- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

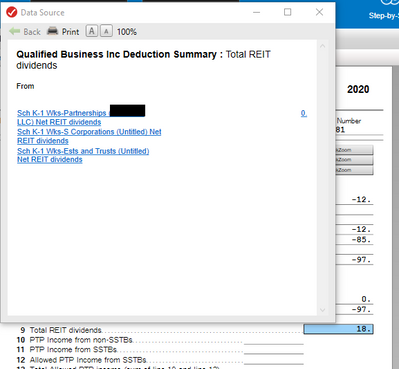

I am seeing the same thing in the Windows desktop version of TT Premier. The Data Source shows coming from the K-1 as 0 but shows 18 on the Summary below. Not a REIT or PTP so it is obviously not transferring correctly. TurboTax needs to fix this bug. I'm going to override it to the get it right for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

It's likely not a bug. If you have a Form 1099-DIV with a box 5 entry, that is where it is coming from. That box reports REIT dividends.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

- Thanks ,Daniel.

- Before your reply I went and scrutinized my 1099 Divs and found the $92 in box 5.

- It happened last year also but I did not get **bleep** over it .

- Had time this year to be **bleep**!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

5smallhokies's response does not appear to be for certain. See other response above about 1099-DIV line 5 (Section 100A dividends).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

RE: Frm 8895 Turbo Tax program states I have income from an REIT when I have not received or entered any Data from a Sched-K. Its reported on QBI wrksh line 9 Why?

I just confirmed DanielV01's reply was the correct answer for me. In terms of updates to TurboTax, it would be nice if the "Data Source" pointed to the 1099-DIV instead of looking for non-existent K-1's.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bees_knees254

New Member

user17549282037

New Member

Propeller2127

New Member

Newby1116

Returning Member

Lukas1994

Level 2