- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: How can I unlock the screen so that I may add more 1099Rs. It ask aquestion About the distrib...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I unlock the screen so that I may add more 1099Rs. It ask aquestion About the distribution code and instantly locked up. The code was 4D

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I unlock the screen so that I may add more 1099Rs. It ask aquestion About the distribution code and instantly locked up. The code was 4D

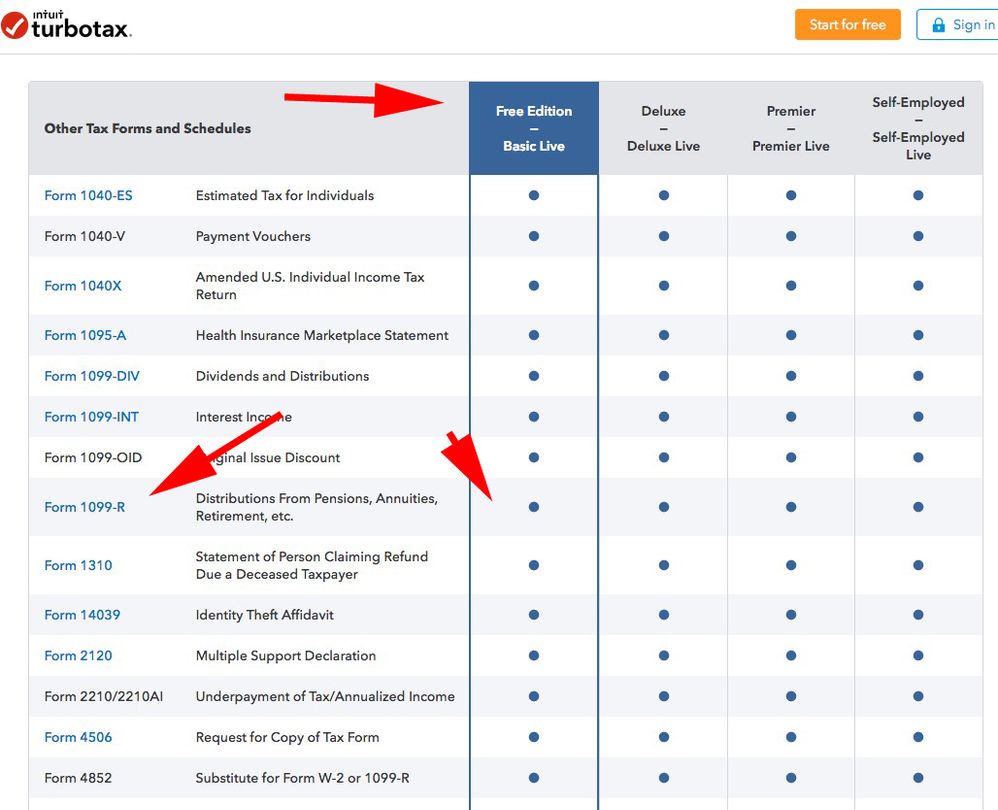

I noticed you are in the Free edition. The Free edition of TurboTax only supports W-2 wages and the Earned Income Credit.

In order to enter your income from your retirement distribution, you will need to upgrade to the Deluxe version of the program. This is needed as you need additional forms to report you retirement income.

Forms included in TurboTax products

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How can I unlock the screen so that I may add more 1099Rs. It ask aquestion About the distribution code and instantly locked up. The code was 4D

@JotikaT2 wrote:

I noticed you are in the Free edition. The Free edition of TurboTax only supports W-2 wages and the Earned Income Credit.

In order to enter your income from your retirement distribution, you will need to upgrade to the Deluxe version of the program. This is needed as you need additional forms to report you retirement income.

Forms included in TurboTax products

The link you provided shows that indeed the 1099-R is supported. I would suggest to the poster that you clear the browser cookies and cache or try a different browser.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hartski1

New Member

sugersam5

Level 3

nomoresafeer

New Member

thoreson50--

New Member

mcmilval

Returning Member