- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

Federal portion is correct; however, when it transferred to New Jersey tax return TurboTax taxed the entire IRA distribution. The IRA distribution was converted to a Roth IRA - therefore money should not be taxed.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

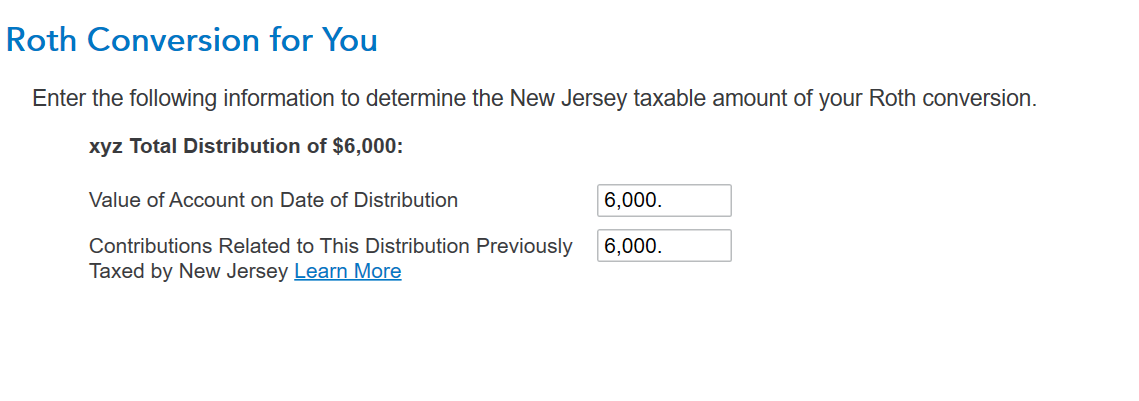

As you prepare your NJ return, you'll see a screen Roth Conversion For You. If you had no other traditional IRAs existing before or after the conversion, you would enter the amount of the distribution as Contributions Relating to This Distribution Previously Taxed By NJ. See the screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

As you prepare your NJ return, you'll see a screen Roth Conversion For You. If you had no other traditional IRAs existing before or after the conversion, you would enter the amount of the distribution as Contributions Relating to This Distribution Previously Taxed By NJ. See the screenshot below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

Hello IsabellaG,

Very useful information.

I was able to do the Federal portion as well

Quick question specific to my case.

I did a $6,000 traditional IRA contribution Q1 of 2019, this money grew to about $6,058 and I converted it to Roth IRA in Q3 of 2019. On TurboTax 2019, I placed $6,058 on Value of Account on Date of Distribution, and $6,000 on Contributions Related to This Distribution Previously Taxed by New Jersey. Am I doing this correctly?

I appreciate your help and expertise.

Thanks.

Jeff

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

Is there a new way to address this in 2021? I can't find this update in the current year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

I have the same question. How do we handle for 2021 taxes for NJ After-Tax 401K contribution rolled over to Roth?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

If you have a 1099-R, what codes have been entered in Box 7? TurboTax may be applying a tax on the entire amount converted to the Roth IRA because as of January 1, 1984, and according to the NJ Division of Taxation, contributions that employees made to 401(k) plans from their wages were not taxed. Since the contributions were not taxed when made, they are fully taxable when you receive a distribution (withdrawal). If you made contributions to a 401(k) plan before January 1, 1984, your distribution will be treated differently than if all the contributions were made after that date.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

Hi @IsabellaG could you reshare the screenshot? Your solution might solve my question but I don't see the screenshot in the post!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

And sure enough in the forms, you'll see how this flows through seamlessly as non taxable

And this Pensions worksheet as well

Enjoy the rest of your evening!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

I am using Turbotax Desktop. Running into same issue. I don't see these prompts. It only asks if there was a ROLLOVER to SIMPLE IRA. Can you please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you stop TurboTax from taxing a Roth Backdoor IRA in the State of New Jersey tax return?

Just to clarify, which prompts don't you see and in which section, the federal input screens or the NJ input screens? Please be a little more specific.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

spunky_twist

New Member

sunflower110603

New Member

dougiedd

Returning Member

alex_garzab

New Member

DavidRaz

New Member