- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

I'm disabled and only have social security benefits for income. Turbo tax program won't let me get passed the 1099R form. I don't have a 1099 R form. I've gone back through the program and checked box NO for pensions. It still will force me back to the 1099R form. How do I skip passed the 1099R completion to file my tax form.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Go back into the Federal section of the program.

- Select "Wages & Income"

- Scroll down to "all income"

- Select show more to the right of "Retirement Plans & Social Security"

- Select start/revisit to the right of "IRA, 401(k), Pension Plan Withdrawals (1099-R)"

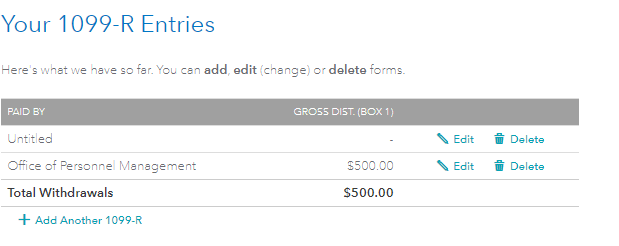

- Select delete to the right of any 1099-R forms which are not applicable.

I also recommend scrolling down through the Income & Expenses section to ensure the information has not been entered into another section. If it has and it shouldn't be there, you may have to delete the input.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

if your ONLY income is from social security AND there was no federal (volentary) tax withholdings on that social security payment, why are you filing at all? you may not need to file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

Got a 1099R with my SSN but no company id, no address and no data. It's holding up my e-filing.How do I delete it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099R

If you have income on your Form 1099-R, you must enter it. If there is incomplete information, call the issuer and find out why the information if incomplete. You stated in one post that you did not have a form and then later that you did have one.

If you do have one, enter the information. If you don't delete the form.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rodiy2k21

Returning Member

Tater19

Level 1

NANCYHIRD46

New Member

elle25149

Level 1

Angel_eyes_4eva

New Member