- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- IRA rollover to same account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

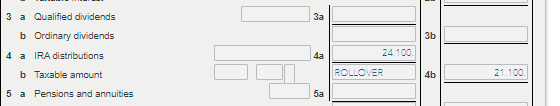

I took out $24,100 in distributions from my regular IRA. Within 60 days, I redeposited $3,000 into the same IRA.

It seems to me that the "NET" taxable IRA distribution should be $21,100. In the entries in TurboTax I answered YES that some or all of the amount was rolled over into the same account. The worksheet shows the entry for $3,000. Yet, on my 1040, the amount continues to show the full distribution 0f $24,100. WHY is there not an adjustment for the rollover?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

Does it have $24,100 on both Lines 4a and 4b? Line 4a is the total amount. Line 4b is taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

The only way I could arrive at the "right" result that you show, I had to go back and check "No, none of this this withdrawal was form RMD (This is not common)" To have the parenthetical 'this is not common" will lead to a lot of confusion. The whole implication for the parentheses is: Don't use this box unless absolutely sure!

The whole issue centers around this CARES ACT and its effect on RMD. Is there not a simple, simple explanation of how to handle this issue?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Cub3

New Member

borisaf72

New Member

Jayceeruth7

New Member

user314

Level 3

pasillas-martin

New Member