- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: consolidated retirement accounts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

consolidated retirement accounts

I consolidated retirement accounts from multiple jobs into one traditional IRA account. Some 1099-R indicated in box 7 a G others noted a 7. Do these count as income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

consolidated retirement accounts

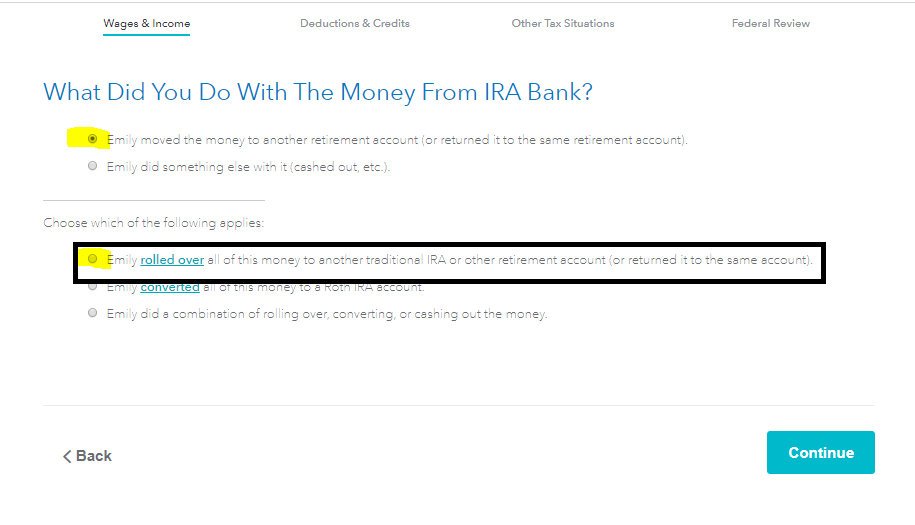

If the amounts reported on the forms 1099-R coded 7 in box 7 were rolled over to the Traditional IRA, you should continue with the TurboTax interview which follows the entry of the 1099-R. At the page titled What did you do with the money? Check that you moved it to another retirement account and that you rolled it over to a Traditional IRA (see screenshot).

The amounts rolled over will be excluded from taxation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

consolidated retirement accounts

When consolidating the retirement accounts, the 1099-R distribution code in Box 7 was G. The interview did not ask if the money was rolled over to a traditional IRA, just a Roth. Will the money be treated as income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

consolidated retirement accounts

No, code G indicates a direct rollover, that is a rollover where the funds go from one bank to the other without a check being issued to you. The amount will appear on line 4a, but will not be added into your taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

consolidated retirement accounts

Or if it was from 401K accounts it will be on 1040 line 4c and say ROLLOVER by 4d.

The 1099R with Code 7. Did you get a check and deposit it in the new IRA Account within 60 days? Was there any taxes or withholding taken out?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tgfathergoose

Level 1

bgambrill

Level 1

harman55

New Member

hopelessdeadhead

Level 1

danemer

New Member