- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 401k cares act withdrawal

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

The IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Deluxe as Feb 28, 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

Same question for Turbo Tax Home & Business version... the IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Home & Business as Feb 28, 2021?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

@chuckmc wrote:

The IRS finalized and released form 8915-E on Feb 11, 2021. Why is it still not coming up in Turbo Tax Deluxe as Feb 28, 2021?

It was there in the 2/26 update. Are yiu using online or desktop?

What code is in box 7 on your 1099-R?

Is the IRA/SEP/SIMPLE box checked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

I'm using desktop verse for Home & Business. Box 7 on 1099-R is code 1 and IRA/SEP/SIMPLE box is not checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

Also, I spoke with Turbo Tax. They said they are aware of the problem in the software. Said available if print and mail forms, but that they are working to resolve the issue for e-filing. I was told Mar 11th is estimated fix date. Was surprised the date is so far out. Hoping they can do better than that, so checking on regular basis in case fix goes in sooner.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

@chuckmc wrote:

Also, I spoke with Turbo Tax. They said they are aware of the problem in the software. Said available if print and mail forms, but that they are working to resolve the issue for e-filing. I was told Mar 11th is estimated fix date. Was surprised the date is so far out. Hoping they can do better than that, so checking on regular basis in case fix goes in sooner.

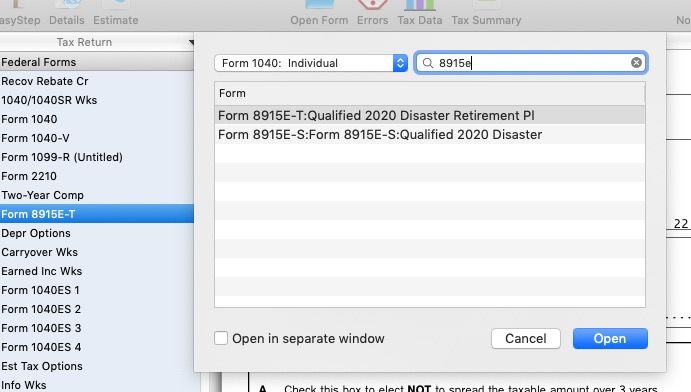

Fix for what? The 8915-E form is in all desktop versions now. Switch to the forms mode and use the open forms box and search for 8915E.

If not there then you are not up to date on version r19 of the software and need to update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

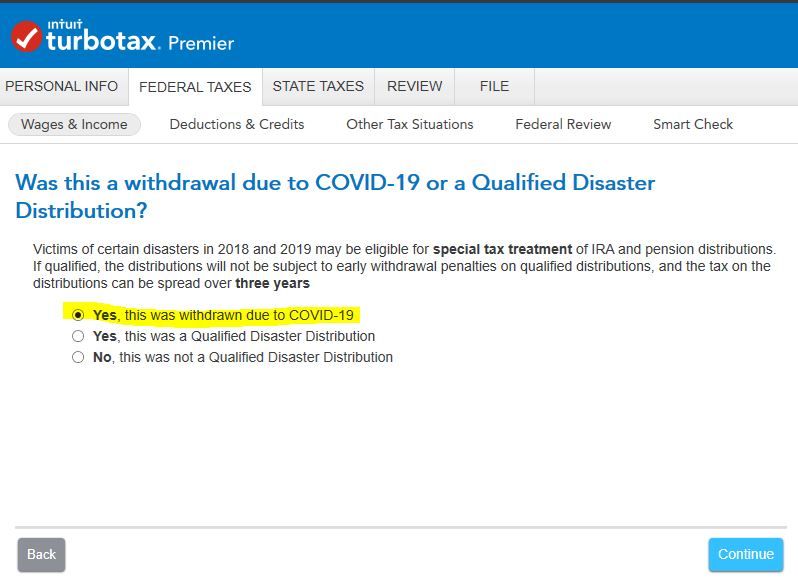

My version is up-to-date. Yes Turbo Tax knows that the form is there, but the issue is that the form is not working correctly for e-filing. The software does give an option to identify the withdrawal as Coronavirus Disaster related. As a result, the software is incorrectly calculating a 10% penalty on the withdrawal.

I do not manually complete forms, but out of curiosity, I followed the instructions you provided in case it might allow me to get around the issue. When I opened form 8915E-T, the form says to check the box for Coronavirus Disaster related withdrawals, however the box grays out and will not allow me to mark it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

@chuckmc wrote:

My version is up-to-date. Yes Turbo Tax knows that the form is there, but the issue is that the form is not working correctly for e-filing. The software does give an option to identify the withdrawal as Coronavirus Disaster related. As a result, the software is incorrectly calculating a 10% penalty on the withdrawal.

I do not manually complete forms, but out of curiosity, I followed the instructions you provided in case it might allow me to get around the issue. When I opened form 8915E-T, the form says to check the box for Coronavirus Disaster related withdrawals, however the box grays out and will not allow me to mark it.

So after entering the Form 1099-R and answering questions concerning the withdrawal you do not see this screen-

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

There is an additional issue within TurboTax with regard to the penalty tax.

I was given the option to select that I am declaring the Covid Disaster, which reduced my taxable amount; however, I am still getting an error message:

"Form 1 Penalties on IRA We're still working on updates related to penalties on IRAS, retirement plans, MSA distributions (Form 1099-R) that qualify for disaster or covid relief. You can keep working on your return, and we'll remove this message when it is ready."

It is currently charging .33 on 10% of the withdrawl taken. ($30,000 withdrawl times 10% times .33 = $990 penalty.)

When will this be fixed, and ready for me to file my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

@mditty4193 wrote:

There is an additional issue within TurboTax with regard to the penalty tax.

I was given the option to select that I am declaring the Covid Disaster, which reduced my taxable amount; however, I am still getting an error message:

"Form 1 Penalties on IRA We're still working on updates related to penalties on IRAS, retirement plans, MSA distributions (Form 1099-R) that qualify for disaster or covid relief. You can keep working on your return, and we'll remove this message when it is ready."

It is currently charging .33 on 10% of the withdrawl taken. ($30,000 withdrawl times 10% times .33 = $990 penalty.)

When will this be fixed, and ready for me to file my taxes?

This thread and question was about a 2019 tax return and it a year old.

The 2020 Federal tax return for COVID distribution is complete but some states still need need more work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

Hello, @Opus 17 @macuser_22 @DoninGA

How do I get there? Do I just use the search bar and type in 401K?

Thank you,

Teresa M.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

After inputting your 1099 information, the program will ask you questions. If you have already entered the information, make sure to update your software and then go into that 1099, edit & go through the questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

401k cares act withdrawal

Enter your 1099-R by following these steps. Disregard the blue "You need to revisit... It is an older screenshot.

- Open (continue) return if you don't already have it open.

- Inside TurboTax, search for 1099-R and select the Jump to link in the search results.

- Answer Yes on the Did you get a 1099-R? screen.

- If you land on the Your 1099-R Entries screen instead, select Add Another 1099-R.

- Select which option matches your form and Continue.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tthurston2248

New Member

ArchesNationalPark

Level 3

ArchesNationalPark

Level 3

slicric01

Level 1

Ggq

New Member