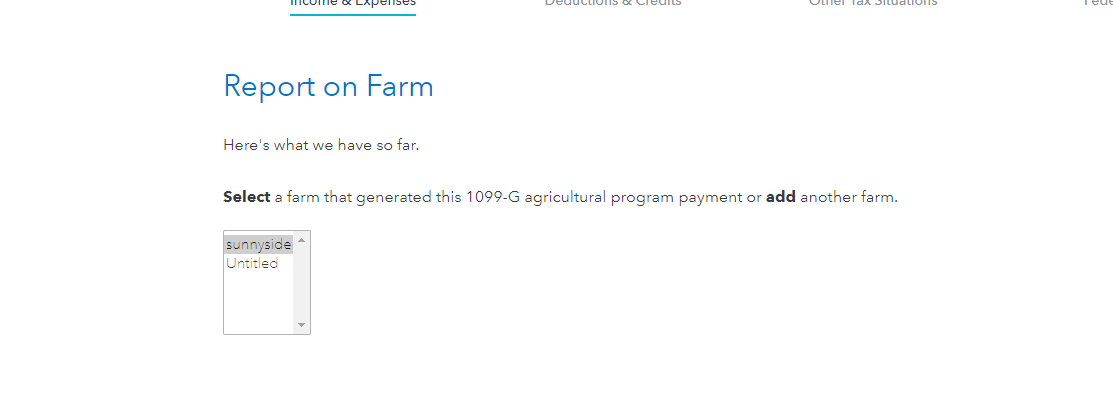

The screenshot below shows where to enter the information. After you have entered the payment, Continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

Hope I don't sound sarcastic or rude, but are you sure about that? This is a 1099-G from the USDA. When I do as you say (add the 1099-G income as an Agriculture Payment on Sched F), my federal tax goes from me owing them $286 to them paying me $736! The state tax goes from them paying me $116 to them paying me $1675! That seems like a major change to me. I know why some of that may be....without this 1099 income showing up on the Schedule F, we had a loss this year. Adding the income to the schedule F, we showed a profit and we then had to pay SE tax, but TT then wrote off health insurance premiums and gave us a qualified business deduction from form 8995. It all sounds too good!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

It is possible that you qualify for an earned income credit, and that can go up as your income increases, which would increase your refund or reduce the amount of tax you owe. Small increases in income can affect the earned income credit substantially. You can look on line 27(a) to see if it is listed on your form 1040.

You can view your form 1040 while working in the online version of TurboTax by following these steps:

While working on your return in the Federal section of TurboTax:

1. Choose the Tax Tools icon on your left menu bar

2. Tools

3. View Tax Summary

4. Choose the Preview my 1040 on your left menu bar

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

OK, thanks to everyone. I think I finally have it down now. We have to start thinking differently.....we are not entering 1099 info into TT for IRS purposes, we are doing it for TT so that the program can place the income on the forms. That being said, I can manually enter this data myself without doing the 1099 data entry......just like I would if I were using paper forms! In my case, that would be entering the income directly on the Schedule F as taxable income (agricultural payments from 1099-G's end up in the same place). If I just do the data entry of the 1099, and it has the income as a box 6, taxable grant, TT records this as "other income". This is ok I guess, if you have no associated costs because you skip out on SE tax.....but you can't write off your associated costs so it should go the either C or F. Getting this into the Schedule F made a huge difference in this years taxes! Thanks again to everyone

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-G from the USDA with the funds shown in box 6, a "taxable grant." I have costs associated with the grant

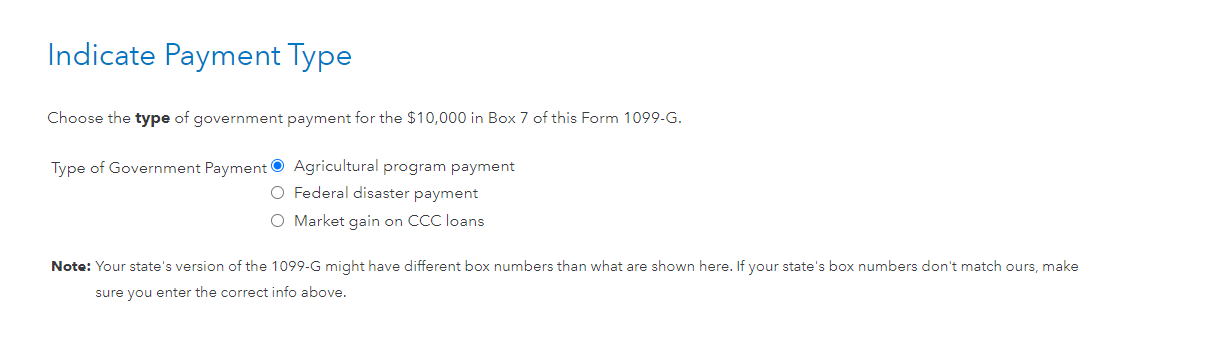

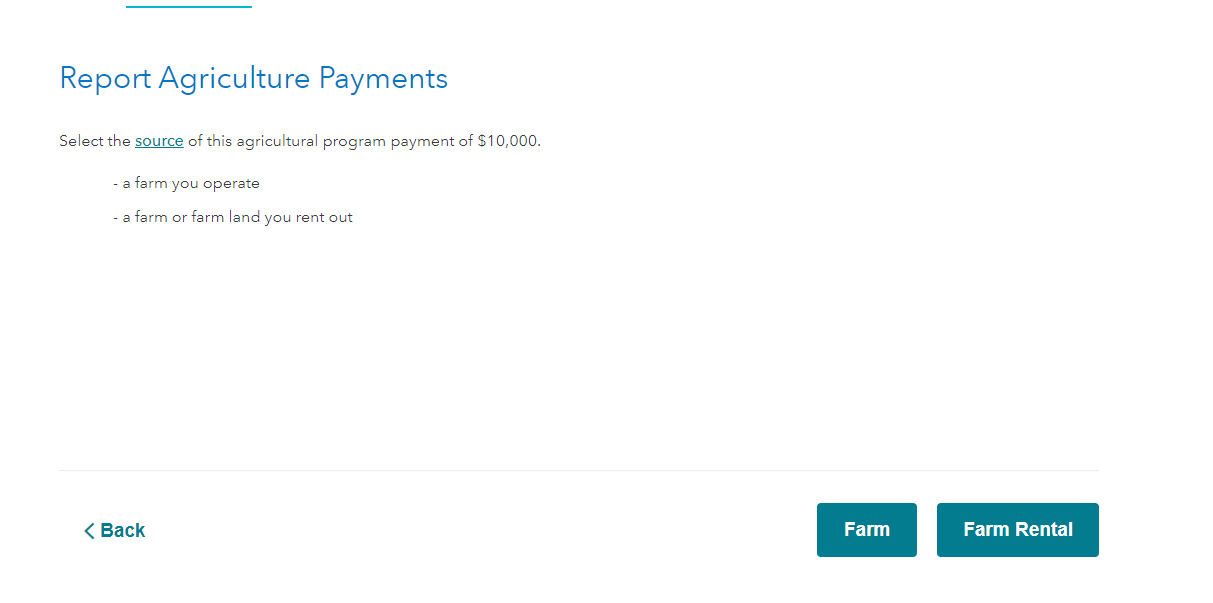

Here are additional steps to follow to make sure that the 1099-G Agricultural Grants are entered in the right place.

[Edited 02/12/22 | 12:48 PM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Aowens6972

New Member

rkplw

New Member

Reynan2124

New Member

Kuehnertbridget

New Member

jjon12346

New Member