- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- How do I enter my government pension income reported to me on a 1099-R. The software keeps asking me to provide bank info. My pension is paid directly from OPM.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my government pension income reported to me on a 1099-R. The software keeps asking me to provide bank info. My pension is paid directly from OPM.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my government pension income reported to me on a 1099-R. The software keeps asking me to provide bank info. My pension is paid directly from OPM.

The bank info you are seeing may be a result of trying to import the Form 1099-R instead of typing it in yourself. It is easy to miss the 'type it in yourself' option if you are not looking for it. Try using the steps below to go back to the section where you would enter the Form 1099-R and be sure to indicate that you will type in the information (there will be a box to check for that). Then enter the details of your Form 1099-R and answer all of the follow-up questions that will come up. The answers to the questions after you enter the Form 1099-R will determine your taxable income.

Use the following steps to enter your Form 1099-R:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-R” and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-R”

- Click on the blue “Jump to 1099-R” link

- Enter the information from your form and answer all the follow-up questions

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter my government pension income reported to me on a 1099-R. The software keeps asking me to provide bank info. My pension is paid directly from OPM.

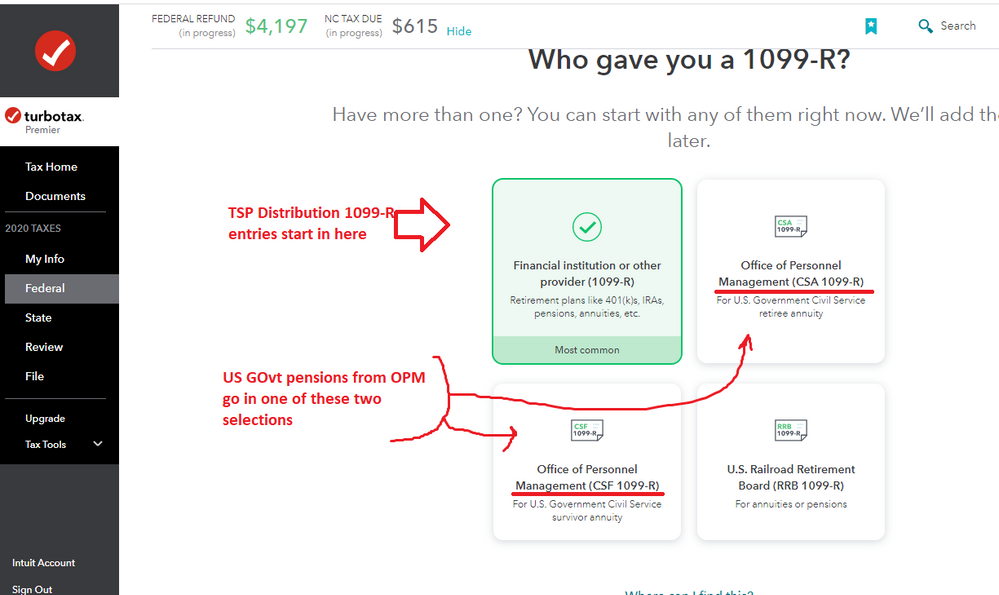

When you do start into the 1099-R entry section, make absolutely sure you select the correct 1099-R Sub-type before continuing. Some of the box numbers on your OPM CSA-1099-R ( or CSF-1099-R ) are numbered differently form a plain 1099-R:

______________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jjon12346

New Member

DolceDolce

Level 4

DolceDolce

Level 4

edmarqu

Level 2

ryan-j-delahanty

New Member