- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

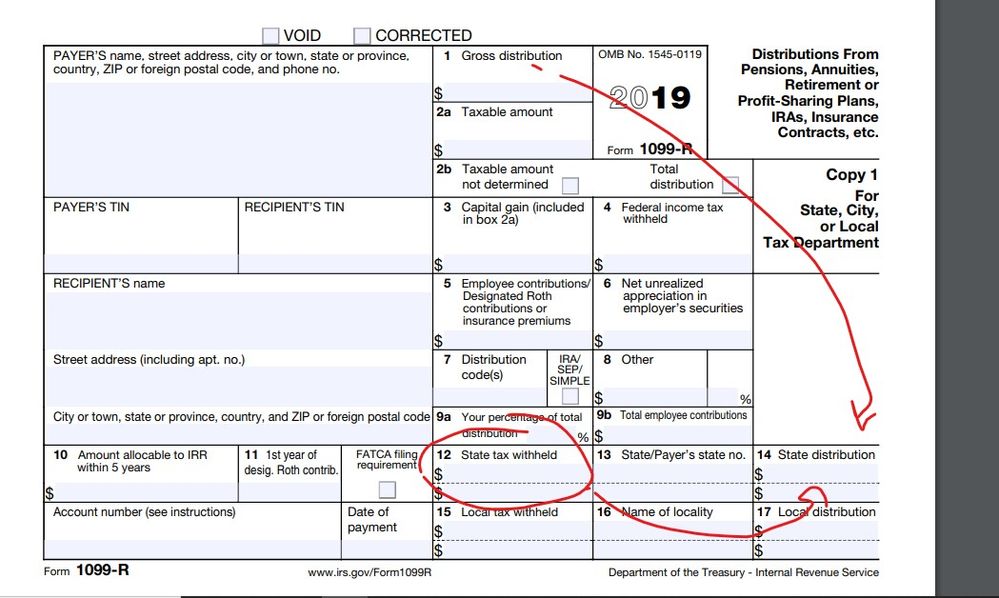

Ok ... if you had $3000 of state withholding you must have had more than $3000 of state distribution ... the program is telling you to fix box 14 ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

Box 14 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 12 & 13 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state distribution so box 14 is just left blank.

But recently, there are at least two states (one being NY) that will reject 1099-R's with a state tax and a blank box 14 so it is okay to enter the box 1 amount into box 14 to satisfy the states requirement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

So why would the withholding be equal to the gross distribution?

gross distribution is box 1, box 14 is state tax withheld, box 16 is state distribution-

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

In the original question, the poster entered zero (or left the box blank) as the state distribution. The state taxes ($3,000) were greater than the state distribution (0). That's why the error appeared.

The solution is to enter the gross distribution in box 1 also in the box for state distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

This is exactly what I did and my New York State tax return was rejected anyway. :(

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

Yes I put box 1 number in box 16 (state distribution) here in NY and my return was rejected- any other suggestions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I resolve this error? Form 1099-R Box 12a New York State tax withheld ($3000) can not be greater than or equal to gross dist ($59100) or state distribution ($0)

What exactally is the reject message and reject code?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

Vermillionnnnn

Returning Member

in Education

benjamindken

New Member

keimdo

New Member

cheery2

New Member