- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

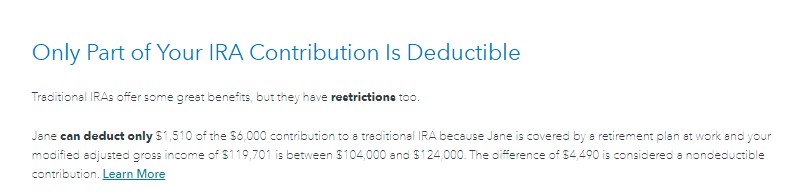

To clarify, you are getting the screen "Only Part of Your IRA Contribution Is Deductible" similar to this one (yours would say between $65,000 and $75,000) :

If you did not have a retirement plan at work then please verify that your W-2 entry did not have the retirement box 13 checked.

Login to your TurboTax Account

Click on "Search" on the top right and type “W-2”

Click on “Jump to W-2” and you should see the “Here's your W-2 info” screen

Click on "Edit"

Also, verify you did not select you had a retirement plan during the IRA contribution interview.

Or are you getting a penalty screen because of excess contribution?

Please be aware the total contributions you make each year to all of your traditional IRAs and Roth IRAs can't be more than:

- $6,000 ($7,000 if you're age 50 or older), or

- If less, your taxable compensation for the year

If you has less taxable compensation (wages, salary, self-employment) than $6,000, then you cannot contribute the full $6,000.

**Mark the post that answers your question by clicking on "Mark as Best Answer"