- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

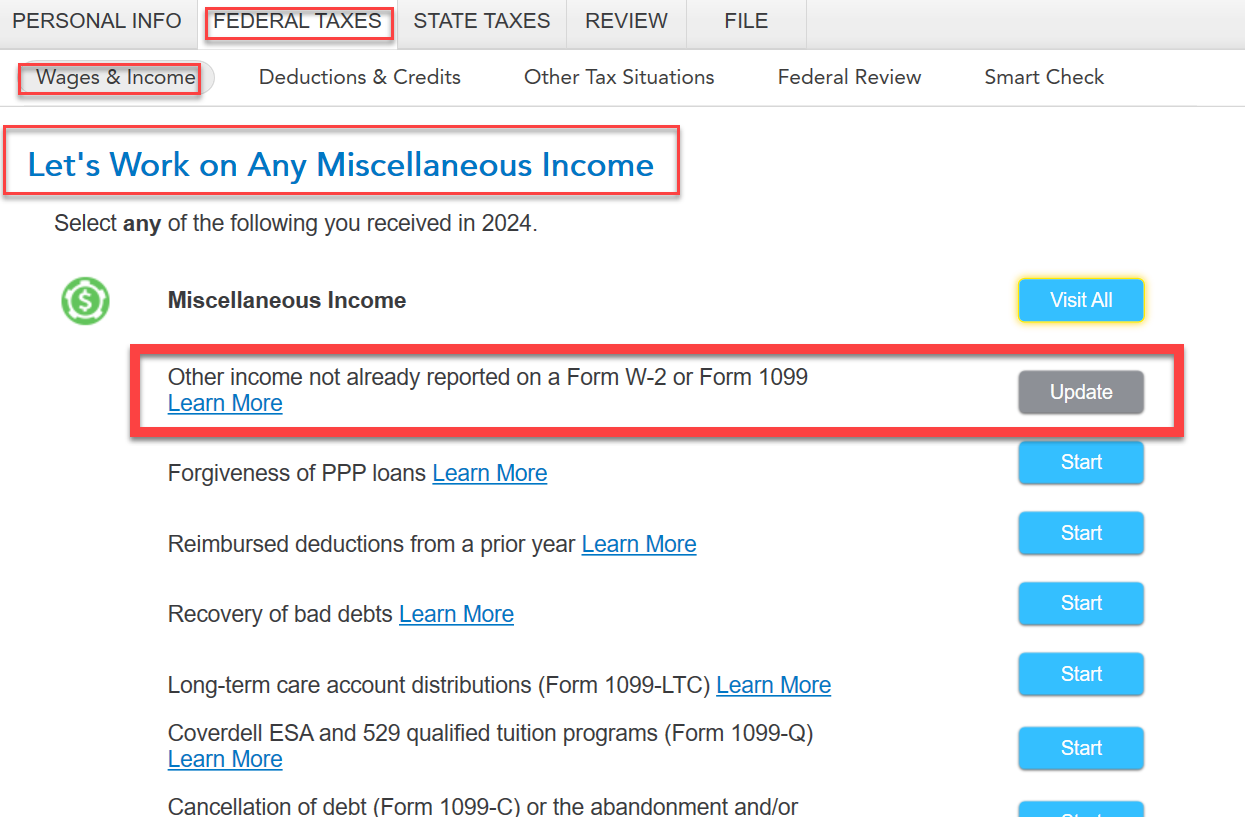

Those steps used to work. Ok, I have entered wages and an IRA successfully today. Follow these steps:

- Open to federal income

- Locate Miscellaneous or Other Income or Show Less Common Income

- Select Other income not already reported on a W2 or Form 1099

- Start/Edit

- Other wages received, yes

- Continue, pass household,

- Continue, pass sick pay

- Continue, pass Medicaid

- Continue to Earned Income? YES

- Continue

- Select Other source of income

- Enter description and amount

- Done

Now you can enter the IRA contribution successfully.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 5, 2025

3:57 PM