- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: I need to find my non taxable social security and railroad retirement board benefits. How do ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

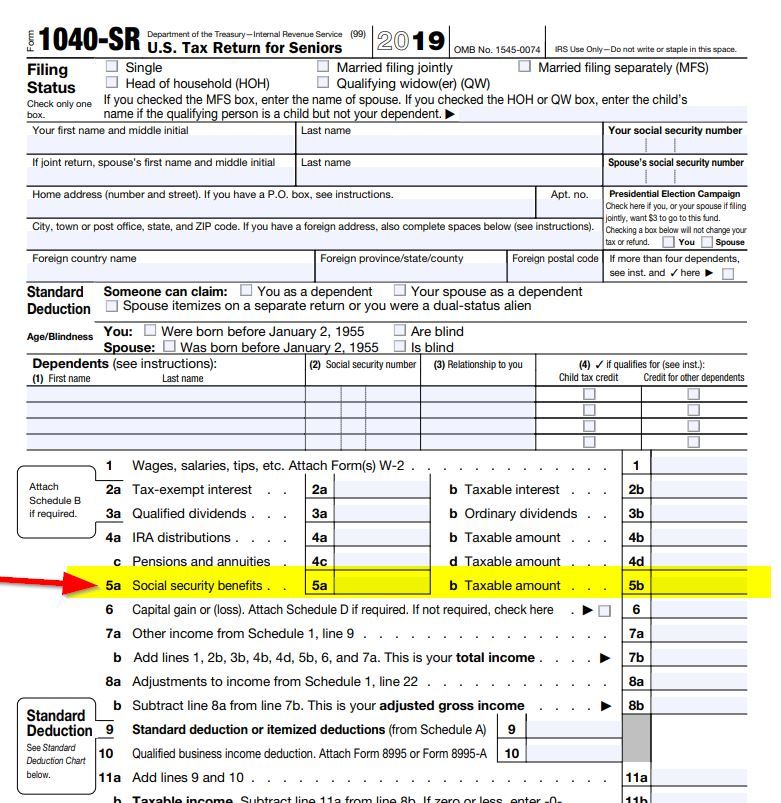

Your total Social Security benefits are found in line 5a on your 1040. Your taxable Social Security benefits are in line 5b. So your nontaxable benefits are the difference between the two.

The same is true with the railroad retirement benefits reported on form RRB-1099.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

i HAVE NO 10400

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

The 1040 or 1040SR is your tax return. Line 5a is total Social Security and line 5b is the Taxable amount. Have you filed yet?

How to preview your return before filing. If you want to see all the forms you have to pay any fees first.

https://ttlc.intuit.com/community/accessing/help/how-do-i-preview-my-turbotax-online-return-before-f...

Here is a screen shot of it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

I entered my social security benefits and for some unknown reason it is showing the taxable to be only 28%. Last year it was 85%.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to find my non taxable social security and railroad retirement board benefits. How do I find that figure?

@phildon Did you income go down from last year? And check your SSA-1099 entries. Maybe you entered box 5 wrong.

Up to 85% of Social Security becomes taxable when all your other income plus 1/2 your social security, reaches:

Married Filing Jointly: $32,000

Single or head of household: $25,000

Married Filing Separately: 0

To see the Social Security Benefits Calculation Worksheet in Turbo Tax Online version you would have to save your return with all the worksheets to your computer. Or if you are using the Desktop CD/Download Software you can switch to Forms Mode (click Forms in the upper right) and click on SS in the list on the left side.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmgretired

New Member

meeler3

New Member

gthorne8

New Member

jsefler

New Member

opa21

New Member