The first question is should you enter the form. If all of it went to qualified expenses, the IRS does not want it. IRS Publication 970, Tax Benefits for Education states:

If the entire 1099-Q went to qualified expenses, room and board, tuition, etc then you do not need to enter the form. Tuition paid for the first 3 months of the next year also qualify, see page 12, What Expenses Qualify, and page 52 for qualified distributions.

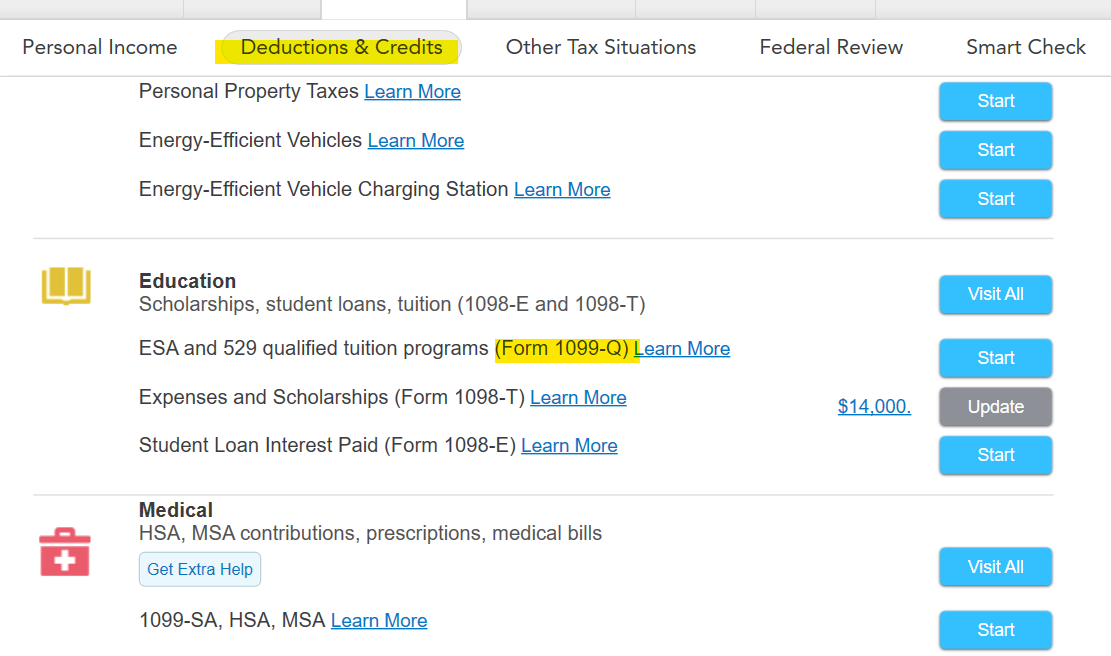

Next, if you should enter the form, it must be entered first, before the 1098-T. In the federal deductions and credits section, under Education, locate ESA and 529 programs.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"