- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

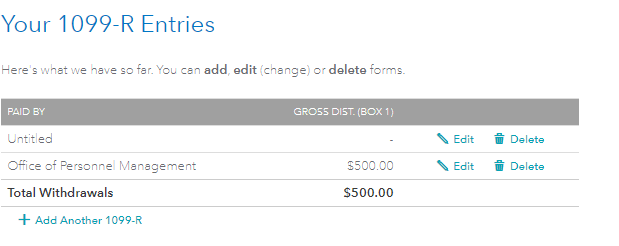

Go back into the Federal section of the program.

- Select "Wages & Income"

- Scroll down to "all income"

- Select show more to the right of "Retirement Plans & Social Security"

- Select start/revisit to the right of "IRA, 401(k), Pension Plan Withdrawals (1099-R)"

- Select delete to the right of any 1099-R forms which are not applicable.

I also recommend scrolling down through the Income & Expenses section to ensure the information has not been entered into another section. If it has and it shouldn't be there, you may have to delete the input.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 22, 2020

6:23 PM