- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

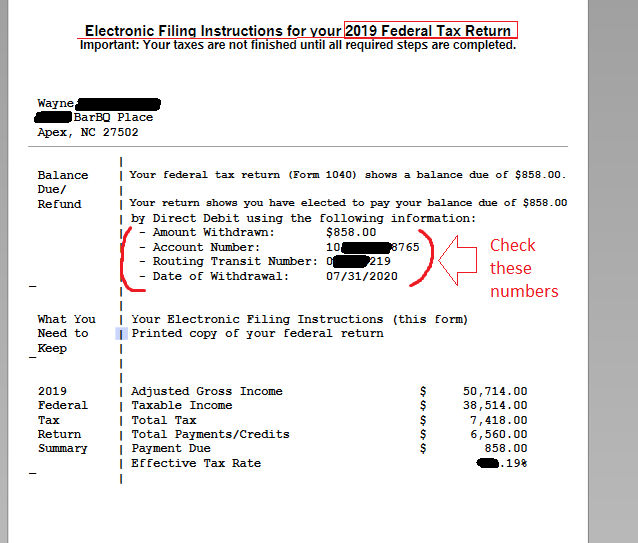

You should have (did you?) create a PDF file of your tax returns when you e-filed?? IF you did it will have an Electronic Filing Instructions sheet in that PDF that shows the date and account/routing numbers you provided for the withdrawal. The withdraw may take an extra day or 3, especially if it happens on a weekend or holiday.

_________________________

See below...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

Call IRS e-file Payment Services 24/7 at 1-888-353-4537 to inquire about or cancel your payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

I tried the number but apparently, they need the exact amount that was sent in to find the payment. However I'm just making assumptions about the amount, because it hasn't been withdrawn yet and so it doesn't appear in their system. so... no dice.

Going to try that number again and see if I can reach a real person instead of a machine.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

You should have (did you?) create a PDF file of your tax returns when you e-filed?? IF you did it will have an Electronic Filing Instructions sheet in that PDF that shows the date and account/routing numbers you provided for the withdrawal. The withdraw may take an extra day or 3, especially if it happens on a weekend or holiday.

_________________________

See below...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there a way to check when the IRS will withdraw money out of my bank account if I owe money? Do they withdraw on the taxes due date? - I chose "e-file" through TT

Ah I see it now. Thanks for the helpful tip. I did not notice this before. Thanks again!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

chinyoung

New Member

sacap

Level 2

PCD21

Level 3

organdan

Level 1

latdriklatdrik

New Member