- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Not all of Income is being acknowledged when computing the Roth IRA contribution limit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

My income is through a fellowship and thus I do not have a W-2.

As a result, I have put in my income as "Other reported income". When it comes to taking into account my Roth IRA contributions, TurboTax states that my income is $0 and thus I have exceed my contribution limit.

I tried removing and adding the income, but that doesn't seem to change the calculus.

Is there something I'm missing or is this a bug in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

If you enter it in as scholarship income, it will go through. The Scholarship income would be treated as EARNED income. Follow these steps:

- Open to federal Deductions & Credits

- Locate EDUCATION

- Select Expenses and Scholarships

- Tell the program you don't have a 1098-T, that you have an exception, don't enter any expenses, enter the excess scholarship on the screen that asks if you received a scholarship you have not yet reported.

This will put your income on Sch 1 and Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) shows this appropriate for your IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

If you enter it in as scholarship income, it will go through. The Scholarship income would be treated as EARNED income. Follow these steps:

- Open to federal Deductions & Credits

- Locate EDUCATION

- Select Expenses and Scholarships

- Tell the program you don't have a 1098-T, that you have an exception, don't enter any expenses, enter the excess scholarship on the screen that asks if you received a scholarship you have not yet reported.

This will put your income on Sch 1 and Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) shows this appropriate for your IRA.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

Hi Amy, thank you for the help!

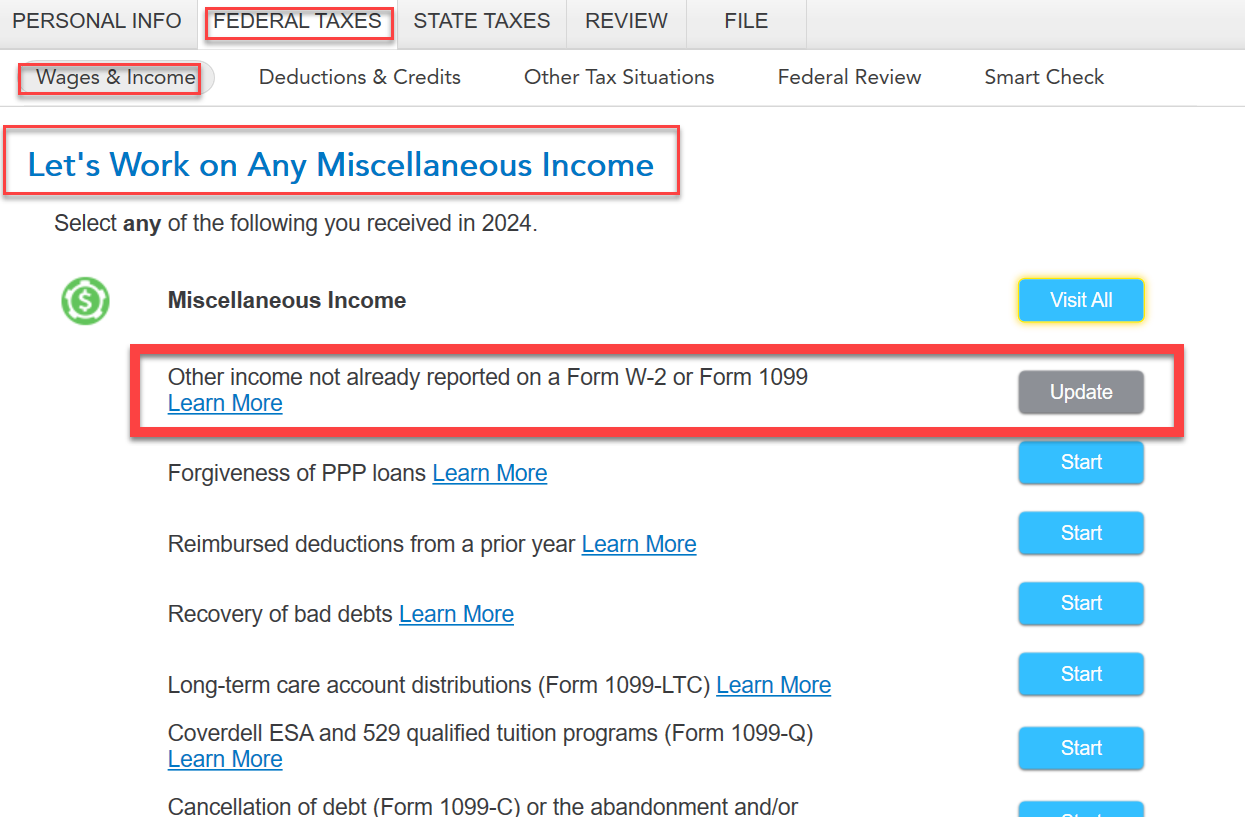

I seem to be doing something wrong, because the only place I can put down the income is in the screen below, which seems to suggest that the income is non-taxable (since I have been making estimated tax payments the platform suddenly suggests additional thousands of dollars of return).

Is there a different screen where I should be inputting this information?

If so how do I get to it?

Once again, thank you for your help!

Best,

Francisco

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

Those steps used to work. Ok, I have entered wages and an IRA successfully today. Follow these steps:

- Open to federal income

- Locate Miscellaneous or Other Income or Show Less Common Income

- Select Other income not already reported on a W2 or Form 1099

- Start/Edit

- Other wages received, yes

- Continue, pass household,

- Continue, pass sick pay

- Continue, pass Medicaid

- Continue to Earned Income? YES

- Continue

- Select Other source of income

- Enter description and amount

- Done

Now you can enter the IRA contribution successfully.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Not all of Income is being acknowledged when computing the Roth IRA contribution limit

Hi Amy,

This seems to have done it, thank you so much!

Best,

Francisco

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tlh7

New Member

fmachado1

Level 1

TreeBark

New Member

whyattw1

New Member

oatleyr

New Member