- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 & prior

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

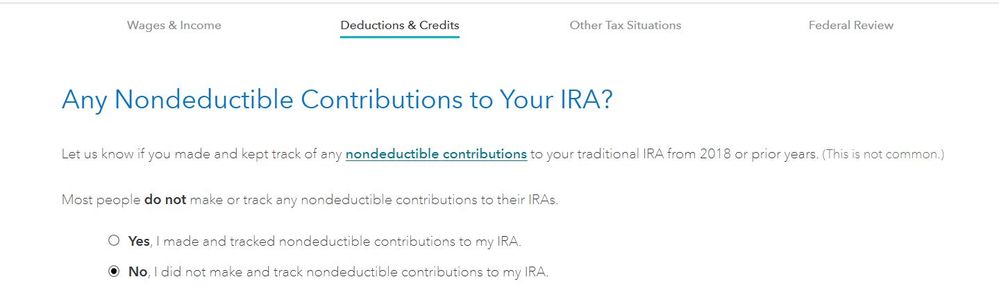

I had no IRAs opened until a few months ago, and couldn't put much in a roth IRA due to income. I will be making a contribution for 2019 of $3030 to a nondeductible IRA before July 15, 2020. In the traditional IRA section, it says "Let us know if you made and kept track of any nondeductible contributions to your traditional IRA from 2018 or prior years." ... nothing about 2019.

If I do select yes to that question, the next page says "If you did make any nondeductible contributions, look at your most recent Form 8606. Find the box called total basis and enter the number from that box below. If you never filed a Form 8606, just enter 0 (zero)", but the box to fill in after that statement still says "Total Basis as of December 31, 2018".... which doesn't include my 2019 contributions.

Where/how do I notate this 2019 contribution as nondeductible?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

That screen will not be presented if you are covered by a retirement plan at work and your AGI is too high to have a deduction (or you do not have taxable compensation to contribute to a IRA at all), then it is automatically non-deductible. The last screen in the interview will tell you that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

You enter 2019 contributions in the IRA contributions section.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

I've done both of those... The problem is there is not a section to mark contributions made after December 2018. All questions Turbo Tax asks regarding nondeductible IRAs (listed in original post) pertain to contributions made before December 2018, which mine was not. Is there somewhere to notate more recent contributions as nondeductible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

When you enter the 2019 contribution in the 2019 program you have the option to indicate it will be non deductible ... keep going and watch for this screen ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

@Critter is that on the free version? It looks different than how mine is set up. I've gone through the deductions section repeatedly and can't find that screen :( This is the closest I can find to it, but it says 2018. What page were you on prior to that one? Or am I possibly not getting that screen as an option because I don't have the option to deduct it since my income was too high?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

Keep going ... the screen you seek is still to come.

Try deleting the contribution and try again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

@Critter I deleted and redid the entire deductions section and went through the remaining rest of the federal section and it is still all the same screens and questions, never that one.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

That screen will not be presented if you are covered by a retirement plan at work and your AGI is too high to have a deduction (or you do not have taxable compensation to contribute to a IRA at all), then it is automatically non-deductible. The last screen in the interview will tell you that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

@macuser_22 Ahh ok thank you! I was also just reading another post you wrote about backdoor roth contributions(link below), which is the end game for this nondeductible contribution. Should I go ahead and do it to report it on this years taxes? Or will it take too long to get the 1099-R? Is there a drawback one way or the other if I was to report it on this years taxes versus next years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

@nicholetuck wrote:

@macuser_22 Ahh ok thank you! I was also just reading another post you wrote about backdoor roth contributions(link below), which is the end game for this nondeductible contribution. Should I go ahead and do it to report it on this years taxes? Or will it take too long to get the 1099-R? Is there a drawback one way or the other if I was to report it on this years taxes versus next years?

Your 2019 non-deductible *contribution* can only be reported on a 2019 8606 form fie with your 2019 tax return.

If you do a Roth conversion in 2020 than that is a 2020 conversion that will be reported on a 2020 1099-R and go on your 2020 tax return next year. (The July 15 due date only applies to IRA *contributions*. Distributions/conversions are done and reported in the calendar tax year that they are done.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I notate a nondeductible IRA contribution made that was made for 2019 on turbo tax? It only asks about contributions for 2018 and prior

@macuser_22 thank you so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PCD21

Level 3

TMM322

Level 1

happysue19

New Member

toddrub46

Level 4

binarysolo358

New Member