- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Form 8606 Calculation Error - Turbotax 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

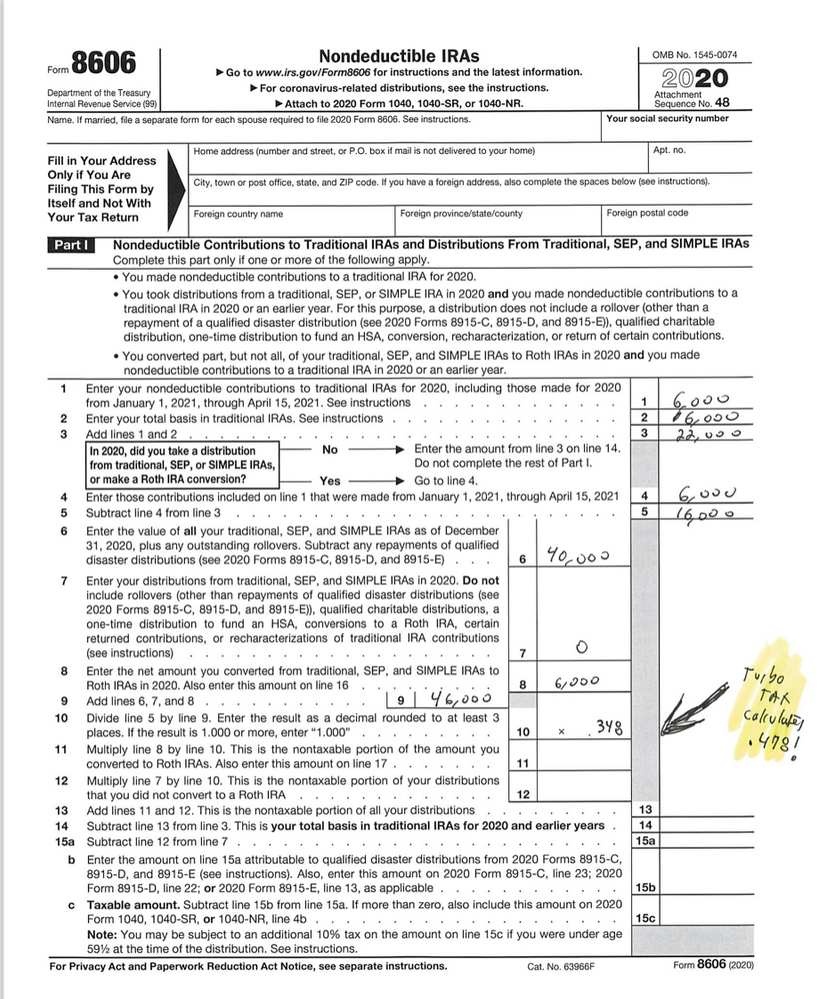

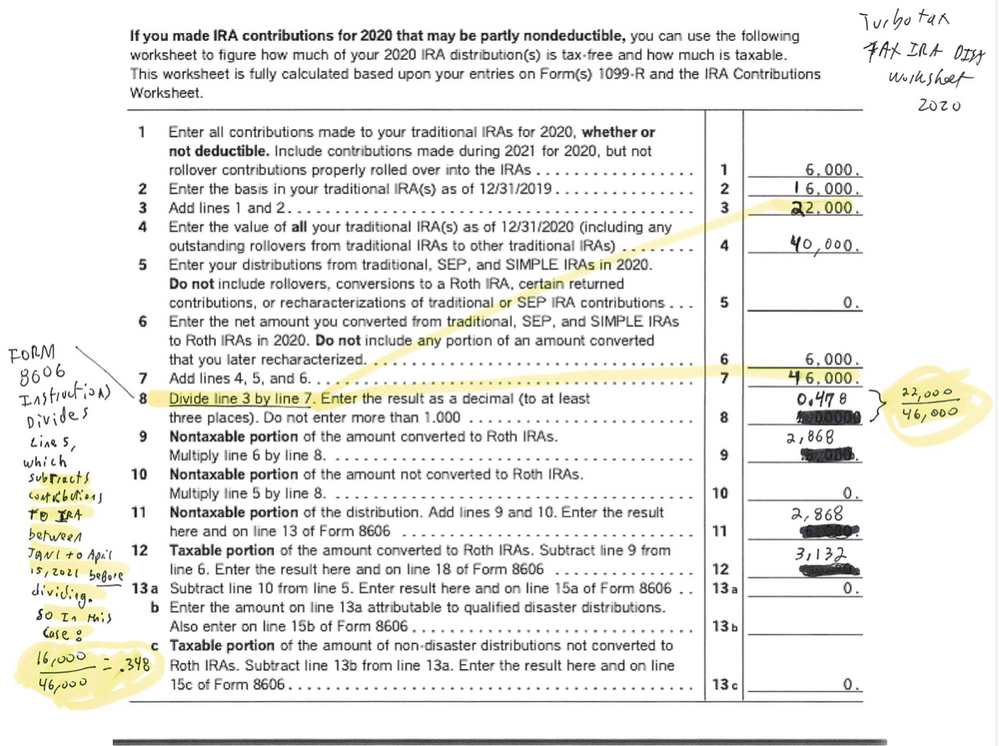

We believe we found a calculation error in the TurboTax 2020 calculation in a situation where non-deductible contributions to traditional IRAs for 2020 are made between January 1, 2021 and April 15, 2021. In the TurboTax "Tax IRA Dist" worksheet, the calculation in line 8 divides line 3 by line 7. However, in the Form 8606, the amount entered in the equivalent of line 3 SUBTRACTS first the non-deductible contributions to traditional IRAs for 2020 made between January 1, 2021 and April 15, 2021. In the Turbotax worksheet, line 3 is using the amount before subtracting back out the amount contributed in 2021. I attach a sample calculation in the picture attached using the TurboTax worksheet and using the Form 8606.

I value your thoughts community! Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

@69VanNuys wrote:

Thank you for confirming the error. I believe you are correct that the software is using Table 1-1, which works only if Line 4 of Form 8606 is ZERO. That is, if no contribution was made between January 1, 2021 and April 15, 2021. Turbo tax is not running the calculation through the entire Form 8606 calculation and it results in a calculation error.

As user @dmertz pointed out - there is no error. TurboTax is using the IRS worksheet 1-1 on Pub 590.B.

You will find the TurboTax calculations on the "Taxable IRA Distribution Worksheet" in TurboTax.

That IRS worksheet says to enter ALL contributions, including any made for the prior year before the due date and add them together which is what TurboTax does.

We agree that the IRS worksheet seems to conflict with the 8606 instructions and will include the prior years contribution in the calculations which results in a lower tax then the 8606 calculations do, but that is what the IRS says to do and it seem that most tax software have started to use the worksheet instead of then 8606 because of the better tax treatment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

TurboTax is apparently using Worksheet 1-1 from IRS Pub 590-B to calculate the nontaxable and taxable amounts of this Roth conversion rather than doing the entire calculation on Form 8606, indicated by asterisks on lines 13, 15 and 18.

https://www.irs.gov/publications/p590b#en_US_2019_publink1000270091

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

Thank you. Does anyone know how to report this to TurboTax to get or fixed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

Thank you for confirming the error. I believe you are correct that the software is using Table 1-1, which works only if Line 4 of Form 8606 is ZERO. That is, if no contribution was made between January 1, 2021 and April 15, 2021. Turbo tax is not running the calculation through the entire Form 8606 calculation and it results in a calculation error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

@69VanNuys wrote:

Thank you for confirming the error. I believe you are correct that the software is using Table 1-1, which works only if Line 4 of Form 8606 is ZERO. That is, if no contribution was made between January 1, 2021 and April 15, 2021. Turbo tax is not running the calculation through the entire Form 8606 calculation and it results in a calculation error.

As user @dmertz pointed out - there is no error. TurboTax is using the IRS worksheet 1-1 on Pub 590.B.

You will find the TurboTax calculations on the "Taxable IRA Distribution Worksheet" in TurboTax.

That IRS worksheet says to enter ALL contributions, including any made for the prior year before the due date and add them together which is what TurboTax does.

We agree that the IRS worksheet seems to conflict with the 8606 instructions and will include the prior years contribution in the calculations which results in a lower tax then the 8606 calculations do, but that is what the IRS says to do and it seem that most tax software have started to use the worksheet instead of then 8606 because of the better tax treatment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

Thanks for your thoughts!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

@dmertz - I am starting think that @69VanNuys is correct and something has been overlooked in the IRS 590-B instructions.

What do you think?

Follow this --- assume

$6,000 2019 contribution.

$6,000 2020 contribution made in Feb 2021 *for* 2020.

2020 1099-R $12,000 converted to Roth

=====

This produces a

8606 line 1 = $6,000 (2020 contribution)

8606 line 2 = $6,000 (2019 contribution)

8606 line 3 - $12,000 (line 1+2)

8606 line 4 = $6,000 (contribution made in 2021 for 2020)

8606 line 5 = $6,000 (line 3 - line 4)

TurboTax uses the IRS worksheet 1-1

The worksheet uses the total of the $12,000 contributions to arrive at the non-taxable amount of $12,000 on line 8 of the IRS worksheet that is line 11 on the TurboTax version.

But note: the IRS pub 590 prior to the worksheet 1-1 (under Contribution and distribution in the same year) says when to use the worksheet and step #4 says:

4. if line 5 of Form 8606 is less than line 8 of Worksheet 1-1, complete lines 6 through 15c of Form 8606 and stop here.

Well, as I read it, line 5 of the 8606 is $6,000 and line 8 (TurboTax line 11) is $12,000 so the worksheet should NOT be completed and the remainder of the calculations should be done on the 8606 lines 6-15c.

Am I reading that right and TurboTax is doing it wrong or am I missing something ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

Thanks for thinking about it and keeping the dialogue open. Will be interesting to hear what the community thinks about how to resolve this situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

User dmertz is the community expert on this subject. If he agrees that TurboTax has been doing it wrong for the last 2 years, I will put in a bug report with the moderators.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

My position is that TurboTax is excessively 'liberal' in its use of Worksheet 1-1. I don't think that TurboTax should be using the worksheet if the contribution would be nondeductible even without the added income of the taxable portion of the distribution, for example, or if the individual explicitly chooses the contribution to be nondeductible. In either of those cases the entire amount of the traditional IRA contribution ends up on Form 8606 line 1.

I no longer pursue this issue since (almost) nobody complains about being able to apply a greater amount of basis by TurboTax using Worksheet 1-1. Apparently a few people have been questioned about it by the IRS and they've just needed to provide a copy of the completed worksheet in response. I've heard that there is at least one other tax software that somehow includes this worksheet in the forms needed for filing when this worksheet is used.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

What about the rule I pointed out that says the 8606 shoud be used and not the worksheet. Seems like TT is ignoring that rule.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

I think that TurboTax is following that rule. In my test of this, TurboTax prepares the worksheet as required and then fully prepares Form 8606 instead of transferring amounts to Form 8606 from the worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

The trouble is that in my actual return, Turbo Tax is not following form 8606. It is following the Table 1-1. Turbo Tax does NOT go through the steps in 8606 and ends up with a different number on the taxable and non-taxable lines. TT is following the table. Form 8606, as I described in my photos above, subtracts from the amount contributed in 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

@69VanNuys wrote:

The trouble is that in my actual return, Turbo Tax is not following form 8606. It is following the Table 1-1. Turbo Tax does NOT go through the steps in 8606 and ends up with a different number on the taxable and non-taxable lines. TT is following the table. Form 8606, as I described in my photos above, subtracts from the amount contributed in 2021.

Yes - that is what we are discussing. TurboTax (and other software companies) are using the IRS worksheet because it is more favorable to the taxpayer and allows contributions *for* the tax yer but made after the tax year to be counted.

Note that that worksheet should be used if the reason for the non-deductible contribution is because of being covered by a retirement plan at work and the deduction is phased out or eliminated. It is not clear if that is what the IRS intended, but I have not heard of ANYONE being audited because of using that worksheet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Form 8606 Calculation Error - Turbotax 2020

Thank you for your time and comprehensive responses. Following this rationale of using Table 1-1, there is still an uncertainty. I will explain in detail so that you can re-create it on your end using TurboTax.

Senario:

Under 65 using BackDoor Roth annually. Contributions to Traditional IRA and Conversion to Roth for the tax year are made between January 1 and April 15 of the following year. There is an existing Traditional IRA balance.

2020: $6,000 contributed to Traditional IRA (for tax year 2019). $6,000 converted to Roth (for tax year 2019). Both of these transactions occur in February of 2020.

2021: $6,000 contributed to Traditional IRA (for tax year 2020). $6,000 converted to Roth (for tax year 2020). Both of these transactions occur in February of 2021.

Question:

Table 1-1 Line 2 states:

Enter the total of all contributions made to your traditional IRAs during 2019 and all contributions made during 2020 that were for 2019, whether or not deductible. Don't include rollover contributions properly rolled over into IRAs. Also, don't include certain returned contributions described in the instructions for line 7, Part I, of Form 8606

The Table 1-1 example above was published in 2019, so assume all references to 2019 are 2020 and 2020 are 2021.

In this scenario example, should line 2 be $6,000 or $12,000? I assume the "that were for 2020" language is intended to qualify both (1) the 2020 contributions and (2) the contributions made during 2021. Which means it would only be $6,000.

Thoughts?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

EricBBL

Level 3

fabianalonso192

New Member

cory25

New Member

castelltx

New Member

Lippard1

New Member