- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/20...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

Please be aware, if you (or your spouse) have a retirement account at work and your income exceeds certain levels then your deduction of a traditional IRA contribution may be limited. Please see IRA deduction limits for details.

Please make sure you keep Form 8606 that reports the basis for your records since this will be important when you receive distributions from your traditional IRA. If you have a basis (nondeductible contributions) then each distribution will have an amount allocated to this basis and this amount will be tax free.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

Thank you for the response, but I am still confused.

I am single and have not had a retirement account through work for 3 years. The last 401k balance was rolled over into my Traditional IRA account at that time.

My income in 2020 was the lowest it has been in a decade - less than I have contributed to my traditional IRA in Q1 of 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

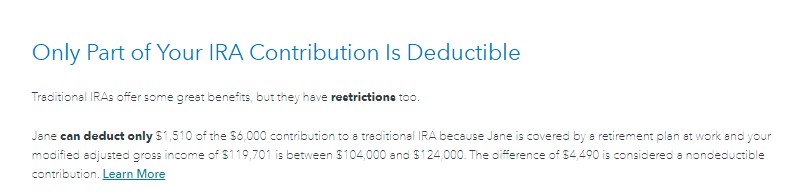

To clarify, you are getting the screen "Only Part of Your IRA Contribution Is Deductible" similar to this one (yours would say between $65,000 and $75,000) :

If you did not have a retirement plan at work then please verify that your W-2 entry did not have the retirement box 13 checked.

Login to your TurboTax Account

Click on "Search" on the top right and type “W-2”

Click on “Jump to W-2” and you should see the “Here's your W-2 info” screen

Click on "Edit"

Also, verify you did not select you had a retirement plan during the IRA contribution interview.

Or are you getting a penalty screen because of excess contribution?

Please be aware the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than:

- $6,000 ($7,000 if you're age 50 or older), or

- If less, your taxable compensation for the year

If you has less taxable compensation (wages, salary, self-employment) than $6,000, then you cannot contribute the full $6,000.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

Thank you, Dana - I think you have answered my question.

Based on your response, it looks like the latter is the case; that is, the excessive contribution screen. My income last year was less than $6K.

Am I better off just not amending my 2020 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

You will have to remove the excess contribution plus earnings by the due date of the return to avoid the 6% penalty. Please make a request with your bank to remove the excess contribution plus earnings.

You should amend your return. If you had some earned income, then you can keep part of the contribution and deduct this amount. You will enter the traditional IRA contribution and on the Penalty screen you will enter the contribution amount (no earnings) that you are removing by the due date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

You are asking from TT Self-Employment. Keep in mind that your IRA contribution is limited to your SE compensation (as defined below), not your gross income. Per the IRS:

Self-employment income.

If you are self-employed (a sole proprietor or a partner), compensation is the net earnings from your trade or business (provided your personal services are a material income-producing factor) reduced by the total of:

The deduction for contributions made on your behalf to retirement plans, and

The deduction allowed for the deductible part of your self-employment taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

Thanks all for the help. Here is what I ended up with:

My taxable income actually worked out to $0 for 2020, which is why no contributions were permitted for 2020.

After speaking with my Advisor, I realized that I had the option of claiming the deductions for this year's contributions on either 2020 or 2021's returns. I had apparently already allocated these contributions to 2021, so do not need to include them on my 2020 return, and thus should not need to amend my return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amending my 2020 return to include contributions to my traditional IRA made prior to 05/17/2021. I have contributed $6K and am not eligible to claim full amount - why?

@vijayc05 wrote:

Thanks all for the help. Here is what I ended up with:

My taxable income actually worked out to $0 for 2020, which is why no contributions were permitted for 2020.

After speaking with my Advisor, I realized that I had the option of claiming the deductions for this year's contributions on either 2020 or 2021's returns. I had apparently already allocated these contributions to 2021, so do not need to include them on my 2020 return, and thus should not need to amend my return.

If nothing had been entered on the 2020 tax return then there is nothing to do. You will report it next year on your 2021 tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

tcondon21

Returning Member

simoneporter

New Member

VAer

Level 4

VAer

Level 4