- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

Those are separate unrelated transactions.

The proper way to report the recharacterization and earnings which is to enter the 2019 IRA contribution in the IRA contribution interview section and then say yes to "Did you switch from a Roth to a Traditional IRA - recharacterize".

The amount The amount of the original Roth contribution must be entered - not any earnings or losses.

Then TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharactorized.

There is no tax or penalty on the before-tax earnings since the earning were simply switched into the recharactorized account.

Enter IRA contributions here:

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),

Retirement & Investments,

Traditional & Roth IRA contribution.

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "ira contributions" which will take you to the same place.

======================================================

For the "Backdoor Roth"

The "Backdoor Roth" does not exist in tax law. It is a procedure used by some to take advantage of a quirk in tax law that allows making a non-deductible contribution to a Traditional IRA when one cannot contribute to a Roth IRA, and the immediately converting the Traditional IRA to a Roth IRA, thereby getting the money into the Roth via "backdoor" tax free.

That "procedure" can only work of all these requirements are met:

1) No Traditional IRA account whatsoever can exist (that includes any SEP or SIMPLE IRA accounts) at the start. If existing IRA's contain any before-tax money or earnings then it will be partly taxable.

2) The Tradition IRA contributions must be reported on a 8606 form as non-deductible.

3) The conversion to a ROTH must be shortly after the contribution to avoid taxable gains.

4) The entire Traditional IRA value must be zero that the end of the year of conversion.

Otherwise the conversion will be partly taxable.

First you must enter your Traditional IRA contributions (if there were 2020 contributions).

IRA contribution

Federal Taxes,

Deductions & Credits,

I’ll choose what I work on (if that screen comes up),,

Retirement & Investments,

Traditional & Roth IRA contribution.

Be SURE to answer the follow up that the are choosing to make this contribution NON-DEDUCTIBLE - if that screen comes up. (DO NOT say that you moved (recharacterized) the money to a Roth) – this is a conversion, not a recharactorazition.

Then enter the 1099-R that shows the distribution.

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),,

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

Answer the follow-up questions answer the question that you moved the money to another retirement. The screen will open up with choices of where it was moved. Choose you converted it to Roth IRA.

When asked if you have made any non-deductible contributions say " "yes" if you did then enter the non-deductible contributions made for tax years before 2020. (Usually zero unless you also made a 2019 or earlier non-deductible contribution. If you do have prior year basis then enter the last filed 8606 line 14 value.).

Enter the 2020 year end value of your Traditional IRA a "0" (zero) - if it is in fact zero - this tax free Roth conversion will not work if it is not zero.

[If you had any other Traditional IRA at the end of 2020, then the nondeductible "basis" must be pro-rated over the current distribution and the total IRA value and only a portion of the Roth conversion will be non taxable and part will be taxable, with the remaining non-deductible basis carrying forward for future distributions. You can never only withdrew the nondeductible basis as long as the IRA exists and has a value more than zero.]

The non-deductible amount of your contribution will be subtracted from the taxable amount of the conversion on then 8606 form and enter on line 4a of them 1040 form and a zero taxable amount on line 4b if you did it right.

Also see this TurboTax FAQ:

https://ttlc.intuit.com/questions/4350747-how-do-i-enter-a-backdoor-roth-ira-conversion

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

@macuser_22 --> This is very helpful. May I ask a follow-up question?

I have the same situation as @tax17- except I did both of these two actions for the 2019 tax year in February - April 2020, thus I received 1099-Rs for my 2020 tax year.

When I did my tax return in 2019, I reported my $1000 contribution to the Roth IRA and then reported my reasoning for recharacterizing it to a deductible traditional IRA. Note: The amount after growth was $1104. I believe that I reported that correctly, but am reentering it (again) in my 2020 taxes as the corresponding 1099-R has 2020 written on it since this recharacterization happened in February 2020. I then added $5000 more to the non-deductible Traditional IRA. (To hit the $6000 max.) in early March 2020. Then, in early April I "Backdoor Roth'd" the total balance over to my Roth IRA. (The balance was valued at $6019 at that time. This is the ALL the money that I had in my traditional IRA. I had never contributed to it before and it had no deductible contributions inside the account, only non-deductible contributions. I have no other traditional IRA account.) I also got a 1099-R showing this transaction from Traditional IRA to Roth IRA in 2020.

I put both of those 1099-R forms into Turbo Tax.

- The first 1099-R for the $1000 recharacterization results in a message saying that I "may" need to amend my 2019 return. (1) Do you know why I am getting this feedback?

- The second form shows the total from this "backdoor roth" on my 1040 Line 4a as expected, but the taxable amount on 1040 Line 4b is ~$5024 instead of the expected $19 (the growth on the total $6000 non-deductible IRA contribution). Do you know why? How do I get it to show $19 instead?

Other possibly relevant information: I over contributed $5500 in 2018 to my Roth but didn't know about recharacterization at the time and had it all moved to a brokerage account in Mar. 2019. This doesn't show up on my 2018 tax return since it was corrected in time. I accidentally reported this $5500 as still being in my account on my 2019 tax return and thus need to amend my 2019 return to show that I had removed the $5500 before the deadline in spring 2019. I will be refunded $330 when this goes thru. I haven't yet summited this amendment. This $330 shows up on my 2020 1040 preview as well (Schedule 2 Line 6). Not sure how to get rid of it either. Maybe the mess up in my 2019 return is causing the problems with Turbo Tax in my 2020 return?

Note: I've contacted Turbo Tax live about this twice and haven't gotten a helpful response either time. The last person said the $5024 taxable was because of my K-1 form, but I have no K-1 form (and after a quick google, I shouldn't have one.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

@lemonwater wrote:

When I did my tax return in 2019, I reported my $1000 contribution to the Roth IRA and then reported my reasoning for recharacterizing it to a deductible traditional IRA. Note: The amount after growth was $1104. I believe that I reported that correctly, but am reentering it (again) in my 2020 taxes as the corresponding 1099-R has 2020 written on it since this recharacterization happened in February 2020. I then added $5000 more to the non-deductible Traditional IRA. (To hit the $6000 max.) in early March 2020. Then, in early April I "Backdoor Roth'd" the total balance over to my Roth IRA. (The balance was valued at $6019 at that time. This is the ALL the money that I had in my traditional IRA. I had never contributed to it before and it had no deductible contributions inside the account, only non-deductible contributions. I have no other traditional IRA account.) I also got a 1099-R showing this transaction from Traditional IRA to Roth IRA in 2020.

I put both of those 1099-R forms into Turbo Tax.

- The first 1099-R for the $1000 recharacterization results in a message saying that I "may" need to amend my 2019 return. (1) Do you know why I am getting this feedback?

- The second form shows the total from this "backdoor roth" on my 1040 Line 4a as expected, but the taxable amount on 1040 Line 4b is ~$5024 instead of the expected $19 (the growth on the total $6000 non-deductible IRA contribution). Do you know why? How do I get it to show $19 instead?

Other possibly relevant information: I over contributed $5500 in 2018 to my Roth but didn't know about recharacterization at the time and had it all moved to a brokerage account in Mar. 2019. This doesn't show up on my 2018 tax return since it was corrected in time. I accidentally reported this $5500 as still being in my account on my 2019 tax return and thus need to amend my 2019 return to show that I had removed the $5500 before the deadline in spring 2019. I will be refunded $330 when this goes thru. I haven't yet summited this amendment. This $330 shows up on my 2020 1040 preview as well (Schedule 2 Line 6). Not sure how to get rid of it either. Maybe the mess up in my 2019 return is causing the problems with Turbo Tax in my 2020 return?

Note: I've contacted Turbo Tax live about this twice and haven't gotten a helpful response either time. The last person said the $5024 taxable was because of my K-1 form, but I have no K-1 form (and after a quick google, I shouldn't have one.)

A 2019 contribution recharacterization is only reported in the 2019 tax return and does not go on the 2020 return at all. The 1099-R code R for the recharacterization should be ignored since it only tells the IRS about the recharacterization but you report it in the IRA contribution sections as you seemed to have done.

The "additional $5,000" - if that was a 2019 contribution made in 2020 for 2019 then that must be entered into the 2019 IRA contribution interview also as a non-deductible contribution that would go on the 2019 8606 form line 1 along with the $1,000 that was recharactorized for a total of $5,000.

If the $5,000 was a 2020 contribution then it gets entered the same way on the 2020 tax return which will put it on the 2020 8606 line 1 - with the carry forward 2019 contribution on line 2 for the total $6,000 on line 3.

It sounds like the $5,000 was never entered for either year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

@macuser_22 Thanks for the quick response. The additional $5000 was for 2019 and was entered in my 2019 return, along with the $1000 recharacterization. Form 8606 line 14 of my 2019 return shows $6000. I entered this in my 2020 questions when I asked if I had tracked non-deductible contributions from prior years. But I'm still getting Line 4b taxable amount at $5024 instead of $19.

Also, 2019 was the first year I had a traditional IRA. I have no other traditional IRA accounts (nor SEP & SIMPLE IRAs) and all the contributions that I have ever made to to the traditional IRA have been non-deductible.

I have contributed another $6000 (non-deductible) to my traditional IRA for 2020 (but I did this in February 2021) and have also included this contribution in my 2020 return. I expect that Form 8606 line 14 of my 2020 return should also be $6000 for this 2020 year. Since I "backdoor'd" this 2020 contribution to a Roth IRA in February 2021, I will have to repeat whatever I do this year in the Turbo Tax software again next year. Fortunately, I did this "backdoor" when the value was still $6000, so no growth. Thus, I will expect 1040 Line 4b to show $0 next year for my 2021 returns.

To make this simpler in the future, I have also already contributed $6000 to my traditional IRA for 2021 and "backdoor roth'd" it before it saw any growth. I plan to make all contribution and 'backdoor' movements in the corresponding calendar year for all future years as this has been difficult and time consuming for my to figure out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

If you entered it a the prior year non-deductible contribution then it should be on the 2020 8606 line 2 - is it?

Also, was the 2020 year end value of all Traditional IRA's zero?

The 8606 calculations should lead you to the problem.

Look at the 2020 8606 lines 1-15 to see the calculations - NOTE: If there is an * next to line 15 then 6-14 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

Again, thank you so much!

2020 8606 Form:

Line 1: $6000

Line 2 (total basis in trad. IRA): $995 --> This should be $6000. See my comments below.

Line 3 (1 + 2) : $6995

Line 4 (2020 contributions made in early 2021): $6000

Line 5 (4 -3) : $995

Line 6: 0

Line 7: 0

Line 8 (amount converted to Roth): $6019

Line 9 (6 + 7 + 8): $6019

Line 10 (5/9): 0.16531

Line 11 (8*10): $995

Line 12: 0

Line 13 (11 + 12): $995

Line 14: $6000

Line 15a-c: 0

Line 16 (8): $6019

Line 17 (11): $995

Line 18 (17 -16) : $5024

IRS instructions for filling out line 2 of 8606: https://www.irs.gov/pub/irs-pdf/i8606.pdf

Total Basis Chart:

IF the last Form 8606 you filed was for a year after 2000 and before 2020,

THEN enter on line 2, the amount from line 14 of that Form 8606.

My 2019 8606 Line 14 shows $6000.

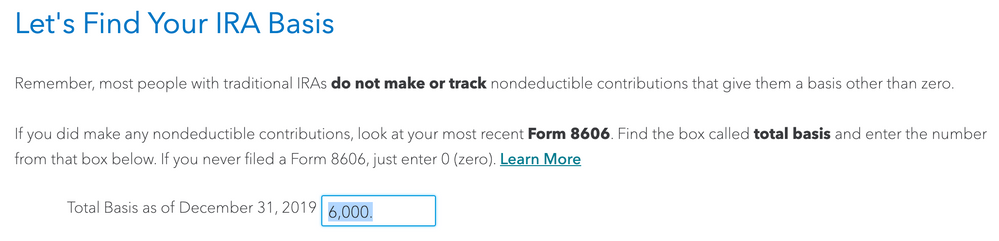

This is where I entered this information on the 2020 website:

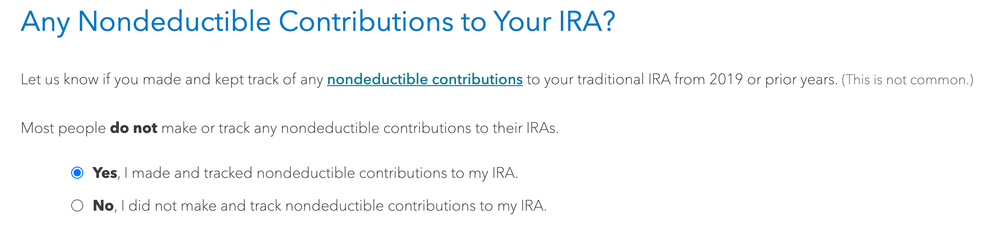

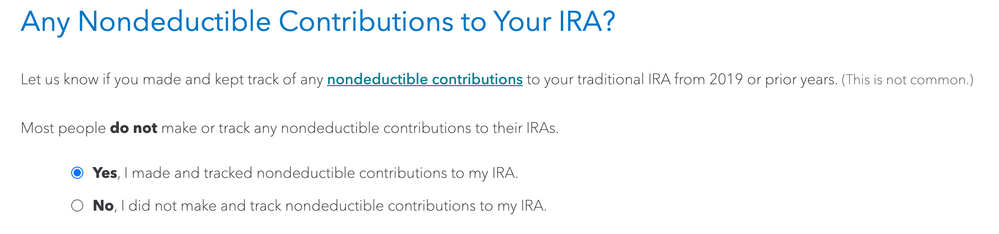

- "Any Non-Deductible Contributions to your IRA? Let us know if you made or kept track of any nondeductible contributions to your traditional IRA from 2019 or prior years. (This is not common.) Most people do not make or track and nondeductible contributions to their IRA."

- Yes, I made and tracked nondeductible contributions to my IRA.

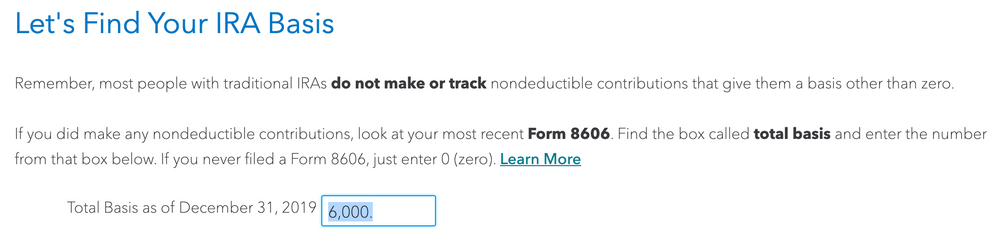

- "Let's find your IRA basis. Remember, most people with traditional IRA holdings do not make or track nondeductible contributions that give them a basis other than zero. If you did make any non-deductible contributions, look at your most recent Form 8606. Find the box called total basis and enter the number from that box below. If you never filed a Form 8606, just enter 0 (zero).

- Total Basis as of December 31, 2019: $6000

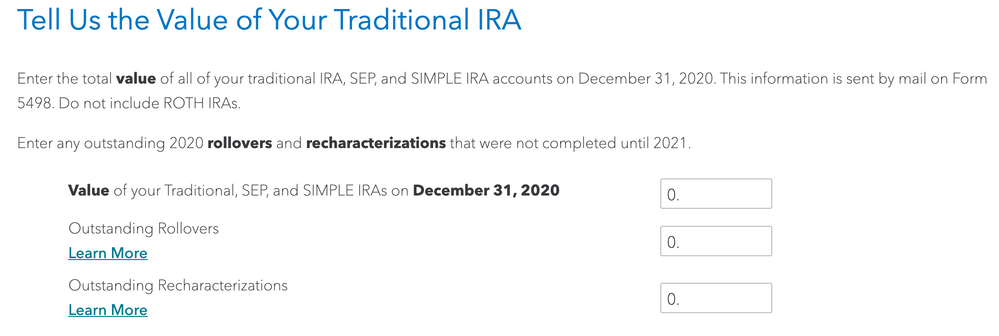

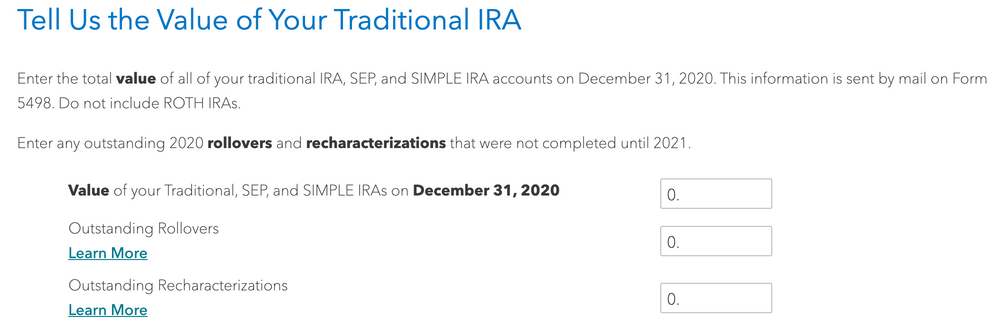

- "Tell Us the Value of Your Traditional IRA. Enter the total value of all your traditional IRA, SEP, and SIMPLE IRA accounts on December 31, 2020. This information is sent by mail on Form 5498. Do not include ROTH IRAs. Enter any outstanding 2020 rollovers and recharacterizations that were not completed until 2021. "

- Value of your Traditional, SEP, and SIMPLE IRAs on December 31, 2020: $0

- Outstanding Rollovers: $0

- Outstanding Recharacterizations: $0

- Note: I did not receive a Form 5498.

Account balance = $0 on every Dec. 31:

Dec. 31, 2018: $0,

- no traditional IRA account yet

Dec. 31, 2019: $0

- no traditional IRA account yet, no contributions

Dec. 31, 2020: $0

- Feb. 2020 - recharacterized $1109 (contribution was $1000) from Traditional IRA to Roth IRA for 2019

- Mar. 2020 - added $5000 to Traditional IRA for 2019

- Apr. 2020 - backdoor converted $6019 (total Traditional IRA account balance) to Roth IRA, thus account balance = $0

future Dec. 31, 2021: $0

- Mar. 2021 - added $6000 to Traditional IRA for 2020, backdoor converted to ROTH IRA before any gain in value

- later in Mar. 2021 - added another $6000 to Tradiational IRA, but for 2021, backdoor converted to ROTH IRA before any gain in value

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

Again, thanks so much for your help!

I've replied to this message twice and it keeps getting deleted for some reason. I'm going to try again but not as much detail.

My 2020 8606 unexplainably has $995 on Line 2. The IRS instructions say that this line should match Line 14 from my 2019 8606, which is $6000. I have tried to put this value into TurboTax in the following places, but my 2020 8606 still shows $995 instead of $6000.

Yes, the 2020 year end value of all my Traditional IRA's was zero. (I only have one Traditional IRA and no SEP nor SIMPLE IRAs).

My only transactions in 2020 were:

- No previous contributions to Traditional IRA (ever)

- Feb 2020 - recharacterize $1109 (contribution amount of $1000) from ROTH to Traditional IRA for 2019

- Mar. 2020 - Add $5000 to the Traditional IRA for 2019

- Apr. 2020 - Backdoor conversion of total account value $6019 (contribution value of $6000) from Traditional to ROTH IRA

My transactions in 2021 have been:

- Mar. 2021 - Added $6000 to traditional IRA for 2020, backdoor converted to ROTH IRA before any gains in value

- later in Mar. 2021- Added $6000 to traditional IRA for 2021, backdoor converted to ROTH IRA before any gains in value

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

Your $6000 prior years basis you entered should be on line 2 on the 8606.

If not, I suggest you delete the 1099-R and re-enter. Be sure there are no other 1099-R forms entered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

I have 3 2020 1099-R forms. I assuming I should delete them all and start over. What order should I enter them?

- Shows the recharacterization of the ~$1000 from ROTH to Traditional (for 2019, done in 2020)

- Shows the backdoor conversion of ~$6000 from Traditional to ROTH (of 2019 contributions, done in 2020)

- Shows the mega backdoor ROTH conversion of money in my 401k (of 2020 contributions, done in 2020)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

@lemonwater wrote:

I have 3 2020 1099-R forms. I assuming I should delete them all and start over. What order should I enter them?

- Shows the recharacterization of the ~$1000 from ROTH to Traditional (for 2019, done in 2020)

- Shows the backdoor conversion of ~$6000 from Traditional to ROTH (of 2019 contributions, done in 2020)

- Shows the mega backdoor ROTH conversion of money in my 401k (of 2020 contributions, done in 2020)

#1 The recharacterization should have a code R that you do not enter in 2020.

#3 Explain more. What code is in box 7? What is in box 2a? What is in box 5? A "mega" backdoor Roth depend your after tax contributions to the 401(k). You might have entered that improperly. delete that 1099-R and then see if the other calculations are correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i file a roth recharacterization to a traditional IRA and then a backdoor Roth Conversion on Turbo Tax?

I had another phone call with TurboTax Live.

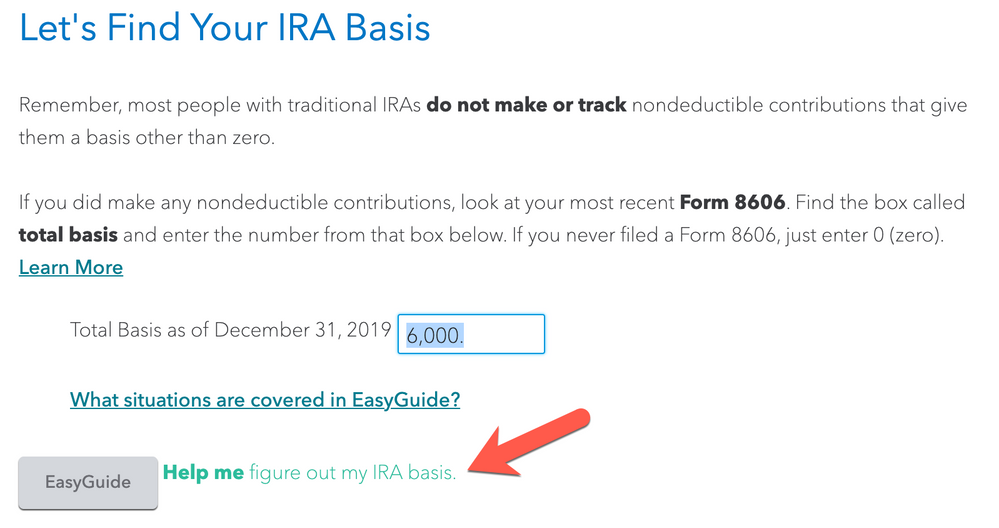

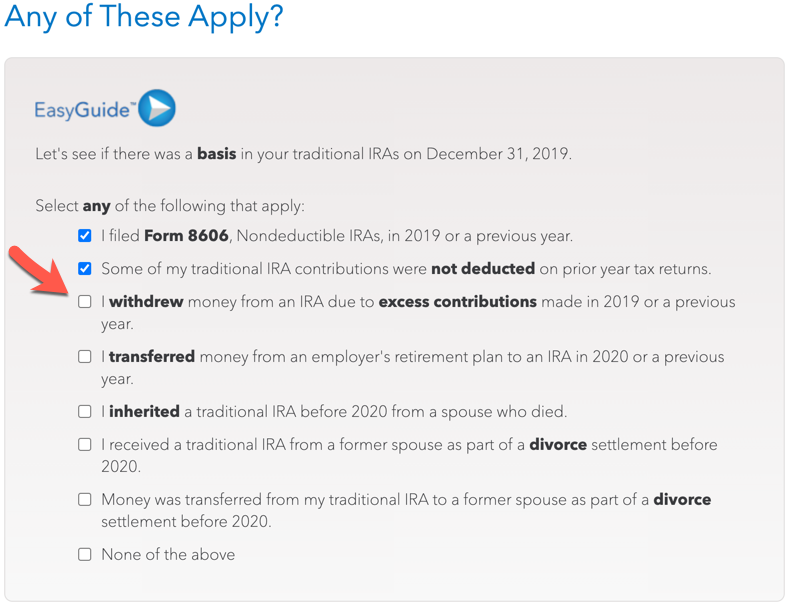

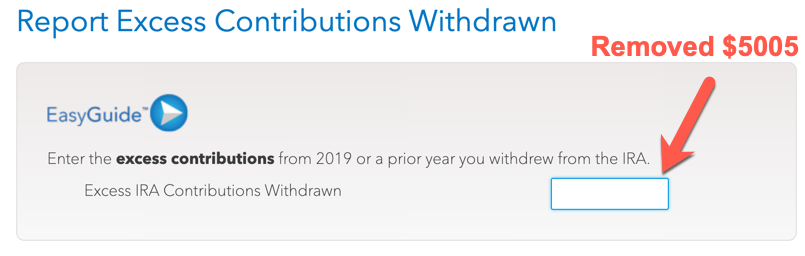

Because you ( @macuser_22 ) helped me figure out that 2020 Form 8606 Line 2 should equal 2019 Form 8606 Line 14, I was finally able to get the problem figured out. On the page where I entered my cost basis from my 2019 Form 8606, there is a button on the bottom called "Easy Guide".

I had checked a wrong button in this menu and it resulted in a blank that had 5005 typed into it, this resulted in the $995 number that was showing up on Line 2 of my 2020 Form 8606. ($6000-$5005). Once we got that blank changed to zero, my taxable portion changed to $19! Whew.

Thank you so much @macuser_22!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17557017943

New Member

tianwaifeixian

Level 4

tianwaifeixian

Level 4

tcondon21

Returning Member

Divideby7

Level 1