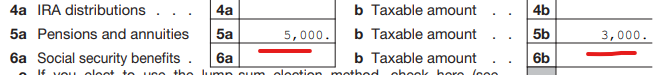

The box 1 of the IRS form 1099-R flows to box 5a of the IRS form 1040.

Box 2a of the IRS form 1099-R flows to box 5b of the IRS form 1040.

In TurboTax Online, report the IRS form 1099-R as follows:

- Down the left side of the screen, click on Federal.

- Down the left side of the screen, click on Wages & income.

- Click the down arrow to the right of Retirement Plans Social Security.

- Click to the right of IRA 401K Pension Plan Withdrawals.

- At the screen Let's import your tax info, select the provider.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"