- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Again, thank you so much!

2020 8606 Form:

Line 1: $6000

Line 2 (total basis in trad. IRA): $995 --> This should be $6000. See my comments below.

Line 3 (1 + 2) : $6995

Line 4 (2020 contributions made in early 2021): $6000

Line 5 (4 -3) : $995

Line 6: 0

Line 7: 0

Line 8 (amount converted to Roth): $6019

Line 9 (6 + 7 + 8): $6019

Line 10 (5/9): 0.16531

Line 11 (8*10): $995

Line 12: 0

Line 13 (11 + 12): $995

Line 14: $6000

Line 15a-c: 0

Line 16 (8): $6019

Line 17 (11): $995

Line 18 (17 -16) : $5024

IRS instructions for filling out line 2 of 8606: https://www.irs.gov/pub/irs-pdf/i8606.pdf

Total Basis Chart:

IF the last Form 8606 you filed was for a year after 2000 and before 2020,

THEN enter on line 2, the amount from line 14 of that Form 8606.

My 2019 8606 Line 14 shows $6000.

This is where I entered this information on the 2020 website:

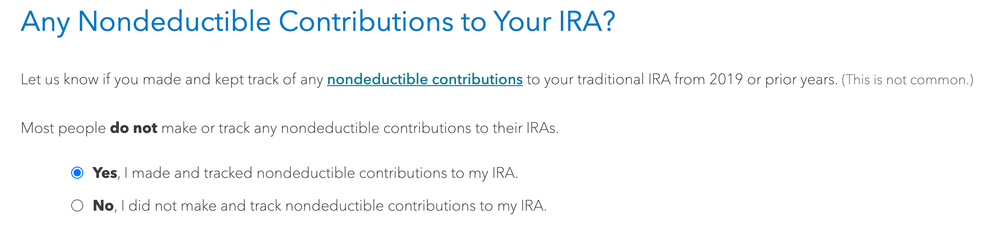

- "Any Non-Deductible Contributions to your IRA? Let us know if you made or kept track of any nondeductible contributions to your traditional IRA from 2019 or prior years. (This is not common.) Most people do not make or track and nondeductible contributions to their IRA."

- Yes, I made and tracked nondeductible contributions to my IRA.

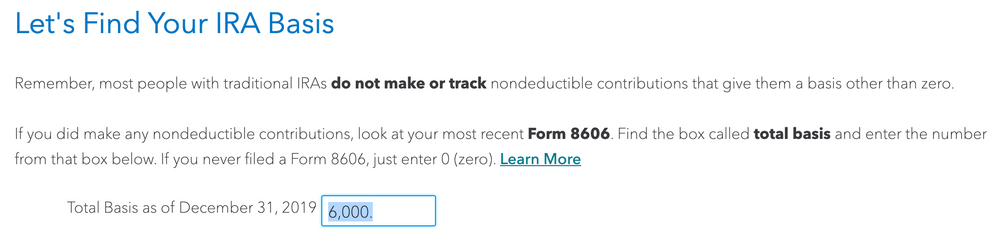

- "Let's find your IRA basis. Remember, most people with traditional IRA holdings do not make or track nondeductible contributions that give them a basis other than zero. If you did make any non-deductible contributions, look at your most recent Form 8606. Find the box called total basis and enter the number from that box below. If you never filed a Form 8606, just enter 0 (zero).

- Total Basis as of December 31, 2019: $6000

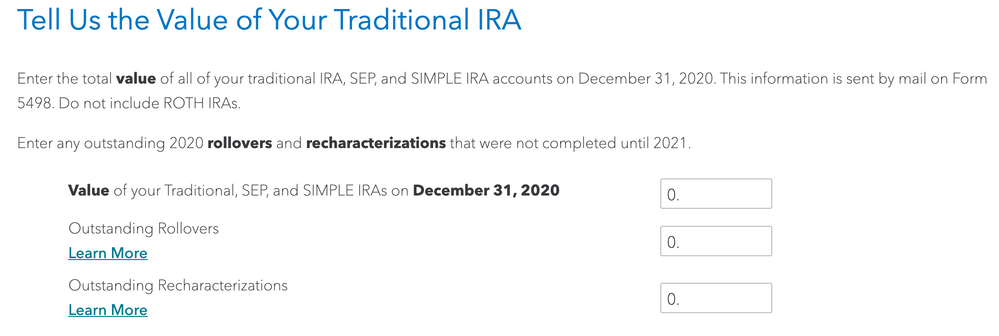

- "Tell Us the Value of Your Traditional IRA. Enter the total value of all your traditional IRA, SEP, and SIMPLE IRA accounts on December 31, 2020. This information is sent by mail on Form 5498. Do not include ROTH IRAs. Enter any outstanding 2020 rollovers and recharacterizations that were not completed until 2021. "

- Value of your Traditional, SEP, and SIMPLE IRAs on December 31, 2020: $0

- Outstanding Rollovers: $0

- Outstanding Recharacterizations: $0

- Note: I did not receive a Form 5498.

Account balance = $0 on every Dec. 31:

Dec. 31, 2018: $0,

- no traditional IRA account yet

Dec. 31, 2019: $0

- no traditional IRA account yet, no contributions

Dec. 31, 2020: $0

- Feb. 2020 - recharacterized $1109 (contribution was $1000) from Traditional IRA to Roth IRA for 2019

- Mar. 2020 - added $5000 to Traditional IRA for 2019

- Apr. 2020 - backdoor converted $6019 (total Traditional IRA account balance) to Roth IRA, thus account balance = $0

future Dec. 31, 2021: $0

- Mar. 2021 - added $6000 to Traditional IRA for 2020, backdoor converted to ROTH IRA before any gain in value

- later in Mar. 2021 - added another $6000 to Tradiational IRA, but for 2021, backdoor converted to ROTH IRA before any gain in value