- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do I file if my 1099-Rs are coded incorrectly?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

I withdrew from my Roth IRA a few times in 2019. I have had the account over 5 years, I am in my 30s, and I only withdrew contributions, so these withdrawals are not taxable and there's no penalty. When making the distributions/withdrawals, I chose the wrong box on the form online for some of them (apparently) and now my financial institution refuses to issue corrected forms since it was my mistake and not theirs.

So my questions are:

1) Should these withdrawals be coded as J? If not, what code?

2) If they should be coded as J (one form from my financial institute is J, and one is T), do I:

a) File the incorrect 1099-R, correct 1099-R, AND form 4852?

b) File the one correct 1099-R (if J), and only use form 4852 to replace the incorrect 1099-R?

c) File only form 4852, effectively combining both the incorrect and correct (if J) 1099-R into one?

3) If I do need to file form 4852, do I put the taxable amount for 2a as $0, or do I check the box for taxable amount not determined like my how original 1099-Rs were filled out?

Thank you! Happy to provide additional info if needed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

Is the code Q from an inherited Roth IRA? Or are you totally disabled?

If not, then it is clearly wrong since you are not over age 59 1/2.

You should tell the account trustee that they must have your age wrong and then need to correct the 1099-R with a code J as it should be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

I’ll edit the original post - I just double checked and it was T, not Q. I’m sorry for the confusion.

They have my age correct and I am not currently on SSID or considered disabled as of now - that may change but right now it’s not the case.

The financial institute has refused to make any adjustments to the 1099-R as any of the indicators that would be incorrect, were inadvertently added by me at the time of withdrawal - they don’t list the codes, just the circumstances. But no matter what, I’m not getting a corrected form from them. So I either need to a) file the incorrect forms and tell the government they’re not right and none of it is taxable, b) file a new form to correct the 1099-R with T, or c) combine both the incorrect and correct one onto a single corrected 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

Since you are under age 59½, the only legitimate reason that a financial institution should use code T for a distribution paid to you from a Roth IRA is if the distribution is from an inherited Roth IRA maintained for you as beneficiary. How was this Roth IRA established; was it established by transfer from another retirement account or was it established by a cash deposit of a new contribution?

Assuming that this is not an inherited Roth IRA, entering the code T Form 1099-R into TurboTax and telling 2019 TurboTax that you did not have a Roth IRA before 2015 (even though you did), and also making sure that you don't enter and basis in Roth IRA conversions for years prior to 2015, will cause TurboTax to include the code T distribution on Form 8606 along with the code J distribution and will result in a correct tax return and correct tracking of your Roth IRA basis. You could then move this Roth IRA to another custodian (possibly by indirect rollover to eliminate any possible undesirable coordination between custodians that might cause the incorrect coding to be propagated to the new custodian) to eliminate the uncooperative custodian from the picture. It's possible, but unlikely, that the IRS would question the code T distribution being included on Form 8606. To avoid that small possibility you would have to file a substitute Form 1099-R (Form 4852) and use the correct code J. Filing a substitute Form 1099-R will require mailing your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

I started this account myself with a cash contribution.

When making distribution withdrawals from this financial institute, it asks two questions:

"Have you met the five-year waiting period?" Y or N

"Which selection describes your distribution?" Premature (under 59 1/2 years old), Premature (with exception), Disability

When making the withdrawals, I chose Y, and then Premature (under 59 1/2), the first time. I then realized that seemed incorrect, since there was no penalty, being that I was withdrawing contributions, and I subsequently chose Premature (with exception), not realizing that contributions to a Roth are not technically considered an exception even though they are not penalized. They chose code T due to this entry I made on the form. Any future coding issues should be resolved since I know which box to choose in the future.

I don't wish to change custodians (you're referring to the financial institute, correct?). It sounds like mailing my return is probably the best way to handle this since I don't have a very good understanding of IRAs regarding rollovers and coding. Unless, would it make sense to file it as-is with the provided 1099-Rs electronically, and then send in an amended return through the mail to adjust the 1099-Rs? That way I can get it filed and in place first (which I need to do to start receiving unemployment). From what I'm seeing when playing with the options within TurboTax, is that using the 1099-Rs as they were sent to me, and answering the questions properly (including saying that yes I've had the account for 5+ years) is not applying any tax or penalty.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

@Zypher wrote:

They chose code T due to this entry I made on the form.

Entry on what form? The financial institution the issues the 1099-R choose the code based on the iRS rules.

The 1099-R IRS instructions:

https://www.irs.gov/instructions/i1099r

| T—Roth IRA distribution, exception applies. | Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but:

|

None |

Since you are under age 59 1/2, the owner of the IRA did not die, and you are not disabled, then the code T does not apply and the instructions clearly say that a code J must be used.

Code J says:

| J—Early distribution from a Roth IRA. | Use Code J for a distribution from a Roth IRA when Code Q or Code T does not apply. But use Code 2 for an IRS levy and Code 5 for a prohibited transaction. | 8 or P |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

Indicating that you are under age 59½ (and not dead or disabled) means that code J applies to a regular distribution no matter how long you have had a Roth IRA. A financial institution has no business asking if you have met the 5-year waiting period. That's for them to determine based on their own records.

I only suggested the prospect of changing custodians/financial institutions because the one you have now seems somewhat incompetent (or at least uncooperative) based on this experience you are having with them.

(Regarding the selections for the answer to the question asking which describes your situation, they don't entirely make sense. It's extremely unusual for a Roth IRA custodian to use anything other than code J for a regular distribution to the participant who is under age 59½, relying on the participant to make the exception claim on the participant's tax return rather than the effectively certifying though the use of code T any assertion by the participant other than the participant's age.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

I was referencing the form on their website when I submitted the withdrawal/distribution request.:

When making distribution withdrawals from this financial institute, it asks two questions:

1) "Have you met the five-year waiting period?" Y or N

2) "Which selection describes your distribution?" Premature (under 59 1/2 years old), Premature (with exception), Disability

The account is with TDAmeritrade, so not a small company by any means. When I distributed the amount, I put 'Y' and 'Premature (with exception)' thinking incorrectly that removing contributions meant an exception.

Looking closer at my account, they have my SSN of course, but nowhere can I specify my DOB. I will contact them again asking for a revision since T does not apply and they should know this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

Thank you all for your help! Hopefully they will re-issue the 1099-R. They had told me to contact a tax professional regarding filing, which I don't have, so I dove deep into the IRS website, this forum, and the resulting information provided gave me answers. I sent them a message with the following:

I have been informed that all withdrawals/distributions last year should be categorized as J. It would be in TDAmeritrade's error to issue code T, because you know I have met the 5 year waiting period based on your records of the account. You're also aware I'm under age 59 1/2, and have not died.

T is used ONLY if it's unknown if I've met the 5 year waiting period, which I've had the account with you since 2013, so you know the answer is yes. Therefore code T is in error.

Q is used IF I've met the holding period (which you know I have) and I've reached 59 1/2, or died, or become disabled, which you also know I have not.

J therefore should've been the code on all forms for my distributions.

Please send the corrected 1099-R at your earliest convenience.

After learning all this, code T is in error, even if they didn't know my age. My first contribution was December 2013, made to this account, with them from day 1. So this makes NO sense why they're telling me it's not their error. I also put 'Y' that I had met the 5 year holding period on all my submitted forms, so I don't understand what is going on over on their end. If they weren't sure of my age, I marked 'Y' to the holding period, so they should've used Q and not T. If they refuse again, I believe I'll have no choice but to file by mail. Ugh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

I do hope you get it worked out, but do not rush to mail your return. The IRS is not processing anything anyway with this COVID issue. And the filing date has been extended to 07/15.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

@DawnC wrote:I do hope you get it worked out, but do not rush to mail your return. The IRS is not processing anything anyway with this COVID issue. And the filing date has been extended to 07/15.

Thank you! Unfortunately I'm self-employed and unable to work for several reasons (my clients don't need my services when working from home, caring for parents who are immunocompromised and over 70), so I've applied for Unemployment Insurance. They sent the denial for regular Unemployment Insurance (my W-2 had <$100), and for DUA Unemployment Insurance they requested my 2019 1040 and Schedule C, so I am trying to finish them quickly so I can send those forms to them and get my payments started. I have a limited amount of time to reply with my tax forms unfortunately, and they specifically need 2019. Ugh.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

@Zypher wrote:

The account is with TDAmeritrade, so not a small company by any means. When I distributed the amount, I put 'Y' and 'Premature (with exception)' thinking incorrectly that removing contributions meant an exception.

Removing your own contributions is not an exception to the penalty. You can always remove your own contributions tax an penalty free, but that is entered a different way. You financial institution cannot determine that since your contributions apply to all Roth IRA accounts in aggregate, and the financial institution has no knowledge of other accounts.

A code J allows for your own contributions.

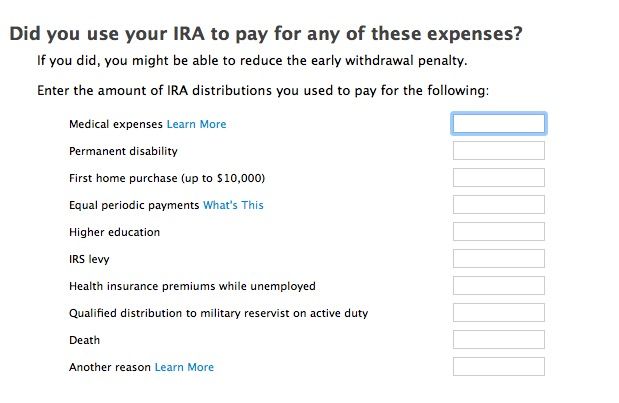

These are the exceptions that they refer to.

Note: "Another reason" means:

Other. The following exceptions also apply.

•

Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older.

•

Distributions from a section 457 plan, which aren’t from a rollover from a qualified retirement plan.

•

Distributions from a plan maintained by an employer if:

1.

You separated from service by March 1, 1986;

2.

As of March 1, 1986, your entire interest was in pay status under a written election that provides a specific schedule for the distribution of your entire interest; and

3.

The distribution is actually being made under the written election.

•

Distributions that are dividends paid with respect to stock described in section 404(k).

•

Distributions from annuity contracts to the extent that the distributions are allocable to the investment in the contract before August 14, 1982. For additional exceptions that apply to annuities, see Tax on Early Distributions under Special Additional Taxes in Pub. 575.

•

Distributions that are phased retirement annuity payments made to federal employees. See Pub. 721 for more information on the phased retirement program.

•

Permissible withdrawals under section 414(w).

•

Distributions that are qualified disaster distributions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

Yep I learned that later, which is why I mentioned thinking incorrectly. Regardless, I’ve met the waiting period and they know that, so code T still makes no sense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I file if my 1099-Rs are coded incorrectly?

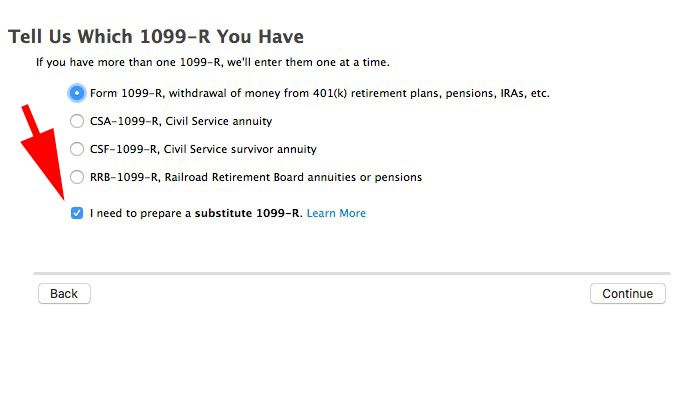

If they will not issue a corrected 1099-R then just use a substitute 1099-R with the correct code J and it will ask for an explanation and the steps that yiu took to get a corrected 1099-R.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AWL4484

New Member

hackerley1113

New Member

kawnek12

Level 1

lucyney

New Member

jerrysiekierski

New Member