in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- IRA distribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA distribution

I used the 60-day rollover feature and returned the entire amount to the ira of origin within 60 days.

Turbotax flags line 2a as "should not be zero" although none of the distribution in line 1 is taxable.

Why is this, please? How do I "fix" it? May I simply ignore the flag and leave the line 2a value at zero?

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA distribution

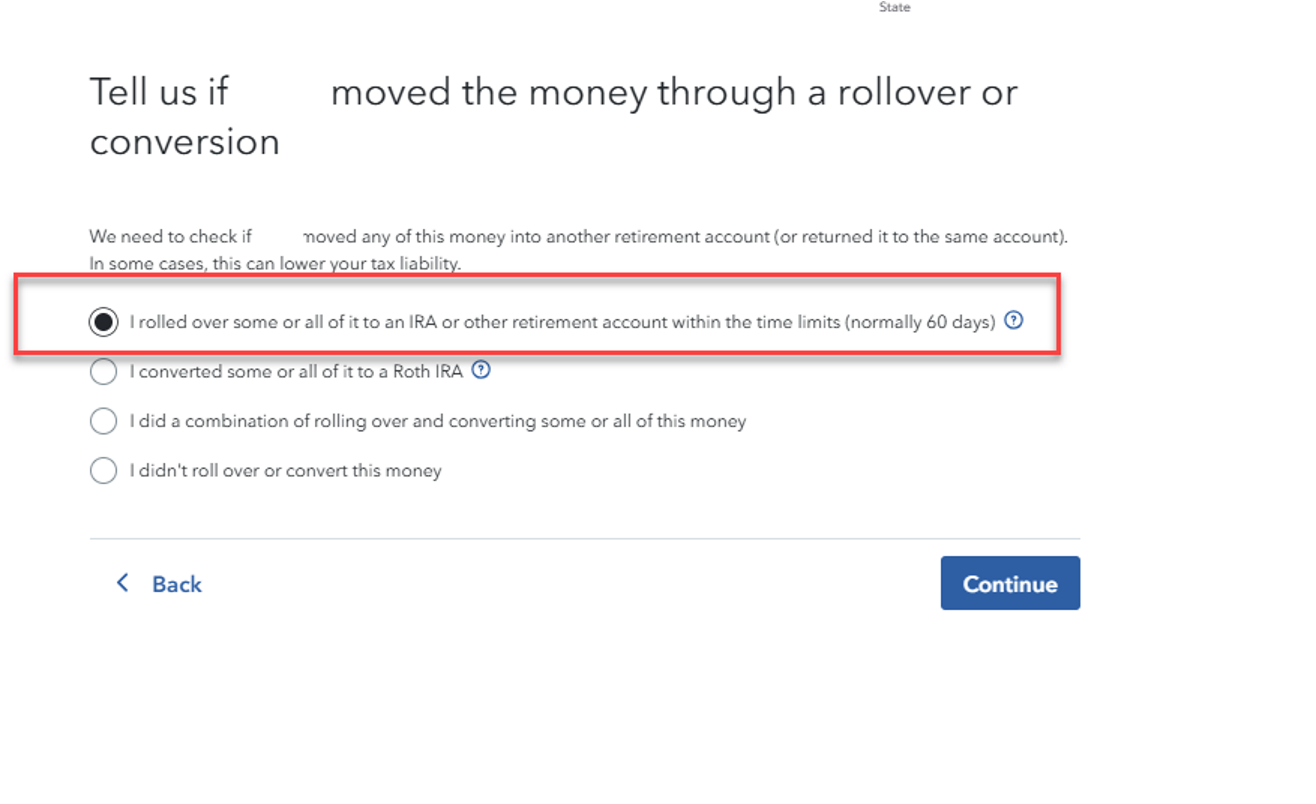

You can leave the zero, but also check the box in the interview that you rolled the funds over. After entering the 1099-R, continue through the interview. You'll be asked "Did you roll over all of this $xx (Box 1) to another retirement account?", select "Yes, I rolled over $xx to another traditional IRA or retirement account (or returned it to the same account." Note- you may need to check the "taxable amount not determined" box in the 1099-R entry if this option doesn't appear to you in the interview.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRA distribution

You must enter the Form 1099-R as received. Since this was an ordinary distribution from a traditional IRA, box 2a is required to be the same as the amount in box 1 as is shown on the form provided by the IRA custodian.

Follow the rest of MindyB's post as to how to report the rollover so that the amount rolled over is excluded from Form 1040 line 4b with the ROLLOVER notation.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

currib

New Member

ir63

Level 2

trust812

Level 4

mgc6288

Level 4