- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

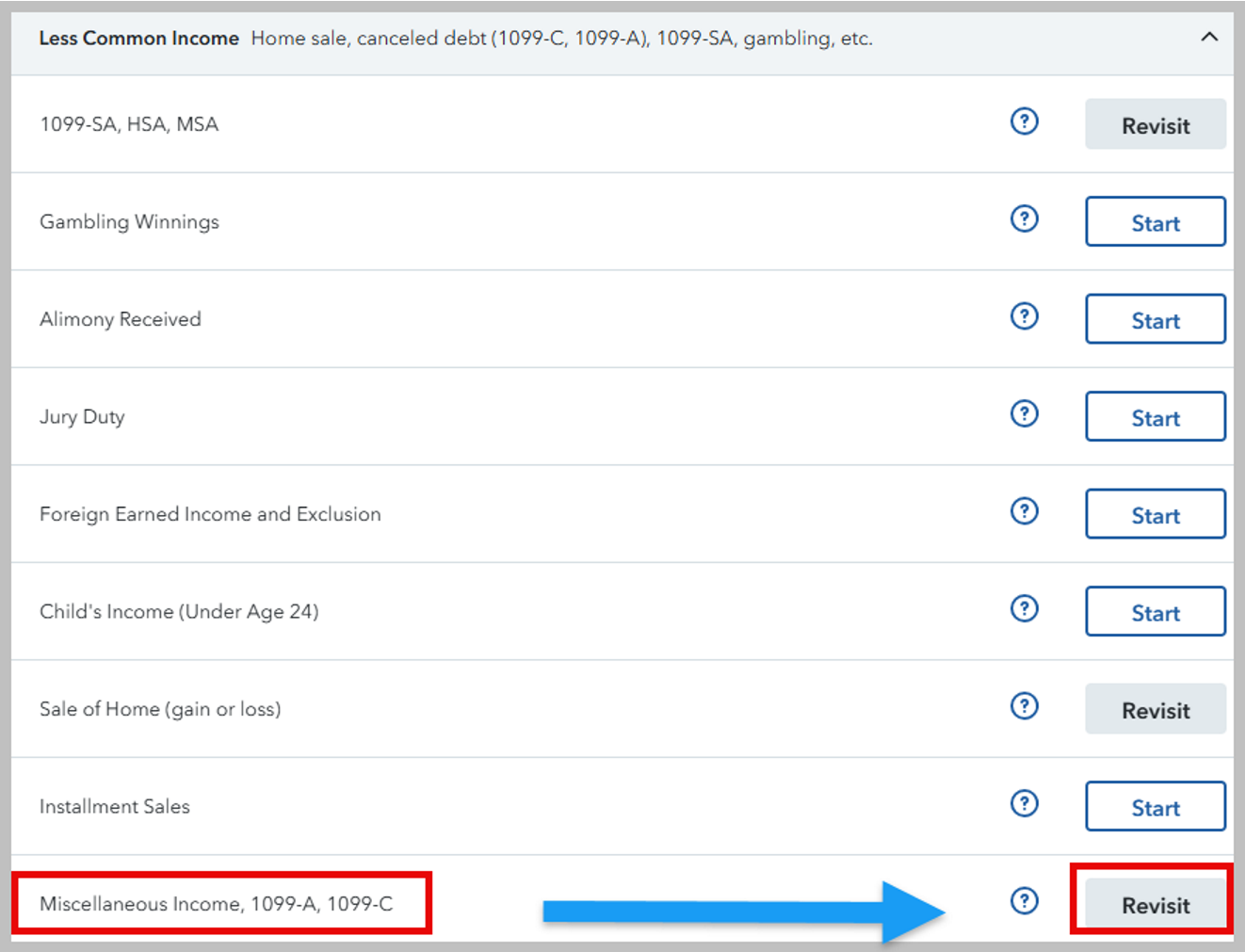

Follow these steps to enter the income (the programs vary a bit but this lets you know where you are going):

- go to the federal income section

- scroll to the bottom/ show less common income

- Miscellaneous Income, 1099-A, 1099-C, Start

- Scroll to the bottom

- Other reportable income, Start

- Other taxable income?

- Select YES

- Description

- Amount, enter your amount

- Continue

If you really did not have any other 529 qualified Room and Board and Qualified Education Expenses - Internal Revenue Service expenses then it is taxable income.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2025

4:34 PM