- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- Is anyone else having a problem with excess social security being reported on the 2017 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having a problem with excess social security being reported on the 2017 return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having a problem with excess social security being reported on the 2017 return?

Did your 2017 return have excess SS reported on line 71?

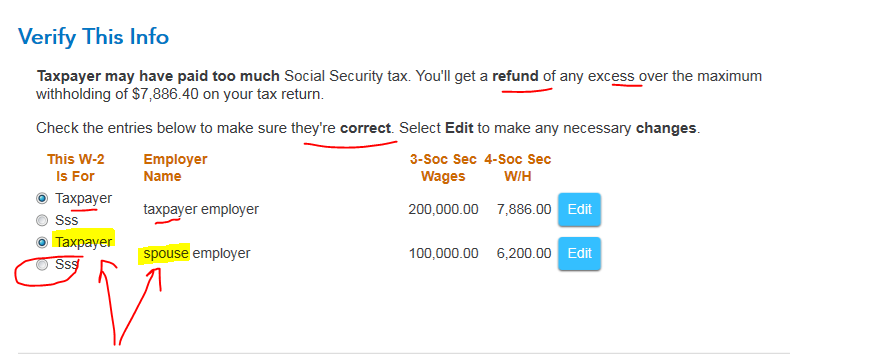

For 2017, If you had more than one employer and the total of box 4 (only box 4 not box 6) on all your 2017 W2s for Social Security is more than $7,886.40 you get the excess back on your tax return. And it is for each spouse separately, not combined.

Are you married and filed Joint? And you both had W2s? The IRS is probably right. They usually are in this case. You assigned both spouse's W2 to the same person so it looked like that person went over the max.

Then better check your 2018 return and see if the W2s transferred over wrong and you have excess ss on 2018 also.

Then for next year either do not transfer from 2018 or delete all the W2s and enter them new, paying attention which spouse.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having a problem with excess social security being reported on the 2017 return?

Yes - our 2017 return has excess SS reported on line 71. We don't recall entering that information. We don't have more than one employer. We are married filing joint. Both had w-2's. Wondering if there is a glitch in the turbo tax program? Now we are on the hook for a lot of money.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having a problem with excess social security being reported on the 2017 return?

There is no glitch in Turbo Tax for this. You probably assigned both W2s to the same person. Add up box 4 and subtract the max of $7,886.40. Is that the difference on line 71? The max is per person not combined.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is anyone else having a problem with excess social security being reported on the 2017 return?

Sadly this is a 100% user error that the program warns you about ... it was your responsibility to read the screen carefully to fix the error before filing ... Review your PDF with the worksheets to see if this is indeed your error ... if so pay the IRS as they are correct.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17716050122

New Member

ray-242

New Member

Tomzee

Level 2

user17711952966

Returning Member

poncho_mike

Level 4