- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Again, thanks so much for your help!

I've replied to this message twice and it keeps getting deleted for some reason. I'm going to try again but not as much detail.

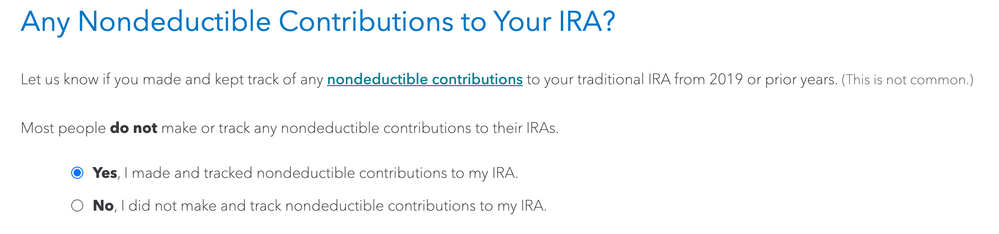

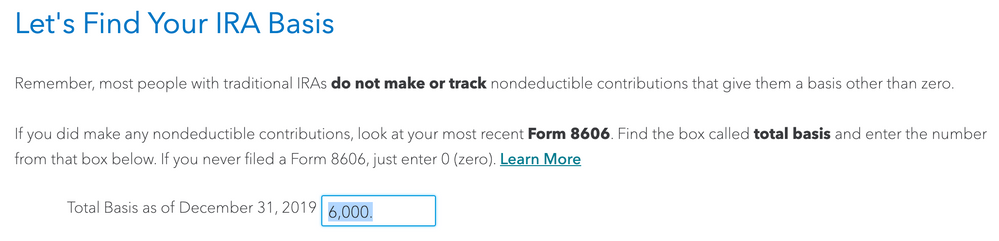

My 2020 8606 unexplainably has $995 on Line 2. The IRS instructions say that this line should match Line 14 from my 2019 8606, which is $6000. I have tried to put this value into TurboTax in the following places, but my 2020 8606 still shows $995 instead of $6000.

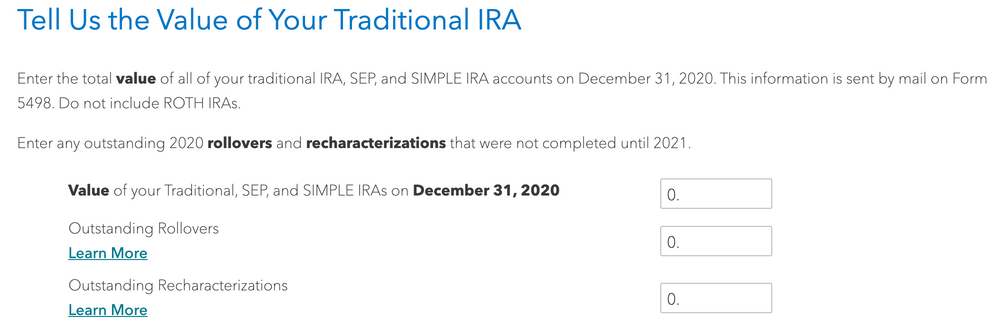

Yes, the 2020 year end value of all my Traditional IRA's was zero. (I only have one Traditional IRA and no SEP nor SIMPLE IRAs).

My only transactions in 2020 were:

- No previous contributions to Traditional IRA (ever)

- Feb 2020 - recharacterize $1109 (contribution amount of $1000) from ROTH to Traditional IRA for 2019

- Mar. 2020 - Add $5000 to the Traditional IRA for 2019

- Apr. 2020 - Backdoor conversion of total account value $6019 (contribution value of $6000) from Traditional to ROTH IRA

My transactions in 2021 have been:

- Mar. 2021 - Added $6000 to traditional IRA for 2020, backdoor converted to ROTH IRA before any gains in value

- later in Mar. 2021- Added $6000 to traditional IRA for 2021, backdoor converted to ROTH IRA before any gains in value

March 28, 2021

6:56 PM