- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do you populate Form 5329 line 6 for taxable amounts related to a tax-free scholarship in TurboTax for distributions not subject to the 10% penalty?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you populate Form 5329 line 6 for taxable amounts related to a tax-free scholarship in TurboTax for distributions not subject to the 10% penalty?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you populate Form 5329 line 6 for taxable amounts related to a tax-free scholarship in TurboTax for distributions not subject to the 10% penalty?

You need to enter your form 1099-Q and work through that section to have form 5329 populated. You can do that in TurboTax by following these menu prompts:

- Deductions and Credits

- Education

- ESA and 529 qualified tuition programs (Form 1099-Q)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you populate Form 5329 line 6 for taxable amounts related to a tax-free scholarship in TurboTax for distributions not subject to the 10% penalty?

My distribution from the 529 account was a refund due to a scholarship, so the amount should be taxed but not have an additional penalty. I can't find a way to get turbotax to remove the penalty (which would be by indicating that it is not taxable by entering the value onto line 6)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do you populate Form 5329 line 6 for taxable amounts related to a tax-free scholarship in TurboTax for distributions not subject to the 10% penalty?

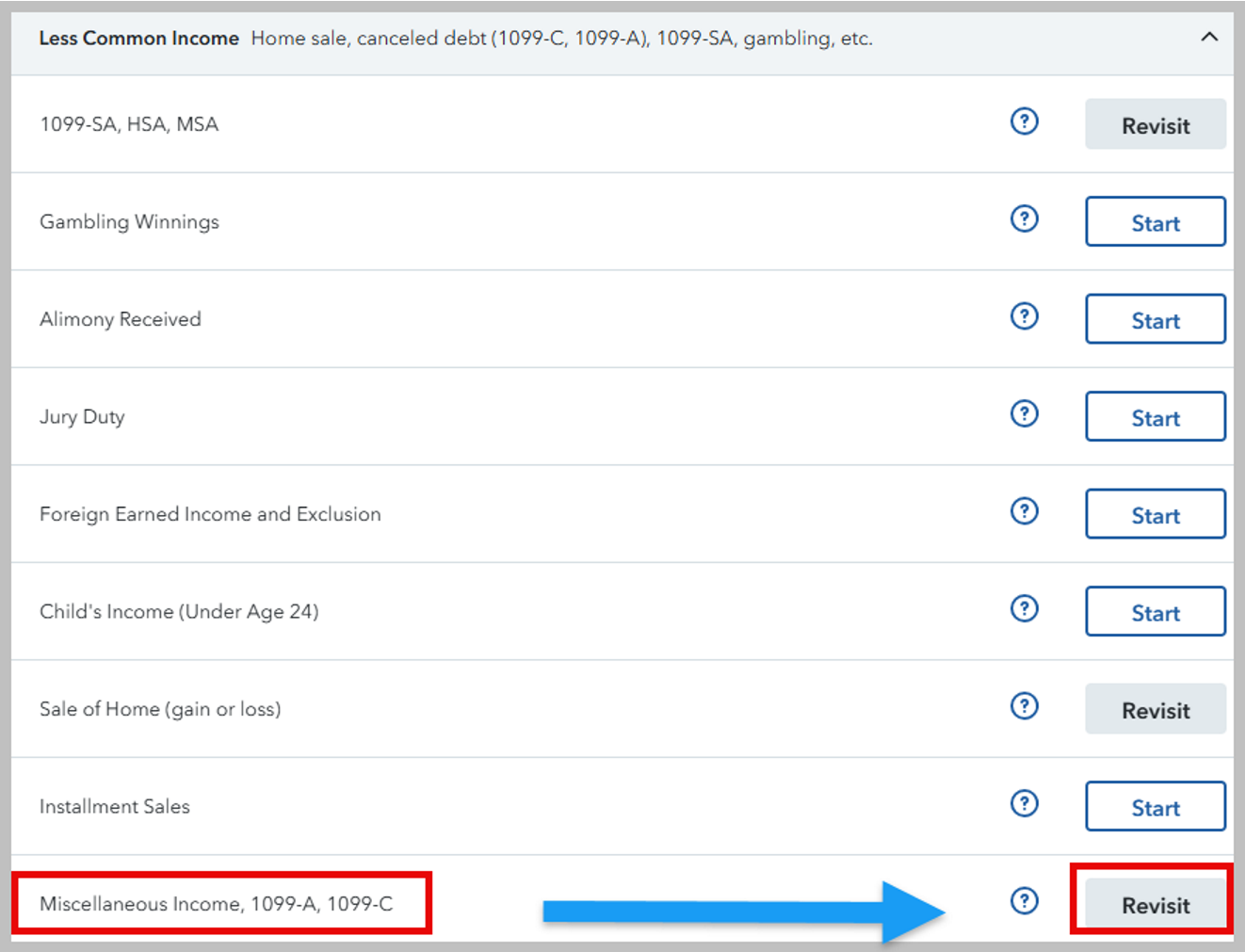

Follow these steps to enter the income (the programs vary a bit but this lets you know where you are going):

- go to the federal income section

- scroll to the bottom/ show less common income

- Miscellaneous Income, 1099-A, 1099-C, Start

- Scroll to the bottom

- Other reportable income, Start

- Other taxable income?

- Select YES

- Description

- Amount, enter your amount

- Continue

If you really did not have any other 529 qualified Room and Board and Qualified Education Expenses - Internal Revenue Service expenses then it is taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jcpeckham

New Member

irunalot

Level 2

parent123

Level 1

in Education

t2025waxq

Level 1

Click

Level 5