- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Box 7 is used to report income to you. The different code...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

Box 7 is used to report income to you. The different codes within box 7 tell what the tax treatment of any distribution amounts should be. 7 is the code for Normal Distribution (which means it was distributed to taxpayer after age 59.5). D is the new 'nonqualified annuity distribution code'.

The taxable amount of the distribution should still be indicated in Box 2a based on the differing rules depending on when the annuity was purchased.

I have listed below, all of the possible codes that you could see on your 1099-R, just in case you have any follow up questions.

--------------------------------------------------------------------------------------------------------------

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

When the Gross Distribution is $10852.25 and the Taxable Amount is 18.90 why does the taxable amount of my social security increase

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

gross distribution is my own money being retutned

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

The distribution code is 7D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

A gross amount of $10,852.25 and a taxable amount of $18.90 indicates that the distribution consists of $10,833.35 of your original premiums being returned along with $18.90 of taxable earnings.

The calculation of the taxable amount of Social Security income depends on the amount of your other taxable income. It's not uncommon to see an increase in taxable Social Security income equal to 85% of the increase in your other income. In that case, an increase in regular income of $19 ($18.90 rounded up) would cause an increase in taxable Social Security income of $16.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

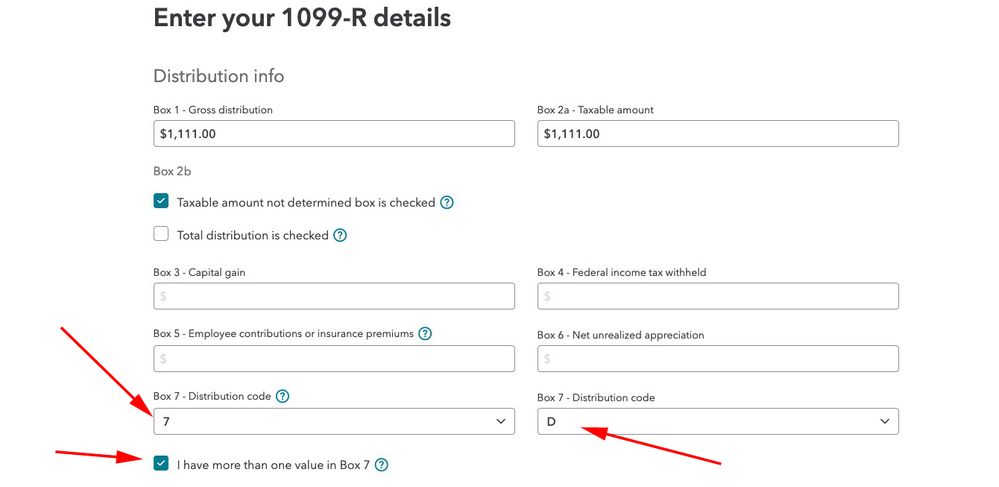

In TurboTax I have to mark it as "7" or "D" what should I use for the 1099-R that is marked "7D" ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

TurboTax's 1099-R form has two box 7 drop-downs. Select "7" in one and "D" in the other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

I can't add the D in Block 7. Only 7. Now what do I do with the D?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

The 2020 1099-R Block 7does not have a 2nd drop down block. There is only one block and the 7D is there. On turbo tax 2020, the 2nd line down has different codes. D is for Death. The D in block 7 on the 1099 now is for disability, which applies to me but the block on Turbo Tax will only take one character.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

@Tethy-_1930 wrote:

The 2020 1099-R Block 7does not have a 2nd drop down block. There is only one block and the 7D is there. On turbo tax 2020, the 2nd line down has different codes. D is for Death. The D in block 7 on the 1099 now is for disability, which applies to me but the block on Turbo Tax will only take one character.

@Tethy-_1930 Are you using the online version of TurboTax?

Code "7" is a Normal Distribution, code "D" is for a non-qualified annuity. (Code "4" is for death. Code "3" is disability.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

You need to click "I have more than one code value in Box 7" directly below the box 7 input field. This will open up another input field to enter the D.

Code 7 indicate normal distribution so you will not have the 10% early withdrawal penalty on top of the normal income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

how do i reach someone to talk with at turbo tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On form 1099-R Box 7 is marked 7D. How does that translate ?

Please use the link below to contact us.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Av74O0OhzB

New Member

Toksica

Level 3

fredtex1

Level 2

gwennypaa

New Member

user17640570153

New Member