- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Re: 1099-R

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

I am trying to enter an inherited 1099-R. Turbo tax is asking when this person was born. The selections are on or before 6/30/50 and on or after 7/1/50. I cannot may a selection on this page. Any suggestions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

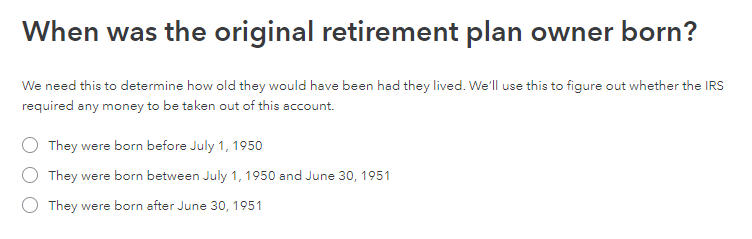

I do not quite understand your question. Are you saying the choices to make (screenshot below) are all grayed out preventing you from make a choice? If not and you know the age of the person from whom you inherited the plan mark one of the circles to continue.

Code 4 will not subject you to a penalty; it is ordinary income in each year you receive the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

My 2 choices for the age of the original owner are:

1) This person was born on or before 6/30/50

2) This person was born on or after 7/1/50

The choices are not grayed out. There is a circle in front of each choice. The software does not allow me to choose one of them. The software does not allow me to go further in completing this 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

TurboTax is trying to determine whether the decedent had been required to be taking RMDs.

how old was he or she?

if you can't select an option , you have a browser problem.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-R

He was born 7/29/16..

I am restarting my computer.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Ikigai

New Member

Ikigai

New Member

sewartist

New Member

judylefaivre

New Member

rkcassie

New Member