- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- IRA rollover to same account

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

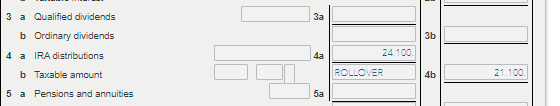

I took out $24,100 in distributions from my regular IRA. Within 60 days, I redeposited $3,000 into the same IRA.

It seems to me that the "NET" taxable IRA distribution should be $21,100. In the entries in TurboTax I answered YES that some or all of the amount was rolled over into the same account. The worksheet shows the entry for $3,000. Yet, on my 1040, the amount continues to show the full distribution 0f $24,100. WHY is there not an adjustment for the rollover?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

Does it have $24,100 on both Lines 4a and 4b? Line 4a is the total amount. Line 4b is taxable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA rollover to same account

The only way I could arrive at the "right" result that you show, I had to go back and check "No, none of this this withdrawal was form RMD (This is not common)" To have the parenthetical 'this is not common" will lead to a lot of confusion. The whole implication for the parentheses is: Don't use this box unless absolutely sure!

The whole issue centers around this CARES ACT and its effect on RMD. Is there not a simple, simple explanation of how to handle this issue?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Naoto

Level 2

QUQU

Returning Member

lesktam

New Member

PigKiller_1

New Member

rsknoebel

New Member